AI juggernaut Nvidia (NVDA) reported its second quarter earnings after the bell on Wednesday, beating expectations on the top and bottom line, and beating on anticipated guidance for the coming quarter.

For the quarter, the company reported earnings per share of $0.68 on revenue of $30 billion. Analysts were expecting EPS of $0.64 and revenue of $28.8 billion. That’s a massive increase from the same period last year when Nvidia saw EPS of $0.27 and revenue of $13.5 billion.

The company also provided third quarter revenue guidance of $32.5 billion plus or minus 2%, analysts were looking for $31.9 billion.

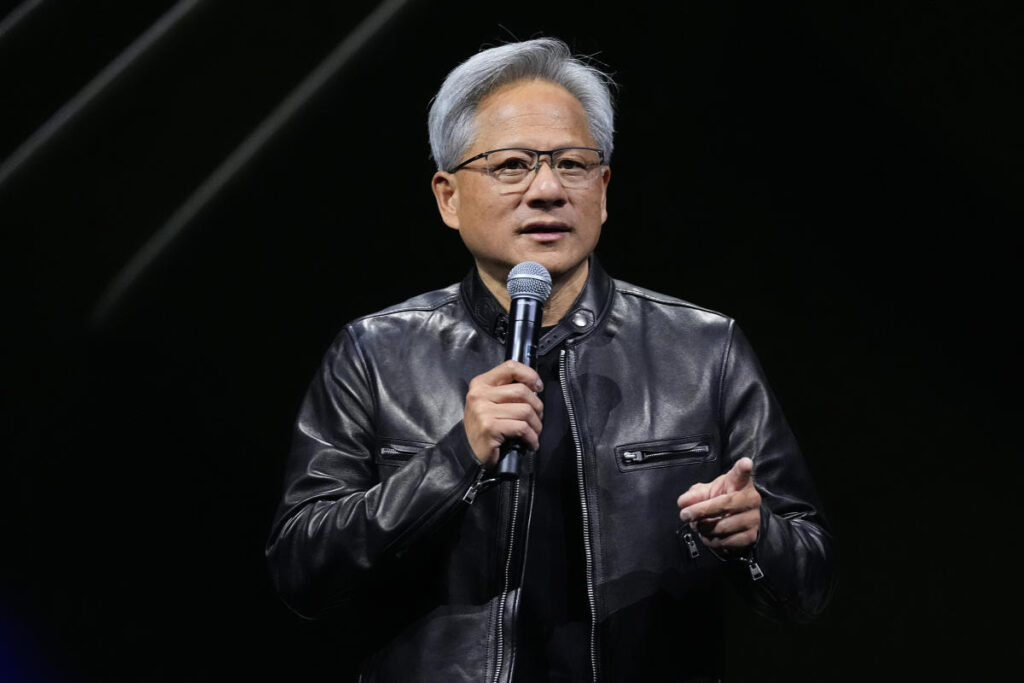

In a statement, CEO Jensen Huang said anticipation for the company’s next-generation Blackwell chip is “incredible.”

Shares of the chip giant were down 6% immediately following the announcement.

The bulk of that revenue came from Nvidia’s all-important data center business, which brought in $26.3 billion in the quarter versus Wall Street’s expectations of $25 billion in revenue. That’s a 154% increase from the same period last year when segment brought in $10.3 billion.

Nvidia is the world leader in AI chip design and software, controlling between 80% and 95% of the market, according to Reuters.

According to CFO Colette Kress, Nvidia anticipates several billion dollars of Blackwell revenue in Q4.

Nvidia’s rivals aren’t resting on their laurels. Earlier this month, AMD announced it is acquiring ZT Systems in a deal valued at $4.9 billion. The move gives AMD more firepower to build out AI system servers, something that’s been a major catalyst for Nvidia’s own sales.

And while it could provide AMD with a boost in sales, it doesn’t mean Nvidia will face any major threats to its reign as the AI king anytime soon.

“There are emerging competitors like AMD that are starting to take a little bit of market share,” Stifel managing director Ruben Roy told Yahoo Finance Monday. “But when you look at the overall infrastructure spend cycle … which we think is going to continue to increase, Nvidia appears to us as the best positioned to benefit from [spending].”

Nvidia’s gaming division, which used to stand as the company’s breadwinner, saw revenue of $2.8 billion up 16% year-over-year.

Email Daniel Howley at dhowley@yahoofinance.com. Follow him on Twitter at @DanielHowley.

For the latest earnings reports and analysis, earnings whispers and expectations, and company earnings news, click here

Read the latest financial and business news from Yahoo Finance.

Read the full article here