(Bloomberg) — US investment-grade corporate bond spreads have breached a level not seen since 2022 as investors bet the Federal Reserve has reached the end of its rate hiking cycle.

Most Read from Bloomberg

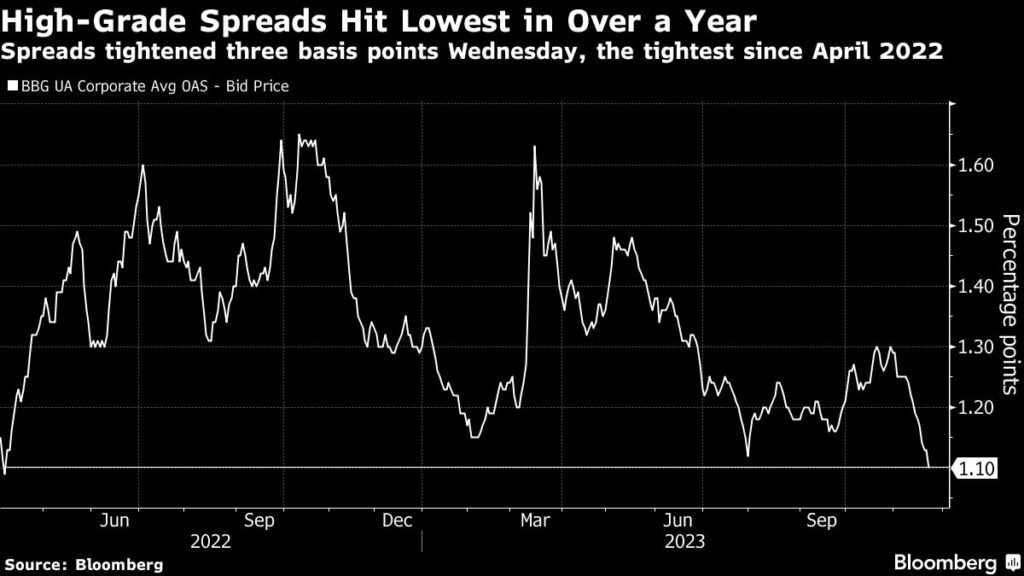

The figure, which measures the extra yield investors demand to own corporate bonds instead of US Treasuries, stands at its lowest level since April 2022, according to data compiled by Bloomberg.

High-grade spreads fell three basis points Wednesday to 110 basis points, according to Bloomberg index data. Spreads on speculative-grade bonds dropped six basis points to 380 basis points — the lowest since September — while the average price on leveraged loans has reached 95.2 cents on the dollar.

The moves come as supply of new investment-grade bonds starts to slow ahead of the US holidays, but demand for quality-rated bonds remains high.

Spreads for blue-chip bonds have remained fairly tight this year, hitting a peak of 163 basis points during the banking crisis in March. Many analysts expected spreads to end the year tighter from last year, but with another month left in the year — and recession fears waning — they may drop even further.

Multiple banks, including Barclays Plc, Morgan Stanley and JPMorgan Chase & Co., saw high-grade spreads ending 2023 between 140 basis points and 155 basis points. The last time spreads were that high this year was in May.

So far looking at next year, Morgan Stanley is calling for spreads to end 2024 at 125 basis points, only slightly wider from current levels.

–With assistance from Gowri Gurumurthy.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Read the full article here