(Bloomberg) — September is already shaping up to be a tough month for investors in the municipal debt market, with a supply-demand mismatch threatening to squeeze performance.

Most Read from Bloomberg

The total amount of redemptions to be paid out by local governments this month totals $22.8 billion, less than half of what was paid out in August and roughly 21% less than 2024’s monthly average, according to data from CreditSights Inc. That drop is set to reduce the baked-in demand that has supported the market for much of the summer.

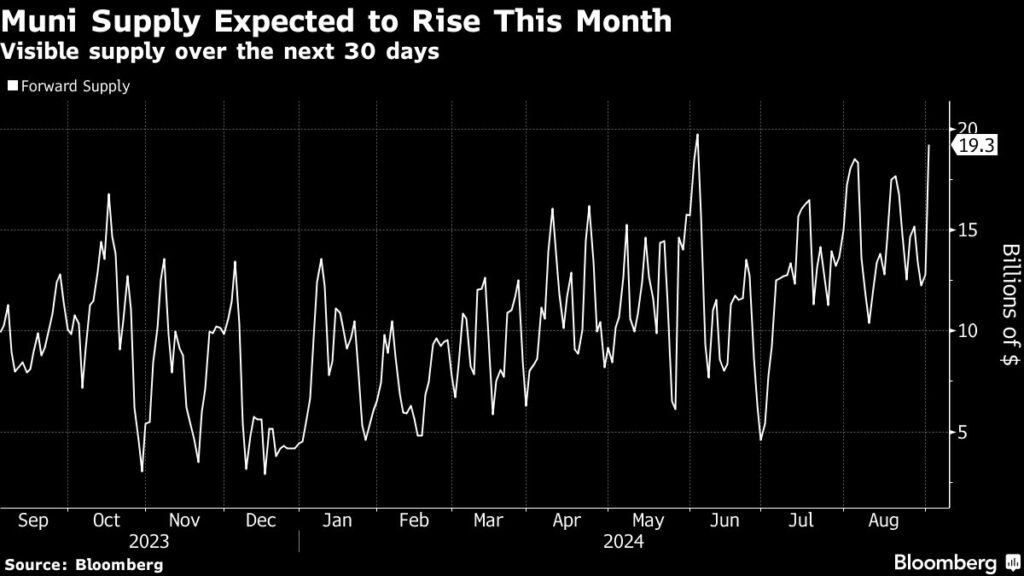

At the same time, roughly $19.3 billion of new issuance is expected over the next 30 days — the most since June — according to data compiled by Bloomberg.

Less money flowing back to muni investors through bond payments coupled with the expected increase in new bond sales as issuers rush to raise debt ahead of the US presidential election, could lead to September weakness.

“Because of the slowdowns in redemptions and the increased pace of new issue supply, we expect that the net-supply will be positive for the rest of the year,” wrote Pat Luby, head of municipal strategy at CreditSights in a research note published Monday.

Actual supply for the month will most likely be much greater than the $19.3 billion forward supply estimate, since some deals are put on the calendar with less than 30 days notice. Bank of America Corp. expects $38 billion of supply this month.

September is also historically the worst month for the asset class, which has posted negative returns in seven of the last eight years.

Eric Kazatsky, a strategist at Bloomberg Intelligence, said the September losing streak could break if the Federal Reserve begins to cut rates at its next meeting in two weeks.

With the first rate cut priced in, and additional cuts on the horizon, “demand from investors looking to lock in higher yields should help boost performance,” he said in a note published Tuesday. “This, coupled with election jitters, could build on positive returns.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here