-

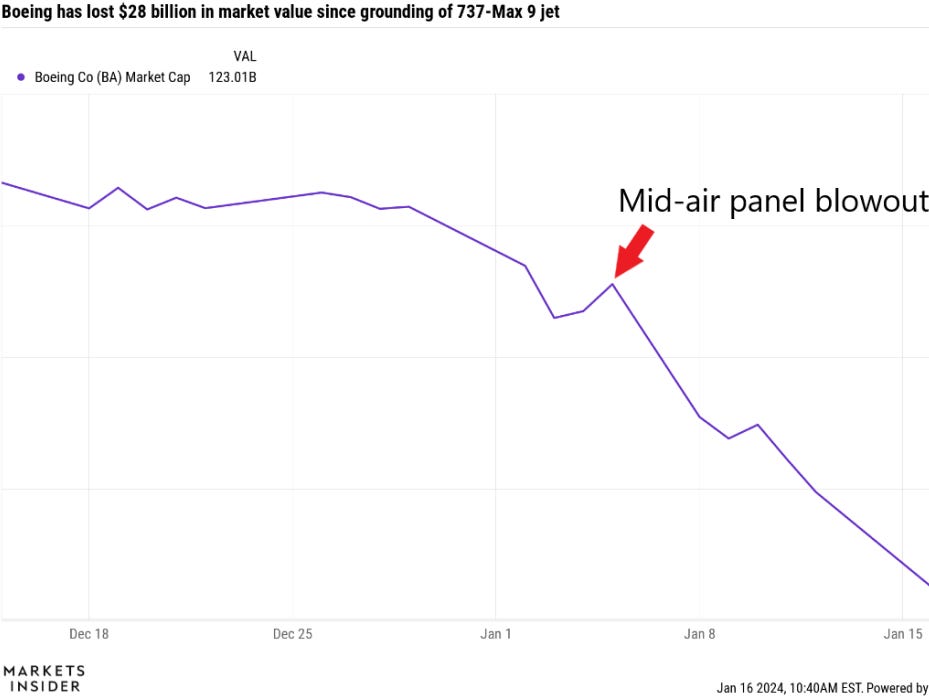

Boeing has erased nearly $30 billion in market value since its 737-MAX 9 plane experienced a mid-air panel blowout.

-

The company has had to ground some of its 737-Max 9 planes pending an investigation by the FAA.

-

Boeing stock extended its 6-day decline to 18% on Tuesday following a downgrade by Wells Fargo.

Our Chart of the Day shows the performance of Boeing stock, which has declined considerably since a door-plug panel was blown out of its 737 MAX 9 jet during the middle of a flight earlier this month.

Boeing stock is down 18% since the mid-air emergency occurred on January 5, erasing $28 billion in market value.

The Federal Aviation Administration has grounded every single 737 MAX 9 jet that has a plug door similar to the one that blew out during the middle of the Alaska Airlines flight on January 5.

Boeing is facing an investigation by the FAA on its quality control checks to determine if the company failed to ensure that its completed planes conformed to its approved designed.

Investor worries are growing that the grounding of the 737 MAX 9 jet could impact Boeing’s delivery schedule of planes, with Wells Fargo downgrading the stock on Tuesday to “Equalweight” from “Overweight” for that very reason.

“Boeing has struggled with quality issues for some time; what’s new is an outside party taking a closer look,” Wells Fargo analyst Matthew Akers said. Akers said that while the FAA’s investigation is limited to the 737 MAX 9 jet, “it’s feasible that findings could expand the scope to other MAX models sharing common parts.”

The bank cuts its price target on Boeing to $225 from $280. Boeing stock traded at $203.25 on Tuesday.

Read the original article on Business Insider

Read the full article here