AGNC Investment (NASDAQ: AGNC) is not an easy stock to understand. It’s often viewed as an income investment because of its huge 14%-plus dividend yield. Only dividend investors have been let down by the company’s long string of dividend cuts. You need to take a different view of AGNC if you want to buy it. Here’s what you need to know about this niche real estate investment trust (REIT) and why it isn’t too late to buy it, but only if you know what you’re buying.

What does AGNC Investment do?

Most real estate investment trusts are fairly simple to understand. They buy properties and lease them out to tenants, which is basically what you would do if you bought a rental property. Mortgage REITs like AGNC, however, don’t buy properties. They buy mortgages that have been pooled into bond-like securities. That’s nothing like what a landlord does. It’s more like managing a bond mutual fund.

The mortgage securities AGNC buys are complex. For starters, they trade all day long, so their prices change rapidly. Buildings tend to trade infrequently. Mortgage security prices, meanwhile, can be affected by investor sentiment, interest rates, housing market dynamics, and repayment rates, among other things. On top of that, REITs like AGNC tend to use leverage to enhance their returns, often backed by the value of their loan portfolio. Mortgage REITs are high risk, particularly if you’re trying to live off the income your portfolio generates.

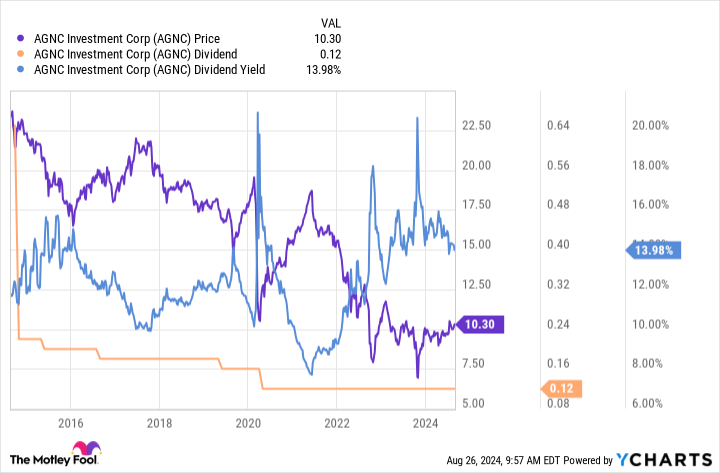

To highlight the risk, notice that the dividend yield in the following chart — the blue line — has mostly been above 10% for the past decade. The dividend itself, however, has headed steadily lower over that span. The only way that happens, given the math behind dividend yields, is for the stock price to head lower along with the dividend, which is exactly what happened. So if you bought for the yield, you would have ended up with less income and less capital.

Why would anyone want to buy AGNC Investment?

AGNC Investment is clearly not a stock that would meet the needs of an income-oriented investor. But that doesn’t mean it’s a bad investment, per se. It just means it’s a bad choice for income-oriented investors. Some investors will find AGNC Investment appealing, and here’s why:

Notice the blue line, which is the total return on this graph. It’s up more than 500% since the company’s initial public offering. That comes despite the drop in the share price and all of the dividend cuts. Total return assumes dividend reinvestment. The basic logic here is that the big dividend has allowed investors to buy more and more shares, which has resulted in the growth of their investment over time. This isn’t the way most income investors think about investing, but it is the way asset allocators and some larger investors do, such as pension funds.

Basically, if you’re trying to build a portfolio with broad diversification, you often want to put money into asset buckets. If mortgages make up one of the buckets, and you plan to reinvest the dividends you receive, AGNC Investment might be an attractive investment option. But this is a very specific purpose.

AGNC Investment is more like a mutual fund than a REIT

As noted, AGNC is not a simple income stock. If you’re looking to live off your dividend income, you should probably look elsewhere. But it is a good way to gain exposure to mortgage securities if you take a total-return approach and particularly if you focus on asset allocation. And since the portfolio is operated sort of like a mutual fund, there’s really no bad time to buy AGNC Investment. The key is to hold for the long term and dividend-reinvest to benefit from the total return potential over time.

Should you invest $1,000 in AGNC Investment Corp. right now?

Before you buy stock in AGNC Investment Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AGNC Investment Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $774,894!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 26, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Is It Too Late to Buy AGNC Investment Stock? was originally published by The Motley Fool

Read the full article here