(Bloomberg) — S&P Global Ratings kept its classification of Chile as the highest in Latin America and raised its outlook to stable, citing the government’s commitment to halt a multi-year rise in the debt burden.

Most Read from Bloomberg

Chile’s foreign currency rating was maintained at A, two notches above its closest regional peer, Uruguay. The decision leaves it on a level with Israel, Latvia and Lithuania. Fitch rates Chile a notch lower at A-, while Moody’s is at par with S&P at A2.

“Despite recent years of elevated political polarization, Chile benefits from anchors on its fiscal and monetary policy that have helped stabilize economic performance,” the ratings firm said. “We think the government’s commitment to fiscal consolidation will stabilize its debt ratios in the coming years.”

S&P had cut Chile’s rating twice since 2017, citing increased pressure on fiscal spending and rising debt levels. But the worst may now have passed. Chile’s five-year credit default swaps, a key indicator of country risk, are near their pre-pandemic levels and have fallen below regional peers such as Panama and Peru, after they were almost the same just a year-and-a-half ago.

The administration of President Gabriel Boric has kept a tight rein on spending. The government set its 2024 fiscal deficit forecast at 2% of gross domestic product in October, compared with last year’s 2.4% shortfall.

Risk Factors

Still, Chile is a long way from regaining its former position as the poster-child of free-market reforms and fiscal prudence in Latin America.

Many regard next year’s budget forecast as optimistic. The deficit totaled 2.2% of GDP in the first eight months of the year, according to Banco Itau, and the shortfall usually ramps up during the final quarter of the year, suggesting an even greater figure by year-end.

“S&P’s decision to stabilize the outlook recognizes progress on fiscal consolidation and the enhancements to the fiscal institutional framework,” said Andres Perez, chief economist for Latin America at Banco Itau, after the announcement. “Still, looking forward, arresting the steady rise in public debt will demand significant spending restraint and higher growth in the near term. Progress on much-needed structural reforms is likely to continue to be hampered by increasing political fragmentation and polarization.”

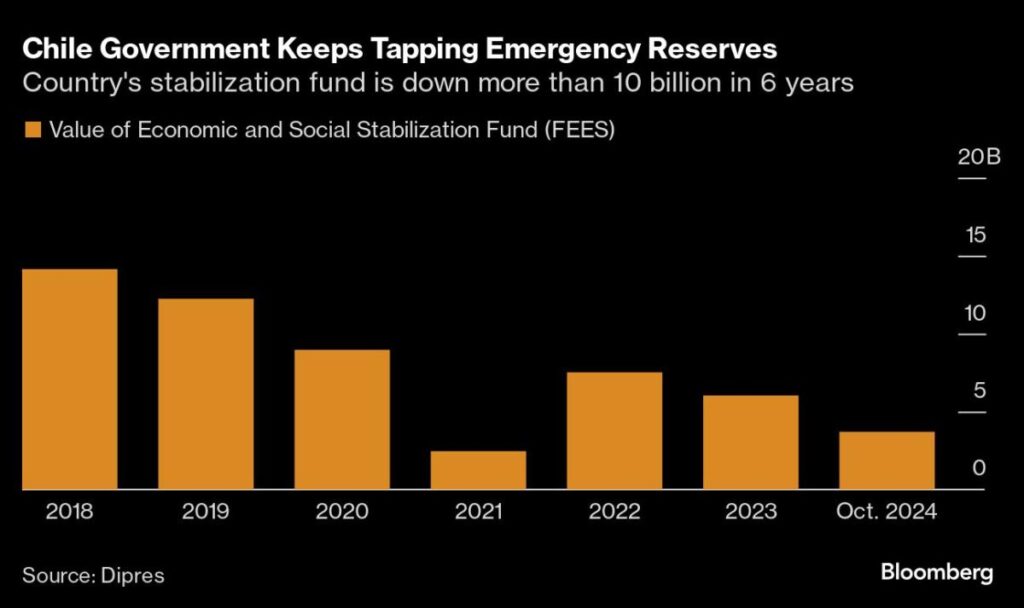

The government has allowed the sovereign wealth fund to halve since the end of 2022, including a withdrawal of $1 billion earlier this month.

More long-term, Chile’s growth has “Latin Americanized” over the last decade, slowing to levels of its regional peers, Sebastian Briozzo, head of Latin America sovereigns at S&P, said last month.

On Edge

S&P warned that “high external indebtedness and external financing needs” could put pressure on Chile’s ratings in a statement accompanying the action.

Many strategists had expected a downgrade some time this year, according to a Bloomberg survey carried out in December. Chile sees its gross debt burden reaching 41.3% of GDP at the end of the year, more than doubling in the past decade.

S&P’s decision comes at a time when key political reforms such as the pension bill are being discussed in Congress with pushback from the opposition. The lower house of Congress unexpectedly rejected the government’s flagship tax reform in March of last year.

S&P cautioned that political disputes could stall the legislative agenda and warned of challenges in passing the long-awaited pension reform as well as other laws to increase investment.

“Despite changes in political leadership and parties in recent years, we think there is political consensus on much of the country’s economic model, including its shortfalls, but there are differences on how to resolve them,” S&P wrote. “Finding middle ground across party lines would help advance structural reforms that boost growth, rebuild resilience, and improve living standards.”

And economic growth remains faltering. GDP shrank 0.6% in the second quarter from the previous three months, though there is some evidence it has rebounded in the third quarter. S&P said it expects average GDP growth of 2.4% during 2024-2027.

“The silver lining for Chile could come from external and internal factors, such is the case of the recovery in copper prices on the back of external demand and the continuation of a recovery in copper production,” William Snead, a strategist at Banco Bilbao Vizcaya Argentaria in New York, said before today’s announcement.

(Updates with Fitch and Moody’s ratings in the second paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here