(Bloomberg) — China’s pledge of up to $340 billion to boost its ailing equities is invoking parallels with past efforts at home and in Japan that largely faltered in lifting the economy after an initial burst of enthusiasm.

Most Read from Bloomberg

The massive support is part of a broader stimulus package unveiled by People’s Bank of China Governor Pan Gongsheng and other top officials Tuesday. The goal is to reverse a drain on household wealth and prime an economy suffering a years-long housing crisis and mired in deflation and weak demand.

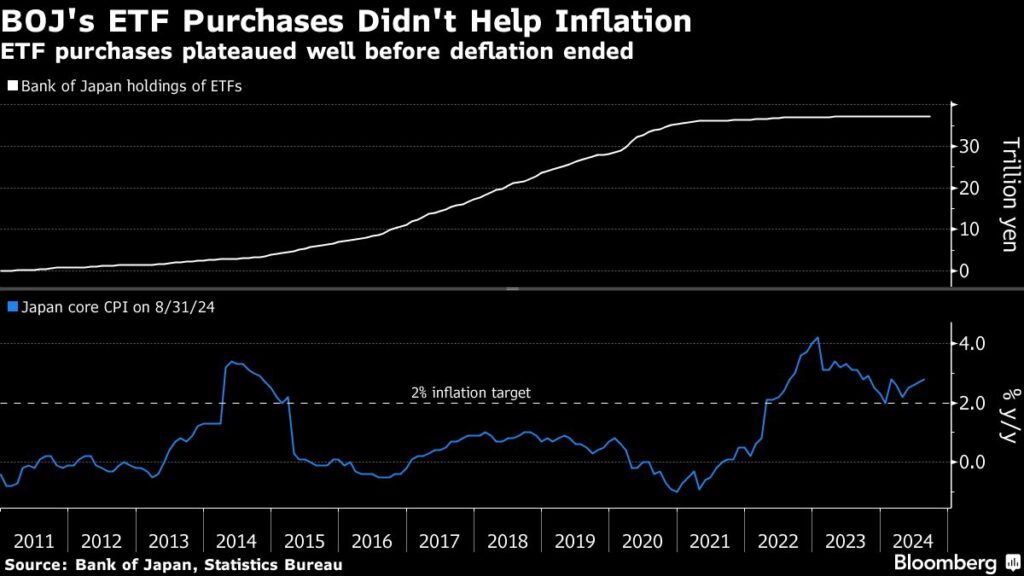

Going by the experience in Japan, where the central bank’s purchases of exchange-traded funds did little to help the reflation of the economy, that will be a tall order.

“China’s easing steps may have some short-term impact, but they’ll only help buy time,” said Shigeto Nagai, head of Japan research at Oxford Economics and former chief of the Bank of Japan’s international department.

“The BOJ’s ETF buying was effective at addressing short-term market shocks but it’s not something to keep doing for a long time in pursuit of stirring inflation,” Nagai said.

The first round of financing made available by the PBOC will be worth a total of 800 billion yuan ($114 billion) and could be doubled or even tripled depending on how much demand there is for the money, according to Pan, who said the central bank is also considering a “stabilization fund.”

Investors initially cheered the rollout, sending onshore stocks up 6% since the announcement. Analysts at HSBC Holdings Plc described it as a “game changer”

These “unprecedented measures to channel liquidity to the stock market” could help the market find a bottom and support a rebound towards the end of the year, said HSBC analysts led by Jeffrey Xie.

But the initial promised amount of 800 billion yuan is barely more than the average daily turnover of Class A shares so far this year, according to Bloomberg calculations.

The new commitment would come on top of the ongoing purchases by government entities such as sovereign wealth fund Central Huijin Investment Ltd., which has has been buying stock ETFs since October.

So far this year, Huijin has purchased more than $90 billion, with Bloomberg Intelligence estimating it accounts for more than 80% of the flows into stock ETFs in 2024.

“These measures should help improve investor sentiment and liquidity, and push both onshore and offshore markets to react positively in the near term,” said Laura Wang, Morgan Stanley’s chief China equity strategist. However, “the scale of the rebound and its sustainability hinge on a successful breakout from deflation and corporate earnings growth bottoming out.”

The latest push builds on a long history of China’s wading into its capital market, though the role of the PBOC in such interventions hasn’t been clear. The rescue attempt following 2005’s stock crash was largely led by China Securities Regulatory Commission.

Another effort followed a decade later when the central bank tried to devalue the yuan, unleashing a currency slump, capital flight, and further declines in stocks.

At that time, the central government also supporting the market. China Securities Finance Corp., alongside other state-backed institutions in the so-called ‘National Team’ spent trillions of yuan, with some of that borrowed from sources including the central bank and commercial lenders. The PBOC was said to have provided funding but the exact number was never made public.

“In terms of the signal, this is a meaningful development and reminiscent of the 2015 playbook as using the PBOC’s balance sheet implies ample firepower,” Barclays Plc analysts led by Kaanhari Singh wrote in a report. “But a sustainable stock-market rebound is going to rely on households directing their deposits back towards equities.”

China has little to show for its past efforts, with the Shanghai and Shenzhen stock index down almost 30% from the mid-2015 peak. While a more activist state policy may serve to buffer panic selling in the short term, it’s corporate earnings and household investment trends that play the biggest role in a market that is still driven mostly by retail investors.

What Bloomberg Economics Says…

“Giving PBOC liquidity support to financial institutions to support the equity market is similar to unconventional measures other central banks have taken in periods of extreme market stress — though the PBOC will not directly step into the equity market like the Bank of Japan and Hong Kong Monetary Authority have done previously.”

— Chang Shu, Eric Zhu and David Qu. For full analysis, click here

More than a decade of equities purchases by Japan’s central bank also hold lessons for China.

The BOJ bought around $258 billion of stock funds until it formally phased out its purchases in March. The central bank bank became particularly aware of its overreach in the market when it became the nation’s largest holder of equities in 2020.

The effort led to “short-term market gains but had a limited long-term impact,” according to a report from Morgan Stanley analysts led by Chetan Ahya on Tuesday.

“As we have seen from Japan’s experience, the key takeaway is that the sustainability and scale of the rebound in asset markets will have to hinge on a successful breakout from deflation and corporate earnings growth bottoming out and recovering,” they said.

–With assistance from April Ma and Toru Fujioka.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here