-

The market rose modestly on Tuesday ahead of Nvidia’s earnings report on Wednesday.

-

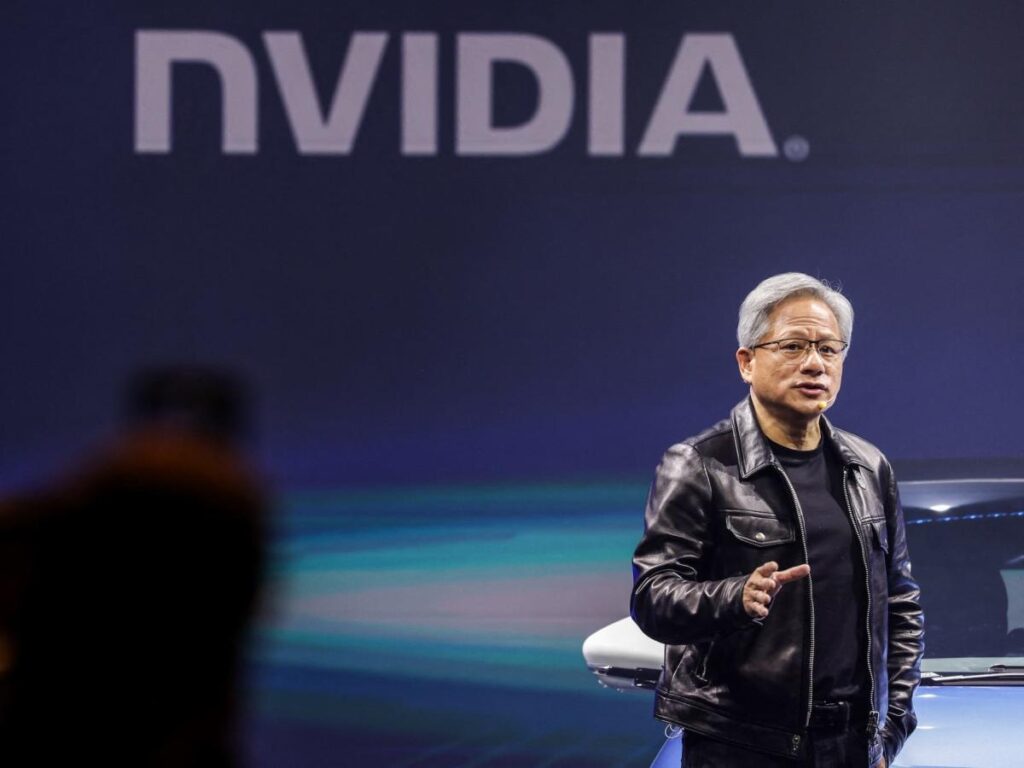

The chipmaker is considered a bellwether for the strength of the broader AI rally.

-

US consumer confidence rose to a six-month high, according to new data released Tuesday.

US stocks hovered near all-time highs on Tuesday, with investors largely holding off ahead of Nvidia’s earnings report.

Investors are gearing up for the chipmaker to publish its second-quarter performance on Wednesday, and Wall Street is bracing for potential market swings in either direction.

Given Nvidia’s central role in supporting the buildout of artificial intelligence, the firm’s release is seen as a metric for how well the AI rally is doing. If Nvidia discloses sales or demand weakness, investors may feel pressured to unwind their AI tech bets.

However, most analysts expect the semiconductor firm to beat consensus forecasts. While Wall Street remains largely optimistic, some banks did warn about near-term volatility caused by chip delay issues.

US consumer confidence hit a six-month high in August, according to Conference Board data released Tuesday. Alongside it, inflation expectations fell to a post-pandemic low, although consumer perceptions about the labor market deteriorated.

“We see weakening perception about the job market, likely putting a crimp on consumer spending in the coming months,” LPL Financial chief economist Jeffrey Roach said. “Investors recently heard from companies that consumers are becoming more selective, looking for deals and discounts.”

Fresh unemployment data will come later this week, with jobless claims scheduled for release Thursday. New PCE Index data will follow on Friday.

Both data points will be useful in determining the extent of interest rates cuts in September, when the Federal Reserve is expected to start easing policy.

Here’s where US indexes stood at the 4:00 p.m. closing bell on Tuesday:

Here’s what else happened today:

In commodities, bonds, and crypto:

-

West Texas Intermediate crude oil shed 2.23% to $75.69 a barrel. Brent crude, the international benchmark, dropped 2.20% to $79.64 a barrel.

-

Gold declined 0.22% to $2,523.48 an ounce.

-

The 10-year Treasury yield rose one basis point to 3.835%.

-

Bitcoin fell 1.17% to $62,117.

Read the original article on Business Insider

Read the full article here