(Bloomberg) — Hong Kong’s long-dormant currency has come out of hibernation, as demand soars following a remarkable rally in Chinese stocks listed on the city’s bourse.

Most Read from Bloomberg

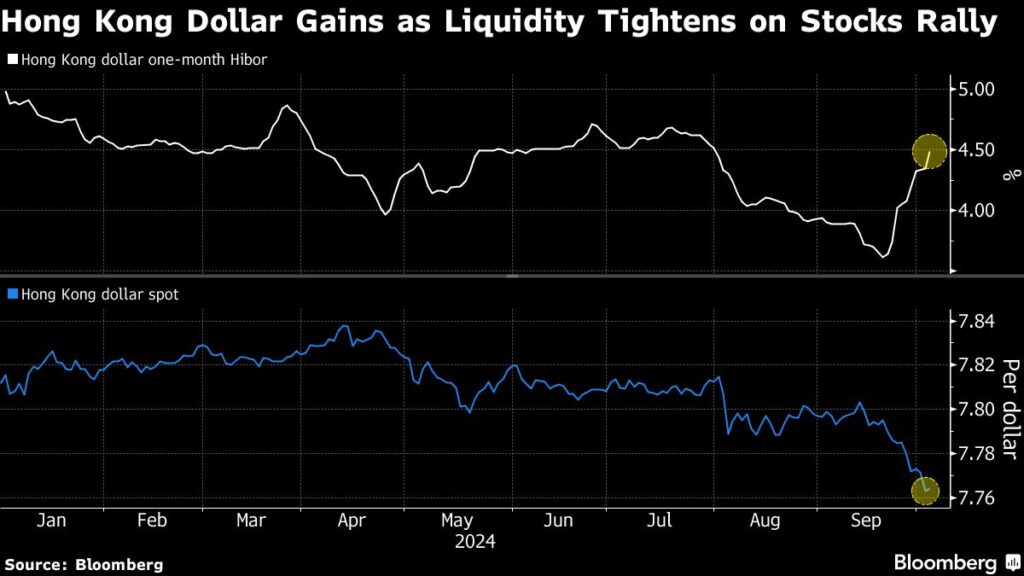

As supply for the Hong Kong dollar tightened, its one-month funding costs have climbed for 10 straight days to the highest since late July. Transactions in the currency’s options also reached nearly six times the daily average.

The burst of activity, rarely seen for a currency pegged to the US dollar, has been a side product of a historic rally in Chinese shares on hopes that Beijing’s fresh stimulus measures will revive a slowing economy. Seasonal factors such as quarter-end regulatory checks for bank liquidity and a recent local bond sale also have boosted demand for Hong Kong’s currency, nudging it toward the strongest level it’s allowed to trade versus the greenback.

“The one-month tenor and below may bear most of the upward pressure,” Oversea-Chinese Banking Co. strategists including Frances Cheung wrote in a note, referring to rates on the Hong Kong dollar. “Our medium-term view for the rates to lag in a downtrend would materialize” if stock inflows sustain and loan demand rises.

Hong Kong-listed Chinese stocks resumed a rally Friday, following a bout of profit taking in the previous session, extending their gains to 35% from a September low.

The local currency was quoted at 7.7663 per US dollar on Friday. It’s allowed to move in a band of 7.75 to 7.85 versus the greenback. Some $4.8 billion of Hong Kong dollar options changed hands on Thursday, about 600% of the daily average, according to data from the Depository Trust & Clearing Corp.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here