(Bloomberg) — The Philippines has kicked off marketing of its first ever US-currency Islamic note as the country aims to expand its funding base and capitalize on a recent drop in dollar borrowing costs.

Most Read from Bloomberg

The Southeast Asian nation is offering a benchmark-sized, five-and-a-half year sukuk at 115 basis points, according to a person with knowledge of the matter. Philippine Finance Secretary Benjamin Diokno said this week that the government expects to raise around $1 billion from the deal.

The Philippines is seeking to attract more Middle Eastern investors to its debt as it looks to fund a budget deficit and support economic growth. The deal follows on the heels of a $2 billion sale of Sharia-compliant notes by Indonesia earlier this month.

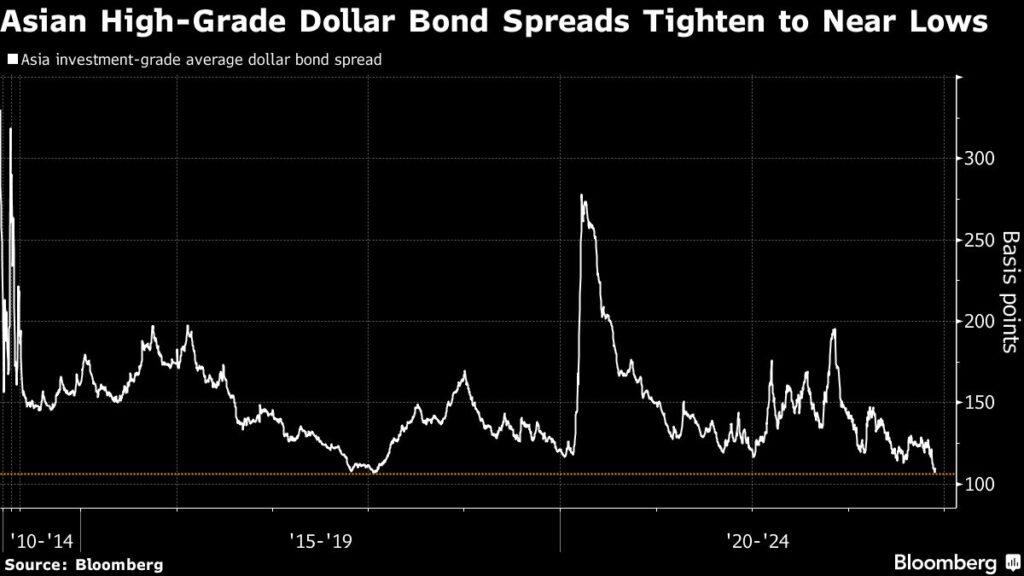

Spreads on Asia investment-grade dollar bonds have tightened to near historic lows in recent weeks, luring back regional borrowers to the US-currency debt market. Still, year-to-date issuance of such notes are running at a decade low, according to data compiled by Bloomberg.

Signs that the Federal Reserve may have concluded its tightening cycle have also helped push down yields over the last month.

–With assistance from Tassia Sipahutar.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Read the full article here