Bahrain Cards Market Reaches All-Time High

Card penetration in Bahrain is relatively high by regional standards, and card use is rising as a result of initiatives by the government and local issuers. Sharia-compliant banking and products are also gaining popularity, leading to increased levels of competition. Global Data’s research team takes a closer look

Payment card penetration in Bahrain was 111.2 cards per 100 individuals in 2016 – higher than regional peers including Israel (107.4), Oman (94.6) and Lebanon (49.9).

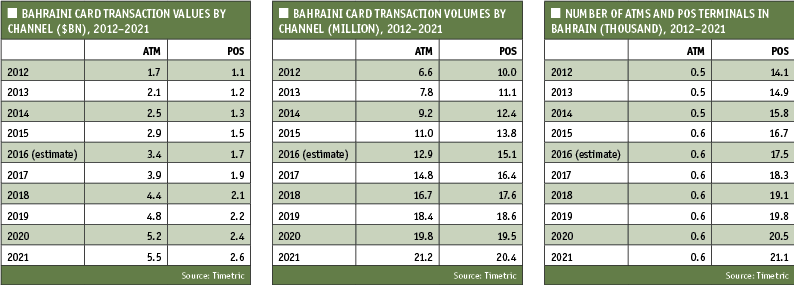

Payment card use is gradually rising in Bahrain, with the combined efforts of the government, private companies and banks to encourage electronic payments.

In one initiative, in February 2015 the government’s social insurance body, the General Organization of Social Insurance (SIO), launched a service allowing residents to pay for insurance using a debit or credit card.

Similarly, the government offers e-government services, allowing residents to pay utility bills using a debit or credit card.

Consumers can make payments at a national website, using a mobile app, or at payment kiosks.

The central bank has introduced a number of security guidelines in the last decade to improve consumer confidence in electronic payments.

In 2007 it required all ATMs to be embedded with fraud-detection and -inhibiting devices. This was followed by a guideline on EMV adoption in 2009, requiring all debit and credit cards in the country to be equipped with secured chip-and-PIN technology. In 2012, the central bank enforced a new guideline requiring banks to send free SMS alerts to customers for every transaction carried out using a debit or credit card.

Demand for Sharia-compliant products

As of July 2015 there were 24 licensed Islamic banks operating in Bahrain, and demand is rising.

The growth of banking in accordance with Sharia principles has intensified competition in the domestic financial sector, and has led banks to modify and improve product offerings.

In August 2016 Kuwait Finance House-Bahrain launched the Sharia-compliant Wakala Investment Account in Bahrain. In April 2015 the bank also launched the Sharia-compliant Visa Signature credit card.

In May 2014 Credimax launched the Sharia-compliant Tayseer credit card, which is available in classic, gold, platinum and corporate variants.

Growth prospects for pay later cards

Pay later card penetration in Bahrain is low, standing at just 13.8 cards per 100 individuals in 2016.

To encourage consumers to use credit cards, the Industry, Commerce and Tourism minister of Bahrain issued a directive in January 2016, preventing banks and merchants from imposing surcharges to credit card users. In accordance with the country’s Consumer Protection Law, a fine of up to $26,595.7 (BHD10,000) can be charged to companies violating this directive.

Banks are taking several initiatives to promote use of credit cards. For instance, there is no minimum salary requirement for entry-level credit cards offered by Ahli United Bank and NBB, and these banks also charge no or very low annual fees on cards.

Banks in Bahrain charge low interest rates on conventional credit cards to attract consumers. In addition to pricing benefits, banks are regularly developing strategies to increase credit card use.

In October 2015, for instance, Credimax partnered with the hypermarket and department store chain Lulu Hypermarket to launch the co-branded MasterCard Danat credit card.

The card offers rewards, discounts and cashback at Lulu Hypermarkets throughout the year.

“Bahrain cards market at all time high” was originally created and published by Electronic Payments International, a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.

Read the full article here