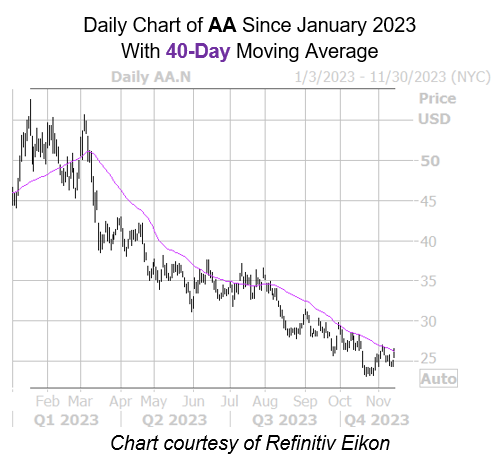

Alcoa Corp (NYSE:AA) stock is enjoying tailwinds this afternoon, last seen up 6.6% at $26.22, though a specific catalyst for this positive price action remains unclear. AA could soon backpedal, though, as it is now flashing a historically bearish signal. This potential plunge could also place the security within a chip-shot of its Oct. 23, two-year low of $23.07, and extend its already steep 42.6% year-to-date deficit, with additional pressure stemming from its 40-day moving average.

Digging deeper, AA’s lows come amid historically low implied volatility (IV). This has been a bearish combination for shares in the past, per Schaeffer’s Quantitative Analyst Rocky White. White’s data points to three other signal over the last five years when the security was trading within 2% of its 52-week low, while its Schaeffer’s Volatility Index (SVI) sat in the 20th percentile of its annual range or lower.

This is currently the case with the stock’s SVI of 47%, which sits in the 12th percentile of its annual range. Shares were lower one month after that signal, averaging an 8.2% dip. From its current trading levels, a move of similar magnitude would put AA back around $24.

At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), AA sports a 50-day put/call volume ratio of 3.45 that sits higher than 93% of annual readings. An unwinding of this optimism could weigh on the shares.

Read the full article here