(Bloomberg) — Japanese stocks rose after the nation’s new prime minister damped speculation about another interest-rate increase, weakening the currency. Treasuries slid and the dollar gained Wednesday on signals the US may slow its easing.

Most Read from Bloomberg

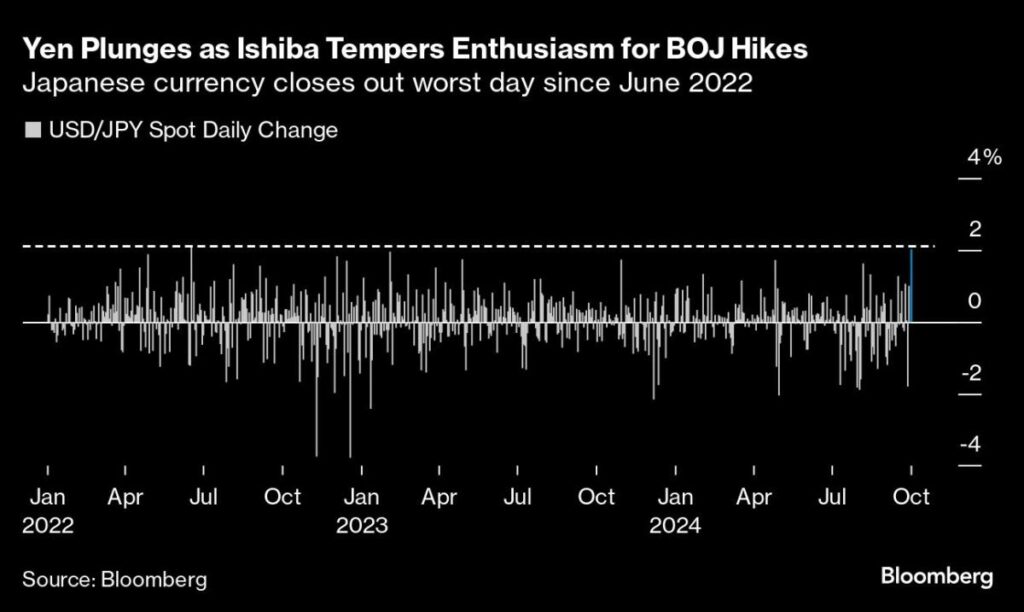

The yen tumbled about 2% against the dollar Wednesday, its worst day since June 2022, after Shigeru Ishiba said the economy isn’t ready for another hike. The currency fluctuated near 146.50 per dollar Thursday, near its weakest level in a month.

Australian shares were little changed as were Hong Kong equity futures, while contracts for the S&P 500 edged higher after the index ended Wednesday little changed. A gauge of US-listed Chinese companies surged almost 5% after mainland stocks listed in Hong Kong jumped Wednesday.

Renewed vigor in the dollar added to the pressure on the yen as stronger-than-expected ADP jobs data led traders to pare bets on aggressive Federal Reserve rate cuts. Swaps traders were penciling in some 33 basis points of policy easing at the central bank’s November meeting, down from 44 basis points just last week.

Oil rose for a third day in early Asian trading as investors await Israel’s response to Iran’s missile attack, with US President Joe Biden urging Israel to hold off from attacking Iran’s nuclear facilities.

An index of dollar strength rose on Wednesday as Treasury yields climbed. The 10-year yield rose five basis points to 3.78% after hitting a low of 3.69% in the prior session amid the flare-up of tensions in the Middle East. US yields were little changed in Asian trading, while Australian and New Zealand yields rose.

Data Wednesday showed US companies added more jobs than economists forecast last month, at odds with other indicators that show a cooling labor market. Friday’s nonfarm payrolls numbers will be the next critical reading on the health of workers and the US economy.

The “ADP employment number surprised to the upside, suggesting the labor market is bending but not breaking,” said Chris Larkin at E*Trade from Morgan Stanley. “Friday’s monthly jobs report will have the final word on the current jobs picture, and more than likely, on near-term market sentiment.”

In Asia, Bank of Japan official Asahi Noguchi is set to speak Thursday, while data due for release includes Singapore S&P Global PMI figures and Jibun Bank PMI composite data. Markets are closed in mainland China and South Korea.

US Jobs

The US nonfarm payroll report won’t take a half a percentage point cut off the table, according to Bank of America Corp. strategists led by Meghan Swiber. “Even if the labor market surprises to the strong side, pricing will still maintain optionality,” they wrote.

To Marc Rowan, the chief executive officer of Apollo Global Management Inc., the Fed’s aggressive policy easing threatens to overstimulate the economy.

“It is not clear we need more rate cuts,” he said in an interview with Bloomberg Television, pointing to ready financing and rising real estate prices.

Richmond Fed President Thomas Barkin said it was too early for the central bank to declare victory over rising prices. “While we have made real progress — there remains significant uncertainty on both inflation and employment,” he said.

Key events this week:

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.1% as of 9:02 a.m. Tokyo time

-

Hang Seng futures were little changed

-

Japan’s Topix rose 1.7%

-

Australia’s S&P/ASX 200 rose 0.1%

-

Euro Stoxx 50 futures rose 0.1%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was unchanged at $1.1045

-

The Japanese yen was little changed at 146.61 per dollar

-

The offshore yuan was little changed at 7.0375 per dollar

Cryptocurrencies

-

Bitcoin fell 0.3% to $60,725.01

-

Ether fell 0.8% to $2,367.48

Bonds

-

The yield on 10-year Treasuries was little changed at 3.79%

-

Japan’s 10-year yield declined three basis points to 0.820%

-

Australia’s 10-year yield advanced six basis points to 4.01%

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here