(Bloomberg) — Momentum for corporate earnings remains solid despite gains in the yen and bodes well for Japanese stocks to rise further this year, according to Goldman Sachs Group Inc.

Most Read from Bloomberg

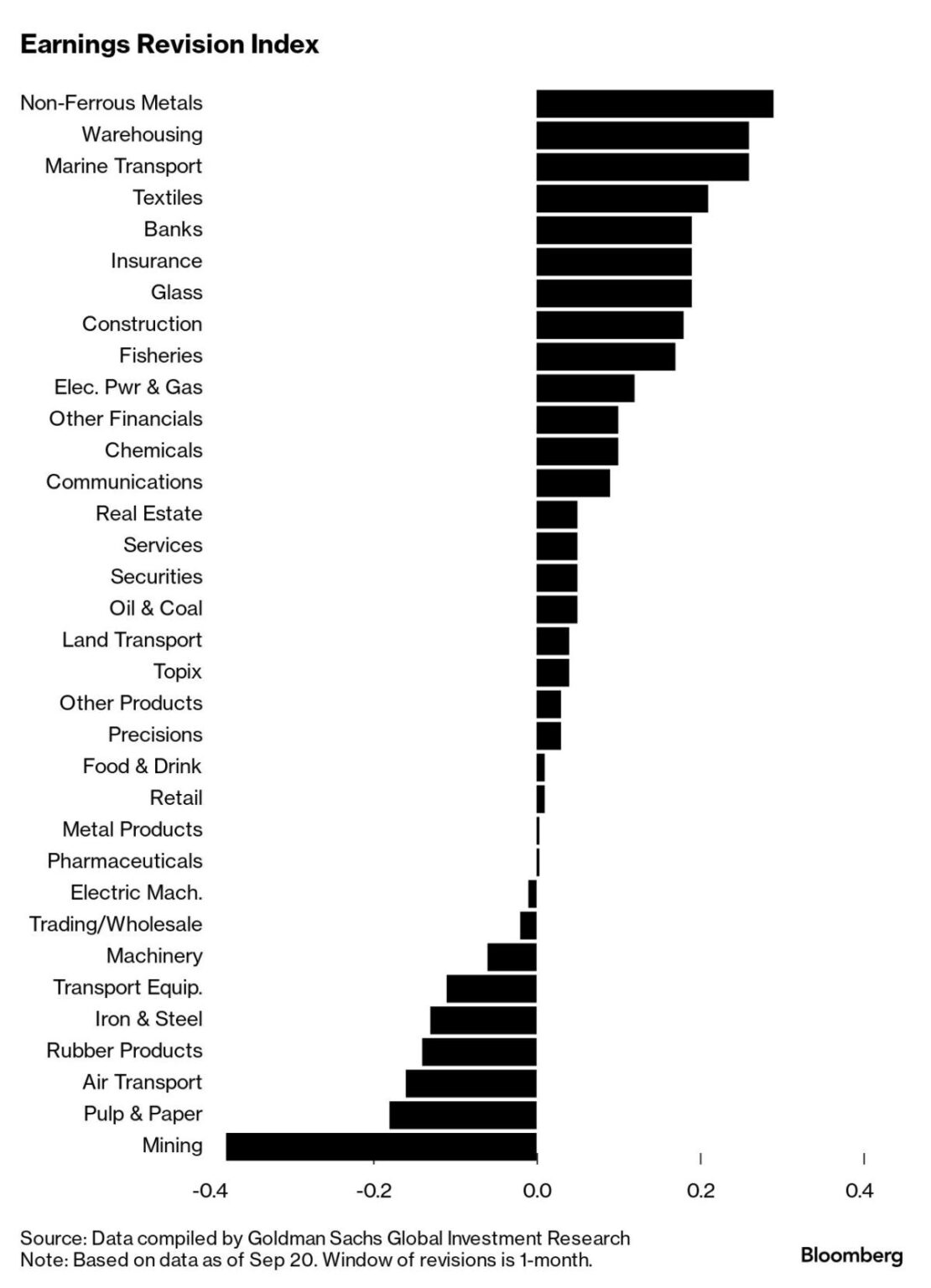

An earnings revision index compiled by Goldman shows that analysts have been raising their outlooks for company profits more than lowering them, though there have been notable difference across sectors. Banks are on the positive side while some exporters such as transport equipment makers are negative.

“Momentum is unexpectedly strong,” Goldman strategist Kazunori Tatebe said in an interview. “If strong earnings are confirmed, it will be a positive catalyst for Japanese stocks.”

The upbeat picture could be tarnished if US policymakers fail to achieve a soft landing for the world’s biggest economy, he said.

The risks to Japanese equities was underscored in early August when the nation’s benchmark gauges fell around 20%, eclipsing moves in the US and elsewhere. After the sell-off, Goldman lowered its year-end target for the Topix to 2,700 from 2,850, but maintained its 12-month target at 2,900. The gauge closed at 2721.12 on Thursday

In the near term, Tatebe expects Japanese shares will be range-bound in the run-up to the US presidential election.

“US economy will be the most important factor for Japanese stocks in the coming months, especially toward the end of the year,” he said.

Macquarie Group Ltd. also has a bullish outlook for Japanese stocks, with a Topix target of 3,200 by end-2025. While there will be losers from yen appreciation, equities in Japan will do well in dollar terms, Macquarie’s Damian Thong wrote in a report.

Corporate Governance

Tatebe also believes that corporate governance reforms will continue to support Japanese stocks. There is now evidence that Japanese companies have made significant changes such as the increase in share buybacks, he said.

Tatebe is bullish on domestic-oriented stocks that will be driven by Japan’s improving economy. He said that the out-performance of domestic demand-related stocks over the past two months has been partly due to the stronger yen. More gains are likely as he expects a recovery in consumption as wages and prices rise.

“If the change in the Japanese inflation story continues to be solid, there is still room for outperformance in a wide range of domestic demand-related areas,” he added.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here