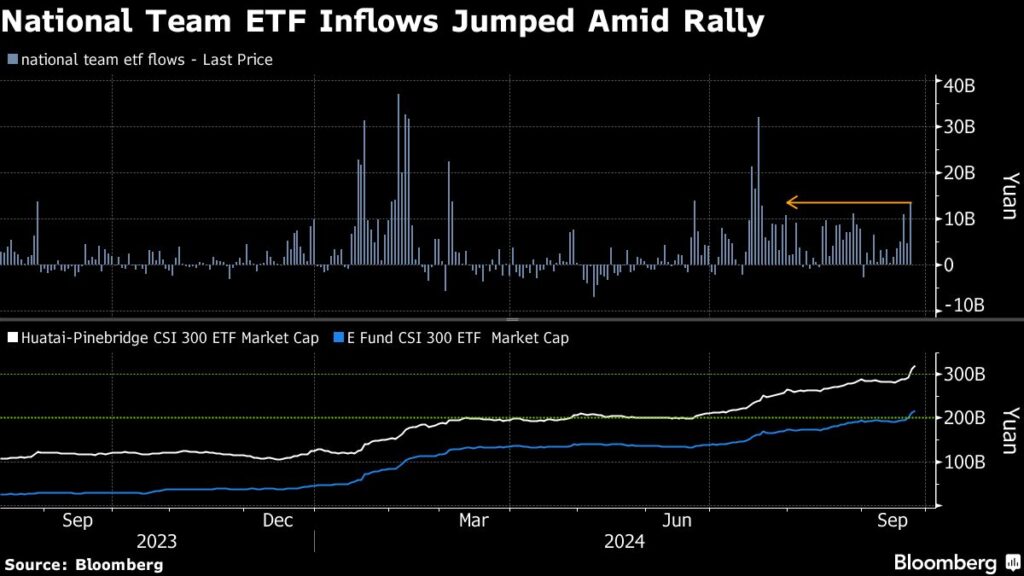

(Bloomberg) — Chinese exchange-traded funds favored by the sovereign fund saw inflows pick up on Tuesday, suggesting state buying might have played a role in the biggest onshore equity rally since mid-2020.

Most Read from Bloomberg

Combined inflows into eight ETFs tracked by Bloomberg rose to 13 billion yuan ($1.9 billion), the most since July when state-backed investors actively stepped into the market during a key political gathering. The CSI 300 Index rose more than 4% on Tuesday as China’s central bank unleashed a set of stimulus to support the economy. The benchmark extended gains on Wednesday.

Inflows were particularly strong into the nation’s biggest ETFs, pushing the value of Huatai-Pinebridge CSI 300 ETF to a record 311 billion yuan. The market capitalization for the product — seen a key target of the National Team in its bid to prop up equities — has swollen about 150% this year. The value of another heavyweight, E Fund CSI 300 ETF, more than quadrupled to around 211 billion yuan. The gains are likely due to state inflows and growing retail interest in the products as a handy tool to bottom fish.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here