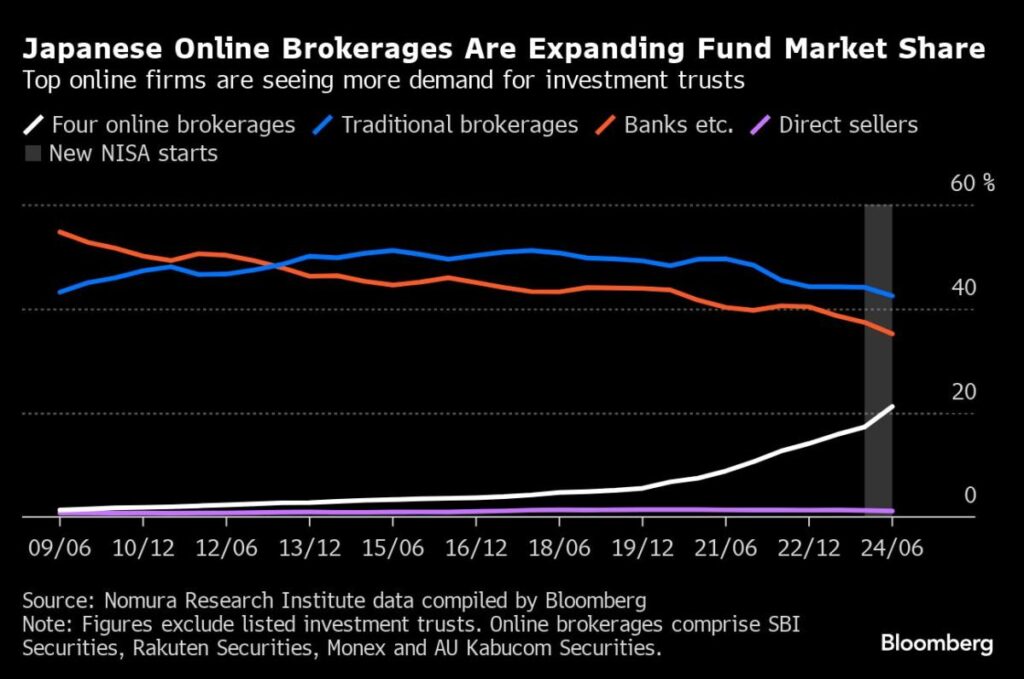

(Bloomberg) — Japan’s top online securities firms are increasing their share of the investment trust market at the expense of banks and traditional brokerages that focused for decades on face-to-face sales.

Most Read from Bloomberg

The popularity of an expanded tax-free investment account program called NISA has encouraged its users, most of whom are in their 40s or younger according to one report, to do deals on their smartphones and laptops. That’s led to the share of online brokerages in the publicly offered investment trust market to rise above 20% for the first time at the end of June from about 16% a year earlier, according to estimates by Nomura Research Institute.

The category that includes banks, which dominated with person-to-person broking about 15 years ago with over a 50% share in terms of net assets managed, only made up a bit more than a third of the market in June. Securities companies that aren’t primarily web-based saw their share slip to 43% from 44% a year earlier, according to NRI.

With an aging and shrinking population straining Japan’s public finances, policymakers have been trying to steer individuals to investments from savings to provide extra returns in exchange for higher risks. Individual investors used to getting nearly 0% interest rates from their bank savings have flocked into investment trusts, which are like mutual funds in the US. The net asset value of the publicly offered trusts soared to a record ¥237.4 trillion ($1.7 trillion) at the end of June, due in part to the inflow of NISA funds and investors’ bullishness on stocks.

Investors were hit early last month by sharp volatility in global stock and currency markets that saw both the Nikkei 225 and Topix indexes plunge 12% on Aug. 5. But while that likely caused sharp swings in the net value of investment trusts, “it did not seem to have a significant impact” on subsequent customer behavior because investors are becoming more focused on long-term investing, according to Hisashi Kaneko, senior researcher at NRI.

Top Japanese online brokers include SBI Securities Co., Rakuten Securities Inc., Monex Group Inc. and AU Kabucom Securities Co.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here