Shares of Nvidia fell on Wednesday even though the company reported some pretty impressive third-quarter earnings figures after the bell on Tuesday—including a whopping 206% year-over-year revenue increase to $18.12 billion. This topped consensus estimates of $16.1 billion, and yet Nvidia stock was down more than 2% the day before Thanksgiving. It could have to do with the chipmaker’s lofty pre-earnings valuation. Nvidia shares have been riding the AI hype train and are now “disconnected from reality,” according to a top analyst whose skepticism breaks from many boosters in the field.

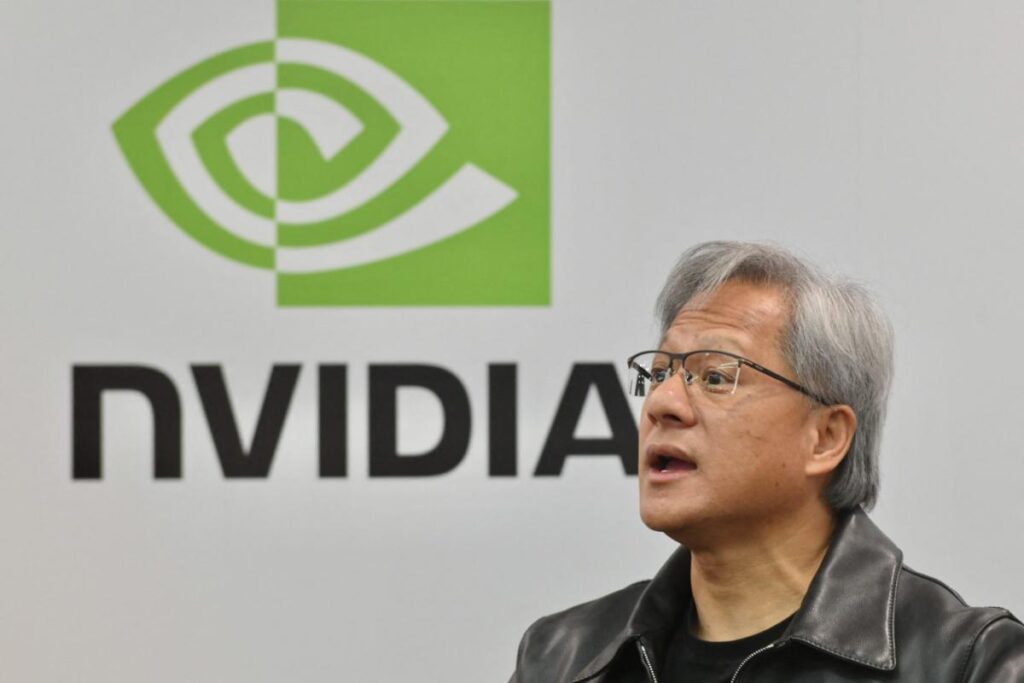

Most experts on Wall Street cheered Nvidia’s latest earnings report, however. Wedbush tech analyst Dan Ives, in a Tuesday note, argued the company’s strong earnings are evidence that AI is the most important tech theme since the birth of the internet, calling CEO Jensen Huang “the Godfather of AI.” And Deepwater Asset Management’s Gene Munster, another veteran tech analyst, said in a video webcast that “the bottom line is Jensen presented the proper case that this AI party can continue.”

But David Trainer, CEO of investment research firm New Constructs, had a very different take. The Wall Street veteran wrote on Wednesday that Nvidia’s valuation is “priced for perfection”—and that’s not a good thing. After all, reality is rarely, if ever, perfect.

“The AI hype driving Nvidia is like the crypto hype that drove lots of other stocks to nosebleed heights only to fall back down to earth a few months after the hype wore off,” Trainer warned.

‘Priced for perfection’

Looking at the numbers, Nvidia stock trades at roughly 120 times its trailing earnings. However, because of its rapid growth rate, it trades just around 30 times its forward earnings. That’s above the S&P 500’s average forward P/E ratio of 20, but definitely not as outlandish as the backward-looking figure.

Still, if you ask New Constructs’ Trainer, Nvidia just can’t maintain its current level of growth. He noted that the current stock price implies that Nvidia’s revenue will surge to $1.7 trillion by 2039. That would be more than the GDP of all of Mexico, which was $1.47 trillion last year.

“Way too much optimism is priced into Nvidia’s stock,” he said. “We believe the future cash flow expectations baked into Nvidia’s stock are altogether much too high for any reasonable investor to believe the company could achieve them.”

Although there is strong demand for Nvidia’s chips and the third quarter earnings report was largely positive, the stock’s valuation just remains “outrageous and far from sustainable,” according to Trainer, who argued investors should avoid Nvidia shares until prices fall below $150 per share.

“Investors who want to invest in the artificial intelligence space should consider companies that benefit from the same tailwinds as the popular AI stocks but have not yet seen their stock prices take off, such as Vishay Intertechnology Inc. (VSH) and Photronics (PLAB),” he added.

The bulls’ take

If you ask the bulls, it was a stern headwind on revenue guidance from U.S. semiconductor export controls on China, Vietnam, and other nations that likely sparked the pullback in Nvidia’s stock Tuesday, not the company’s valuation.

Although Nvidia increased its fourth quarter revenue guidance to $20 billion, Deepwater Asset Management’s Munster explained that there was a “whisper number” on Wall Street that indicated it could be even higher. And with revenue growth being so critical to Nvidia’s robust valuation, the stock could be falling as a result of this slight misstep in revenue guidance amid U.S. export controls.

The U.S. government’s export controls on certain Nvidia chips will slow sales in affected regions—including China, Vietnam, and parts of the Middle East—which in total make up between 20% to 25% of Nvidia’s surging data center revenue.

“We expect that our sales to these destinations will decline significantly in the fourth quarter,” Nvidia’s CFO, Colette Kress, admitted in the company’s earnings call Tuesday. But Kress quickly added that she believes the lost sales will “be more than offset by strong growth in other regions” moving forward.

After seeing monumental revenue growth in the third quarter, Nvidia’s management was decidedly bullish on the earnings call. “Our strong growth reflects the broad industry platform transition from general purpose to accelerated computing and generative AI,” CEO Jensen Huang said. “Large language model startups, consumer internet companies, and global cloud service providers are the first movers. The next waves are starting to build.”

Nvidia’s impressive earnings figures and confident standing certainly impressed Wall Street’s tech bulls. Wedbush’s Ives argued the third quarter earnings release was “another jaw dropper,” and the strong guidance was “heard around the world.”

“The AI revolution is accelerating into 2024 for the broader tech sector,” he wrote in a Tuesday note to clients. “A key theme from this tech earnings season has been that AI monetization has begun to positively impact the tech sector.”

Ives has long argued that we’re in the middle of the “AI gold rush,” comparing the new technology to the birth of the internet. And he reiterated his strong feelings this week, saying: “AI will lead the new tech bull market, which we believe is already well underway with bears now heading back into the dark caves for hibernation.”

Angelo Zino, VP and senior equity analyst at CFRA Research, is another Nvidia bull who liked what he saw on Tuesday. Zino maintained his “buy” rating and $600 price target on Nvidia stock after earnings. He said that the company is working to bring new semiconductor offerings to regions affected by U.S. sanctions, which could be a catalyst for a return to growth in these areas. He also noted the enterprise software business has shown encouraging signs amid the AI boom.

And Raymond James analyst Srini Pajjuri also reiterated his “strong buy” rating on Nvidia Wednesday while pushing back against concerns about the impact of U.S. sanctions. “NVDA reported another strong quarter as broadening AI adoption is helping more than offset the impact from China export restrictions,” he wrote in a Wednesday note. “Looking ahead, we expect strong double-digit growth to continue.”

This story was originally featured on Fortune.com

Read the full article here