(Bloomberg) — Equities in Asia were poised to gain, sidestepping losses on Wall Street following hotter-than-expected core inflation that heightened the focus on the Federal Reserve’s next move.

Most Read from Bloomberg

Japanese equities futures advanced, while stocks in Australia were little changed on Friday. A gauge of US-listed Chinese companies edged higher Thursday, echoing gains in China in the prior session, as investors shifted their focus to a key meeting on fiscal policy this weekend. Hong Kong markets were closed for a holiday on Friday.

The S&P 500 fell 0.2% and the Nasdaq 100 dropped 0.1% Thursday. Treasuries yields were mixed with the short end falling and long bonds remaining largely unchanged. The US two-year yield fell six basis points while the 10-year yield fell one. Australian and New Zealand yields were little changed Friday.

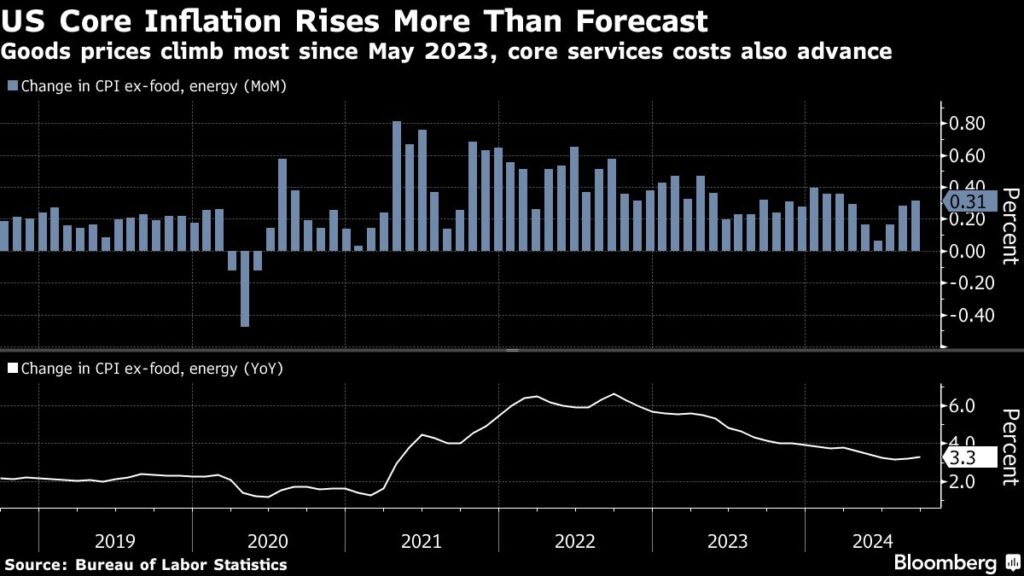

Inflation data released Thursday underscored the challenge facing the Fed. Underlying US inflation rose more than forecast in September in a sign of stalling progress in the fight to bring inflation to target. Separate data showed applications for US unemployment benefits rose last week to the highest in over a year.

“The Fed said the last mile getting toward their inflation target is going to be tough, and that is what we are seeing,” said David Donabedian at CIBC Private Wealth US “But we still expect the Fed to cut rates by a quarter point in November, and likely a similar cut at the December meeting.”

Swaps market pricing indicating a potential Fed rate cut next month was little changed. Traders are pricing in a roughly 80% chance that the Fed will cut by 25 basis point when it meets in November. That compared with a fully priced-in move prior to last week’s strong US jobs data.

Fed policymakers John Williams, Austan Goolsbee and Thomas Barkin were unfazed by the higher-than-forecast consumer price index, suggesting officials can continue lowering rates. The outlier was Raphael Bostic of the Atlanta Fed who indicated in an interview with the Wall Street Journal that in projections released in September he had called for one additional quarter-point cut across the Fed’s two remaining meetings in 2024.

“One slightly hotter-than-expected CPI reading doesn’t mean a new wave of inflation has been unleashed, but the fact that it accompanied a jump in weekly jobless claims may add to short-term market uncertainty,” said Chris Larkin at E*Trade from Morgan Stanley.

“These weren’t good numbers — but that doesn’t mean they upended the larger outlook for solid economic growth and moderate inflation,” Larkin added.

In currency markets, the yen was steady at around 148 per dollar after strengthening on Thursday while an index of the dollar was also little changed. Oil edged lower, trimming some of its gains from Thursday when West Texas Intermediate futures climbed 3.6% as traders awaited Israel’s response to Iran’s missile attack.

Investors are also gearing up for third-quarter US earnings later Friday from JPMorgan Chase & Co., Wells Fargo & Co and Bank of New York Mellon Corp.

China Stimulus

China may deploy as much as 2 trillion yuan ($283 billion) in fresh fiscal stimulus as Beijing seeks to shore up the world’s No. 2 economy and boost confidence, investors and analysts said.

The funds, potentially raised by selling more government bonds, could be announced as soon as Saturday by the country’s finance minister in a highly anticipated briefing, according to a Bloomberg survey.

Chinese stocks jumped on Thursday after the release of details on stimulus measures, with China’s central bank setting up a swap facility to provide liquidity to institutional investors to buy stocks.

“Government agencies are now expected to feel the pulse of the market before publishing policies,” said Ding Shuang, chief economist for Greater China and North Asia at Standard Chartered Plc. “They should avoid letting expectations climb and crash to deal a blow to market sentiment.”

Key events this week:

-

JPMorgan, Wells Fargo kick off earnings season for the big Wall Street banks, Friday

-

US PPI, University of Michigan consumer sentiment, Friday

-

Fed’s Lorie Logan, Austan Goolsbee and Michelle Bowman speak, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.1% as of 8:25 a.m. Tokyo time

-

Hang Seng futures were little changed

-

Australia’s S&P/ASX 200 fell 0.1%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0933

-

The Japanese yen was little changed at 148.59 per dollar

-

The offshore yuan was little changed at 7.0848 per dollar

-

The Australian dollar was little changed at $0.6740

Cryptocurrencies

-

Bitcoin rose 0.9% to $60,252.2

-

Ether rose 0.7% to $2,383.76

Bonds

Commodities

-

West Texas Intermediate crude was little changed

-

Spot gold rose 0.1% to $2,632.75 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Read the full article here