Eli Lilly (NYSE: LLY) might just be the hottest pharmaceutical company on the planet right now. The company is the developer of a number of blockbuster drugs including Verzenio, Trulicity, and Taltz.

Of course, I’d be remiss to not include the company’s latest hits in weight loss. Lilly’s diabetes and obesity care medications, Mounjaro and Zepbound, are currently fueling a new wave of growth for the pharma leader and I don’t see that slowing anytime soon.

But what if I told you that there’s an entirely other reason to love Eli Lilly stock besides its highly successful medicine portfolio?

Below, I’ll break down one under-the-radar reason to consider Lilly for your portfolio for the long haul. Passive income investors won’t want to miss this one.

Did you know that Eli Lilly is a dividend stock?

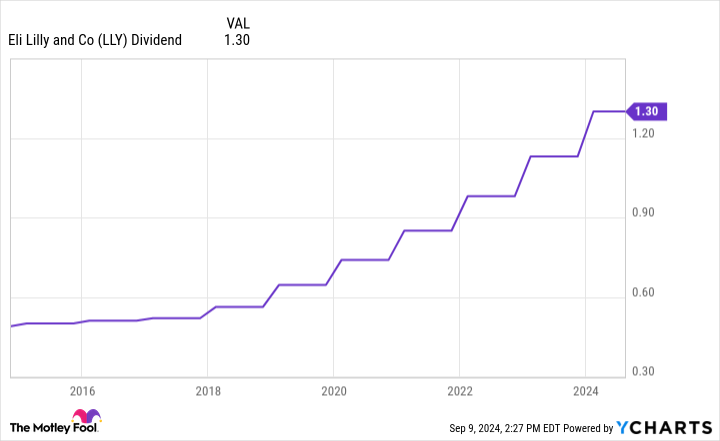

With a yield of less than 0.6%, I’d understand if Lilly’s dividend leaves you uninspired. However, I’d encourage investors to zoom out and think long-term here. Lilly has a history of not only paying a dividend, but raising it.

Today, investors receive a quarterly dividend payment of $1.30 per share (or $5.20 annually).

From 2009 until 2014, Lilly’s quarterly dividend payment was unchanged at $0.49 per share (or $1.96 annually). The table below illustrates changes to Lilly’s annual dividend since 2015.

|

Category |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|---|---|---|---|---|---|---|---|---|---|

|

Annual dividend per share |

$2.00 |

$2.04 |

$2.08 |

$2.25 |

$2.58 |

$2.96 |

$3.40 |

$3.92 |

$4.52 |

|

Growth (YOY) |

2% |

2% |

2% |

8% |

15% |

15% |

15% |

15% |

15% |

Data source: Eli Lilly. YOY = year over year.

As the figures above indicate, Lilly has not just maintained a dividend, but it’s raised the payment significantly. Furthermore, the company tends to declare its dividend hikes around December.

Although I cannot say with certainty if and when Lilly will raise its dividend again, I think there’s a good chance the company will continue rewarding shareholders by either maintaining its current $5.20 annual dividend or perhaps announcing yet another raise at the end of the year.

Eli Lilly has been a tremendous long-term investment

Eli Lilly is much more than a growth stock; it’s truly a prolific medicine company that over decades has managed to have a positive impact on several pockets of the healthcare market.

Since 1972, shares of Eli Lilly have generated a total return north of 100,000%. Clearly, Lilly has been a consistent multibagger opportunity for patient investors.

Although much of the stock’s appreciation can be attributed to Lilly’s steadfast commitment to innovation — underscored by meaningful research and development (R&D), which has allowed Lilly to continually enter emerging opportunities in healthcare — reinvesting dividends and holding onto the stock has also proven to be a lucrative strategy to generate even more gains.

Right now, Lilly is in the early stages of disrupting the weight loss market, and the company just received clearance from the Food and Drug Administration (FDA) for its Alzheimer’s candidate, donanemab. I see Lilly as a compelling long-term opportunity and very much see the rising dividend as a fringe benefit of owning the stock.

Considering management has raised the dividend each year for nearly a decade around December, now could be an interesting time to pounce on Lilly stock.

Should you invest $1,000 in Eli Lilly right now?

Before you buy stock in Eli Lilly, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Eli Lilly wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $652,404!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 9, 2024

Adam Spatacco has positions in Eli Lilly. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Forget Mounjaro: 1 Reason Investors Should Love Eli Lilly Stock Even More (Hint: I’m Not Talking About Zepbound) was originally published by The Motley Fool

Read the full article here