(Bloomberg) — Chinese stocks are on a roll relative to their US peers as optimism over Beijing’s stimulus measures triggered a dramatic rebound. If history is any guide, the rally may have a long way to go, DataTrek Research says.

Most Read from Bloomberg

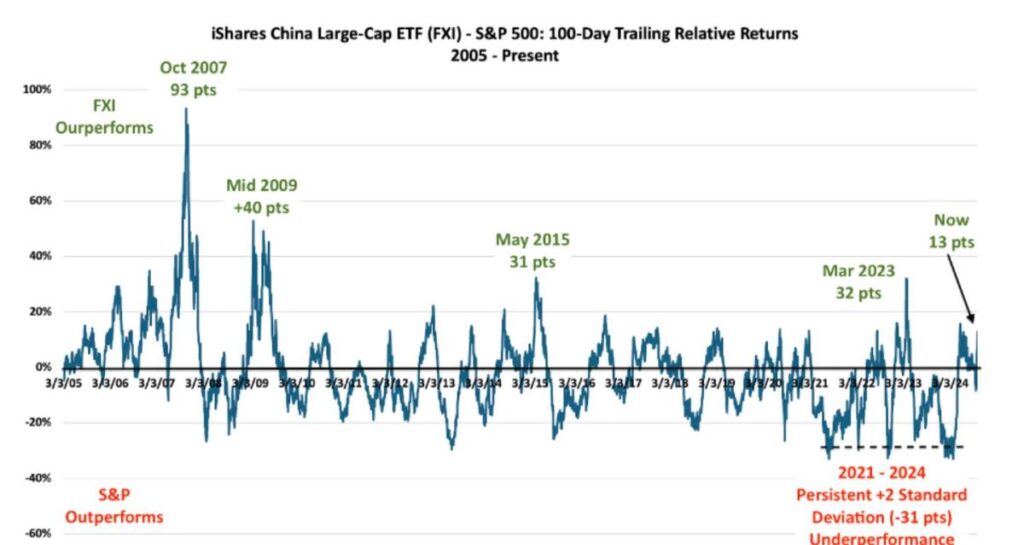

Consider the relative performance of the iShares China Large-Cap ETF (FXI) compared with the SPDR S&P 500 ETF Trust (SPY) over a 100-day time horizon, says the company. During periods of “positive shifts in Chinese policy” — such as 2009, 2015 and 2023 — local stocks typically outperform by 30 points or more. Right now, the relative outperformance sits at only 13 percentage points.

“By this measure, Chinese stocks certainly have more room to run relative to US large caps given their performance after prior policy shifts,” Nicholas Colas, co-founder of DataTrek, wrote in a note to clients.

The FXI ETF has surged roughly 35% over the last 30 days, supported by a spate of stimulus measures that included interest-rate cuts, freeing-up of cash for banks and liquidity support for stocks. The ETF tracking American Index rose by just 3% over the same period.

Still, it’s not yet clear whether those changes represent a pivot in China’s investment outlook and how sustained the rebound is.

“It will require time and much more government action to change the country’s capital allocation process to something that global equity investors can trust will deliver solid long term results,” Colas said. “Chinese stocks present a good trade here but their long run performance relative to US stocks is likely to remain subpar.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here