A little bit of history. In October 2022, the Standard & Poor’s 500 Index was staggered by six straight days of losses, ending on Oct. 12 with the index at 3,577.

The loss was 5.64%, not huge as short-term losses go. But, since Jan. 3, 2022, the market had fallen more than 25% as the Federal Reserve had waging a major campaign to take inflation out of the American economy.

Don’t miss the move: Subscribe to TheStreet’s free daily newsletter

The Oct. 12 close proved the lowest the index would decline during the Fed’s campaign, even though the Fed would continue to raise its key federal funds rate until July 2023 when it reached 5.25% to 5.5%.

Related: Tesla fumbled the perfect opportunity to surprise its EV rivals

The reason: Smart money sensed the interest-rate increases would end, and it was time to get ready.

The S&P 500’s gain in the two years since that 2022 bottom: 62.6%.

The question now, as the S&P 500 and the Dow Jones Industrial hit new highs on Friday and third-quarter 2024 earnings are coming in, is this: How strong is the rally?

The past week’s performance suggested the rally is plenty strong.

The S&P 500 closed above 5,800 for the first time. The Dow Jones Industrial Average ended at a record 42,864; two days produced daily gains of more than 400 points. The Nasdaq was up 1.1%, but a few stocks suggested breakouts.

Best of all, the indexes have risen for five straight weeks, despite worries about broadening war in the Middle East and the ongoing tensions of the Presidential election.

Plenty of analysts and pundits believe the rally has more to run, citing among other things:

-

The Fed has vowed to continue to cut interest rates.

-

The rate on a 30-year mortgage was above 8% at its peak in October 2023; it’s now at 6.6% and could be headed lower.

-

The economy has not fallen into recession as many economists and bankers had predicted a year ago.

-

The national unemployment rate was 4.1% according to the Labor Department’s Oct. 4 jobs report.

“Strategists and economists are in a bind, and they’re about to tell clients they must be fully invested, leading to an explosive new leg higher in the bull market,” Jon Markman, who runs a Seattle money-management firm, wrote on Friday.

Some very big earnings

The week ahead has earnings coming from giant and important companies including:

-

UnitedHealth Group (UNH) .

-

Johnson & Johnson (JNJ) .

-

Dutch chip-equipment company ASML Holding (ASML) .

-

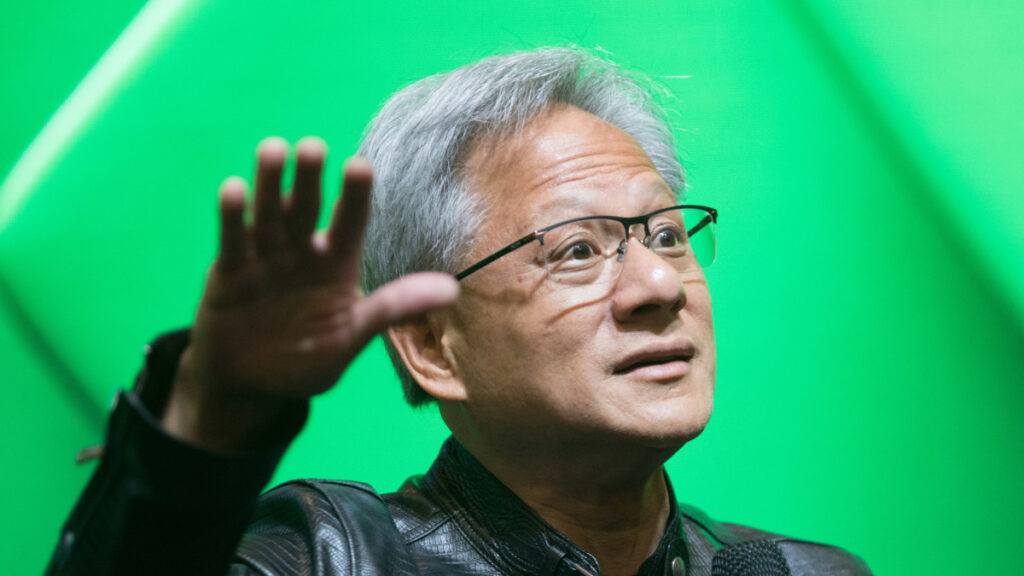

Taiwan Semiconductor (TSM) , which makes the chips Nvidia (NVDA) , Arm Holdings (ARM) and others design

-

Investment houses Goldman Sachs (GS) and Morgan Stanley (MS) .

-

Airlines United Airlines (UAL) and Alaska Air Group (ALK) .

FactSet, the business analytics company, is projecting a 7% year-over-year rise in third-quarter earnings.

That would be the fifth straight quarter of year-over-year earnings growth, the company said.

The economy asserts itself at week’s end

The big economic reports come Thursday and Friday with

-

Initial jobless claims expected at about245,000, down slightly from this week’s 258,000. Thursday.

-

U.S. retail sales, expected to show a 0.3% gain. Thursday.

-

Industrial production, showing a decline because of the strike at Boeing Co.BA. Thursday

-

Capacity utilization, which measures how much of industry’s potential is actually used. Thursday

-

Home builder confidence, which may decline because rising mortgage rates since the Fed cut its key interest rate in September. Thursday.

-

Housing starts and building permits, key economic indicators because the nation suffers from a housing shortage and because construction is so sensitive to interest rates. Friday.

Read the full article here