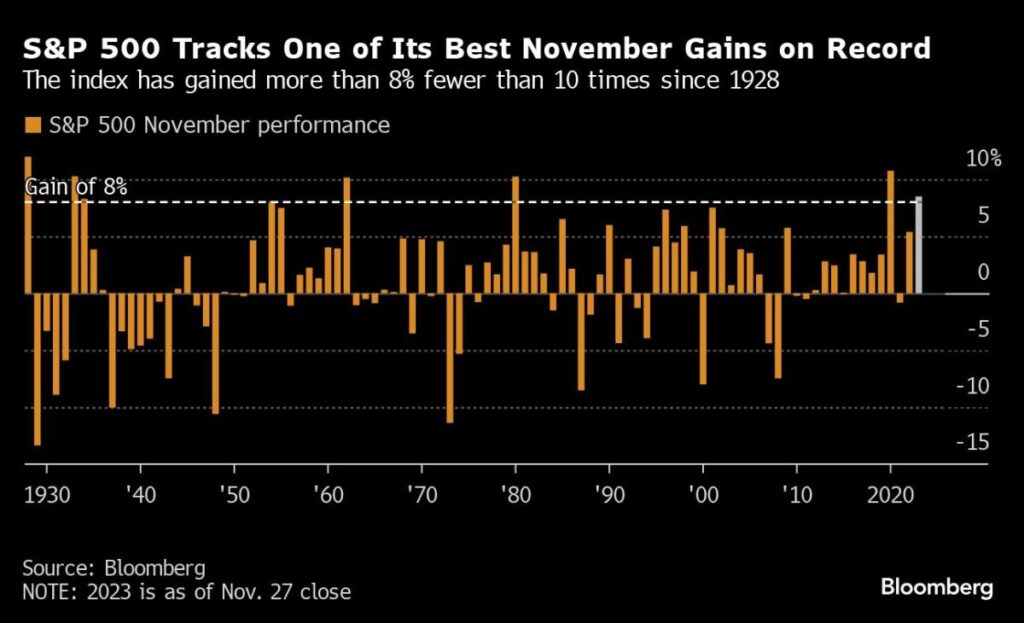

(Bloomberg) — The rally that led the S&P 500 to one of its best November gains in a century is now running out of steam, according to Citigroup Inc. strategists.

Most Read from Bloomberg

The team led by Chris Montagu said futures flows last week were “mixed,” leaving net positioning in the benchmark index looking “slightly bearish.” Positioning in Nasdaq 100 futures is neutral.

“With the S&P up a fourth consecutive week, underlying bullish signs from futures flows are fading,” Montagu wrote in a note dated Nov. 27. “The first stage of the rally was accompanied by large unwinds of October’s short positioning,” he said. Subsequent new additions of long positions have now faded, he said.

US stocks have rallied more than 8% in November — marking one of their strongest gains for the month since records began — on bets of a peak in interest rates and resilient economic growth. However, the S&P 500 has stalled in the past few days, with investors concerned about the health of US consumers as the crucial holiday shopping season ramps up.

Wall Street strategists are more optimistic about the outlook for stocks in 2024. Forecasters at Bank of America Corp., Deutsche Bank Group AG and RBC Capital Markets are among those predicting a record high for the S&P 500 as calls for a recession fade. That marks a shift from this year, when most were warning that higher interest rates would trigger an economic contraction and crater the stock market.

Citigroup’s Montagu said there’s still a chance for further gains before end-2023 as growing losses on the remaining short positions in futures increase the potential for forced covering.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Read the full article here