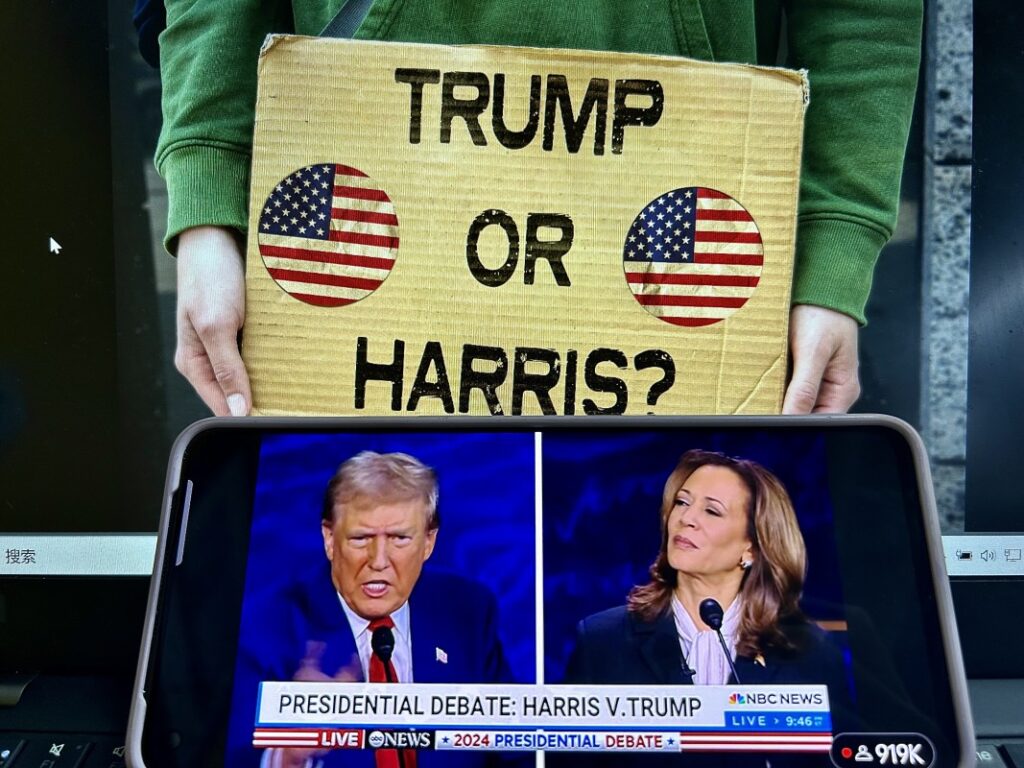

JOSEPH PREZIOSO/Getty Images

Wall Street weighs in on Presidential debate winner

Solar may prove a winner if the Wall Street reaction to Tuesday’s presidential debate is any indication.

First Solar (FSLR) , in fact, was the biggest gainer among stocks in the Standard & Poor’s 500 Index, rising 15.2% to $239.84. The shares have risen more than 39% this year.

First Solar designs, manufactures, and sells solar panels and power systems. The company, based in Tempe, Ariz., also provides project development, engineering, construction and maintenance services. Its factories are in Ohio, Malaysia, Vietnam, and India.

Array Technologies (ARRY) had a bigger gain, 16% to $6.60. The company, based in Albuquerque, N.M., builds and sells ground-mounting solar tracking systems in the United States, Spain, Brazil, and Australia.

Among other solar and renewable energy stocks showing gains:

-

Enphase Energy (ENPH) , up 5.7% to $110.59.

-

Canadian Solar (CSIQ) , up 11.8%.

-

Energy storage company Fluence Energy (FLNC) , up 11.5%.

-

Sunrun (RUN) , up 11.3%.

-

Shoals Technologies (SHLS) , up 10.2%.

The Invesco Solar exchange-traded fund (TAN) rose 6.3% to $40.49. It’s down 24.1% this year. Meanwhile, the First Trust Global Wind Energy ETF (FAN) added 41 cents to $17.10. It’s up 3.8% this year.

More on Markets

Investors believe a Kamala Harris win in the Nov. 5 election would ensure continued federal support for clean energy and, by extension, clean-energy stocks.

Solar stocks have received tax credits through the Biden Administration’s Inflation Reduction Act.

Analysts see a bounce for solar now; Trump slams the idea

In Tuesday’s debate, Trump slammed the administration’s support for solar, adding if Vice President Harris wins the election, “Fossil fuel will be dead.”

A few Wall Street analysts conceded the gains for solar stocks and renewables were related to Harris’ perceived debate win.

“We expect a near-term bounce towards Vice President Harris following the first debate with former President Trump, but the longer-term impact remains unclear,” Raymond James analyst Ed Mills told clients in a note late Tuesday night.

BTIG analyst Isaac Boltansky expected a “lean-in” after Harris’ perceived debate win.

He also said, “From a market perspective, we believe that the presidential race should still be viewed as a toss-up.”

Trump Media & Technology Group (DJT) , the former president’s social media company, was a loser in Wednesday’s trading, falling 10.5% to $16.68.

The shares dropped to as low as $15.30 before rallying. The shares are off 4.7% on the year and down 75% from their March 27 closing high of $66.22.

Related: Veteran fund manager sees world of pain coming for stocks

Read the full article here