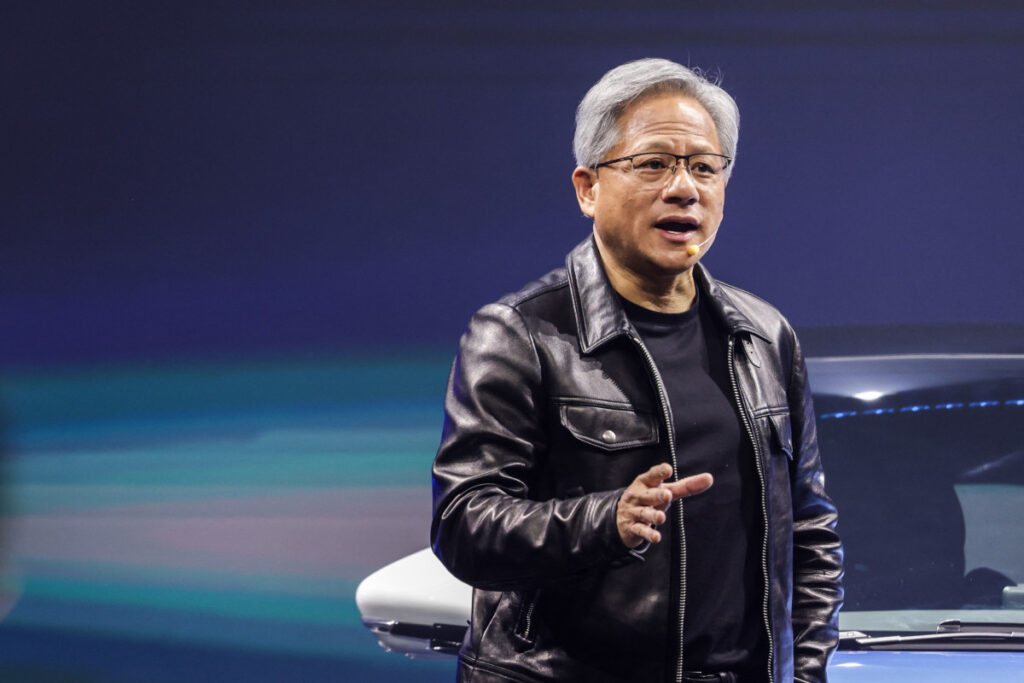

NurPhoto/Getty Images

Nvidia trades higher on “insane” demand ahead

Nvidia stock added 3% after CEO Jensen Huang revealed strong demand for Blackwell.

“Blackwell is in full production,” Huang said on Oct. 2 in an interview with CNBC. “Blackwell is as planned, and the demand for Blackwell is insane. Everybody wants to have the most, and everybody wants to be first.”

Related: Nvidia CEO Jensen Huang just told investors what’s next for the AI chipmaker

Blackwell is a platform Nvidia rolled out in March that allows organizations to run real-time generative AI on models trained to understand and produce human language. Its customers include Amazon AWS, Microsoft Azure, and Google Cloud.

“There is new Al infrastructure generation every year,” Huang said. “So, we’re updating our platform every single year. If we can increase the performance, like we’ve done for Hopper and Blackwell … we’re effectively increasing the revenue or throughput for our customers on these infrastructures by a couple to three times each year.”

AMD stock gains on analyst update

AMD stock added nearly 2% after a BofA analyst said that AMD’s AI event on October 10 could be a “catch-up catalyst,” according to thefly.com

The analyst notes that last year’s AI event on December 6 produced 19% and 80% stock returns one month and three months later, respectively.

Related: Analysts reset AMD stock outlooks after AI acquisition

The analyst argues that roadmap updates in AI and server CPU with supporting cloud customer comments “could reinvigorate AMD stock,” but warns of intensifying competition in the AI industry.

BofA maintains a buy rating and a $180 price target on AMD shares.

Levi Strauss tumbles on weak outlook

Levi Strauss lost 7.3% after the jeans maker posted a revenue miss and reduced its fiscal-year revenue outlook.

For the quarter ended Aug. 25, the company earned 33 cents per share, higher than the 31 cents expected by analysts. However, revenue of $1.52 billion missed analysts’ forecast of $1.55 billion.

More Retail Stocks:

Levi Strauss also lowered its revenue guidance, now expecting sales to grow 1%, down from prior guidance for growth of 1% to 3% and below the 2.3% growth that analysts had expected, according to LSEG data.

The company is considering selling its Dockers brand, whose sales at Dockers were down 15% to $73.7 million during the quarter.

Related: The 10 best investing books, according to our stock market pros

Read the full article here