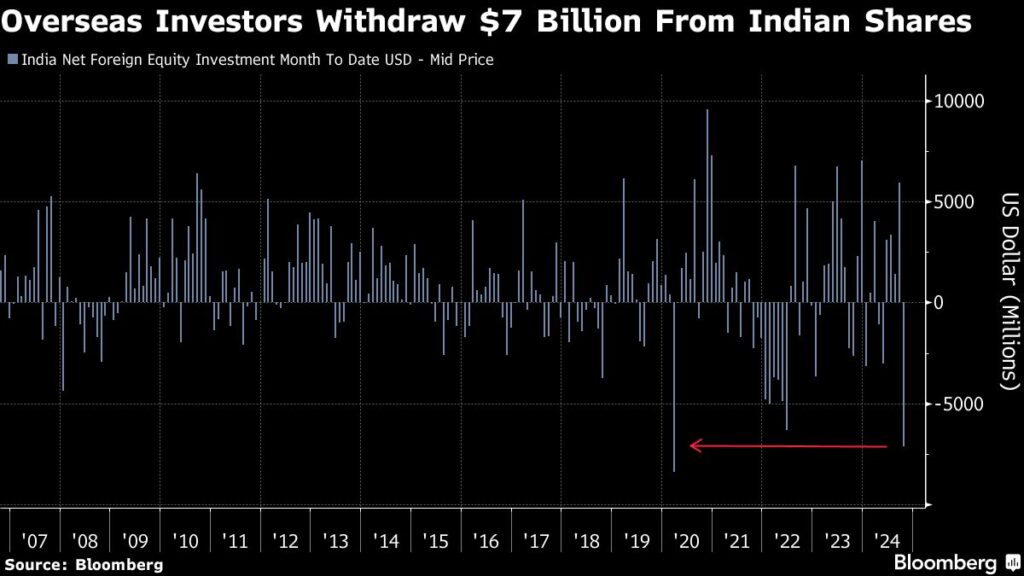

(Bloomberg) — Overseas investors sold Indian stocks every trading session this month, taking the net outflows to the highest since March 2020.

Most Read from Bloomberg

Foreign funds withdrew more than $7 billion from Indian equities in the month through Oct. 14, according to data compiled by Bloomberg. If the trend continues, the month will see the biggest exit since a record selloff during the pandemic.

A fierce rotation to China following a barrage of stimulus measures sucked money out of other Asian markets. Purchases of nearly $7.2 billion by local investors in the same period helped offset the losses in India, but the sentiment is turning.

The number of bulls equaled bears to extinguish the overweight stance on India in a BofA Securities survey. That’s a sharp U-turn from a net 32 percentage point lead for optimists in July.

“The upliftment in sentiment on China has come at the expense of India as seen from the dissipation of the gap in allocations,” Ritesh Samadhiya, a strategist at BofA Securities, said, in a note.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here