Key Takeaways

-

The S&P 500 fell 0.2% on Thursday, Oct. 10, 2024, after the latest inflation data came in hotter than expected.

-

First Solar shares tumbled as Jefferies analysts said various delays could restrain the solar company’s volumes in the current quarter.

-

CrowdStrike shares moved higher after RBC Capital included the cybersecurity firm’s stock among its top picks in the software space.

Major U.S. equities indexes lost ground after the latest Consumer Price Index report showed greater-than-expected price increases in September, driven by an uptick in grocery prices.

In addition to weighing on household budgets, the hot inflation data could constrain the Federal Reserve as policymakers deliberate over further interest-rate cuts.

The S&P 500 fell 0.2% on Thursday, while the Dow was down 0.1%. Both indexes receded from record closes posted in the previous session. The tech-heavy Nasdaq also retreated, though it fared slightly better, closing with a minimal daily loss of less than 0.1%.

Shares of solar panel producer First Solar (FSLR) plunged 9.3%, the most of any S&P 500 constituent, after Jefferies reduced its price target on the stock to $266 from $271. Research analysts warned of potential delays that could restrain First Solar’s volumes in the current quarter and those to come. Other solar industry stocks also moved lower: Shares of solar technology firm Enphase Energy (ENPH) slipped 5.8%.

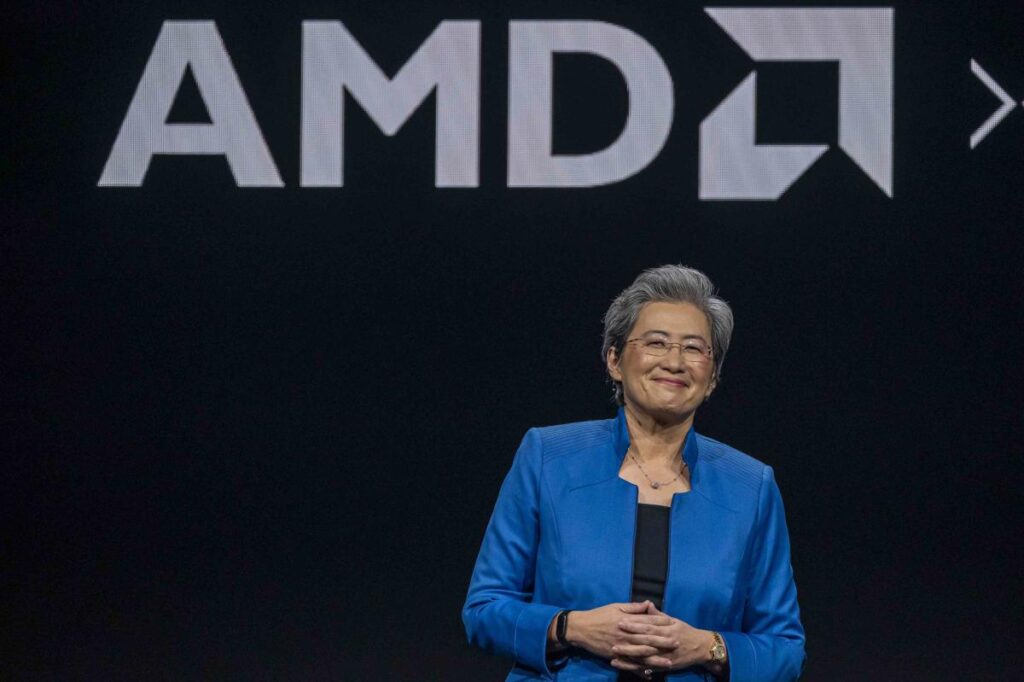

Semiconductor manufacturer Advanced Micro Devices (AMD) unveiled new artificial intelligence (AI) chips at its “Advancing AI 2024” event in San Francisco on Thursday. Its shares dropped 4%, with some analysts suggesting that its presentation may not have been sufficient to convince investors that its new products will be able to compete with AI chips from Nvidia (NVDA).

Shares of Generac Holdings (GNRC), which provides home generators and other power solutions, fell 3.5% as Hurricane Milton moved through Florida. Thursday’s downturn reversed a portion of the gains posted by the stock ahead of the storm.

The day’s strongest performance in the S&P 500 belonged to shares of cybersecurity firm CrowdStrike Holdings (CRWD), which climbed 5.6% after RBC Capital included the stock on its list of top picks in the software space. Analysts believe the company is successfully moving past an incident in July when a faulty software update caused widespread IT outages around the world.

Shares of fertilizer maker Mosaic Co. (MOS) gained 4.4%. Based in Tampa, Fla., Mosaic faced uncertainties about the potential impact of Hurricane Milton on its operations. The company said Thursday that it will begin to assess the impact of the storm as soon as conditions allow.

Shares of Micron Technology (MU) shares added 3.9%. Although AMD’s AI event may have failed to generate much investor enthusiasm, its new chips included more memory than previous products, underlining the importance of high-bandwidth memory for AI processes. Micron, which manufactures memory chips, is a partner of AMD.

Read the original article on Investopedia.

Read the full article here