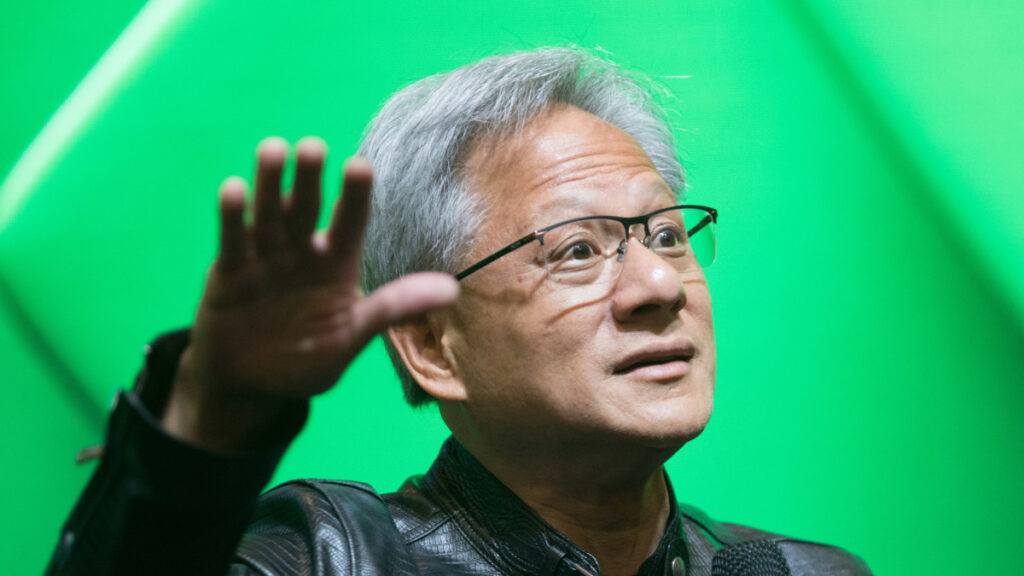

Gene Wang/Getty Images

Nvidia becomes AI powerhouse

It was at a Denny’s restaurant in San Jose, Calif. where, in 1993, Huang met up with two friends, Chris Malachowsky and Curtis Priem, to discuss creating a chip that would enable realistic 3D graphics on personal computers.

Huang said the restaurant, which was just off a busy thoroughfare in the heart of Silicon Valley, was the perfect place to start a business.

Related: Nvidia stock extends $280 billion slump after DoJ probe report

“It had all the coffee you could drink and no one could chase you out,” he said.

The business that the three men started turned out to be Nvidia and Huang has been running the show ever since.

Last year, Huang and Denny’s CEO Kelli Valade, who got her first job as a waitress at a diner when she was 16, unveiled a plaque at the Denny’s restaurant where Nvidia was born.

The company has muscled into the artificial intelligence sector big time and briefly edged out Microsoft as the world’s most valuable publicly traded company.

Huang has done rather well for himself and even donated $2 million to his former school in Oneida to build a dormitory and classroom building, called Huang Hall, for female students.

There have been setbacks, including reports earlier this month that the chipmaker is part of an antitrust probe into the semiconductor sector by the U.S. Department of Justice.

Nevertheless, Nvidia’s stock is up 144% year-to-date and has climbed 188% from a year ago.

“In 2024, the technology sector moved firmly into the AI phase of computing,” Bain & Co. said in a recent study. “Cloud service providers, enterprises, and technology vendors are spending more on AI than ever, and adoption rates are high.”

The study said that creating value with AI requires changes in the working processes of hundreds or thousands of employees.

“Companies need to conduct business diagnostics, redesign processes, set targets, and manage change as they deploy this technology,” Bain said. “But early proof points from our client work are encouraging, showing that generative AI initiatives could be worth up to 20% of Ebitda.”

Last month, Nvidia posted better-than-expected second-quarter earnings, while unveiling plans for a $50 billion stock buyback. The group said demand for its legacy AI chips remains strong ahead of shipments of its new Blackwell line of processors.

Nvidia CEO: ‘We want to be the world’s best’

“We want to be consistently the world’s best,” Huang told analysts during the company’s earnings call. “And that’s the reason why we drive ourselves so hard.”

“Of course, we also want to see our dreams come true and all of the capabilities that we imagine in the future and the benefits that we can bring to society, we want to see all that come true,” he added.

Huang, who has said that “we are at the beginning of a new industrial revolution,” has been making some changes to his portfolio, according to Barron’s.

More AI Stocks:

The former Denny’s employee grossed $713 million through stock sales executed by his Rule 10b5-1 trading plan, an average price of $118.83 a share.

The plan was set to be effective through March 2025, but it sold all the allotted shares six months before expiration. Huang could adopt another plan to sell more shares.

Huang’s plan sold shares from a personal account that now owns 75.4 million Nvidia shares, according to a form he filed with the Securities and Exchange Commission. He also owns 786 million company shares through trusts and partnerships.

Huang is the largest individual owner of Nvidia stock, according to the company’s latest proxy statement, owning a 3.8% stake as of the end of March, before his 2024 stock sales.

In 2023, he sold 237,500 Nvidia shares, all in September, for $110 million, an average price of $463.95 each.

That share count and price were before a 10-for-1 stock split that was effective in early June. The 2023 sales were also planned transactions, ones that involved acquiring stock through the use of options.

Related: Nvidia CEO Jensen Huang just told investors what’s next for the AI chipmaker

Read the full article here