(Bloomberg) — Investors should extend the recent stimulus-fuelled gains in Chinese equities and the yuan as well as the decline in the country’s bonds, according to Stephen Jen of Eurizon SLJ Capital.

Most Read from Bloomberg

“Investors are so underweight everything Chinese, and Chinese equities are extremely undervalued that a serious rally is entirely possible,” Jen, Eurizon SLJ’s London-based chief executive officer, said in a report to clients on Friday.

Jen, who said last month that Chinese companies may be enticed to sell a $1 trillion pile of dollar-denominated assets as the US cuts interest rates, follows investors including billionaire David Tepper in expressing bullishness on China after its government introduced sweeping stimulus measures.

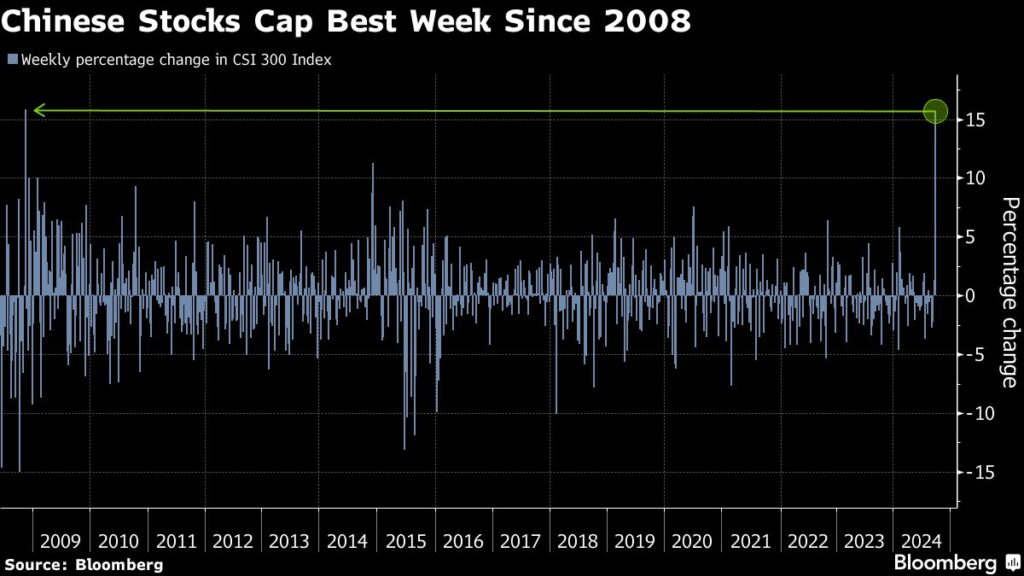

The policy-easing blitz lifted the CSI 300 index last week to its biggest gain since 2008, yet 19% of respondents to Bank of America Corp.’s September survey of global fund managers said “shorting Chinese stocks” was one of the most popular trades.

With China stepping up at the same time as the Federal Reserve is cutting interest rates, and with oil prices remaining low, risk assets “ought to do very well,” Jen said.

“After the US election, I expect global equities to rally powerfully into year-end,” he added.

Jen, the creator of the “dollar smile” theory which posits that the greenback rises when the US economy is either booming or in a deep slump, expects the currency to trade lower against the euro, yen and yuan, as US inflation slows toward zero and the world’s biggest economy “soft lands.”

–With assistance from Paul Dobson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here