(Bloomberg) — Shares in Asia were mixed while Treasuries declined in the region following the Thanksgiving holiday. Oil extended losses.

Most Read from Bloomberg

Japanese stocks rose in catch-up play after a national holiday, while those in Australia also gained. Hong Kong and mainland Chinese equities fell, reversing Thursday’s rally inspired by Beijing’s widening property rescue campaign.

China may allow banks to offer unsecured short-term loans to qualified developers for the first time, according to people familiar with the matter, the latest effort to ease the country’s property woes. A Bloomberg Intelligence gauge of builder stocks fell as much as 2.1% early Friday, following a 8.9% jump in the previous session.

“The property developer debt issue will be solved sooner or later,” said Jian Shi Cortesi, a fund manager at GAM Investment Management. “If this measure is not enough, we will see more support next year,” she added, referring to the report on banks extending unsecured loans.

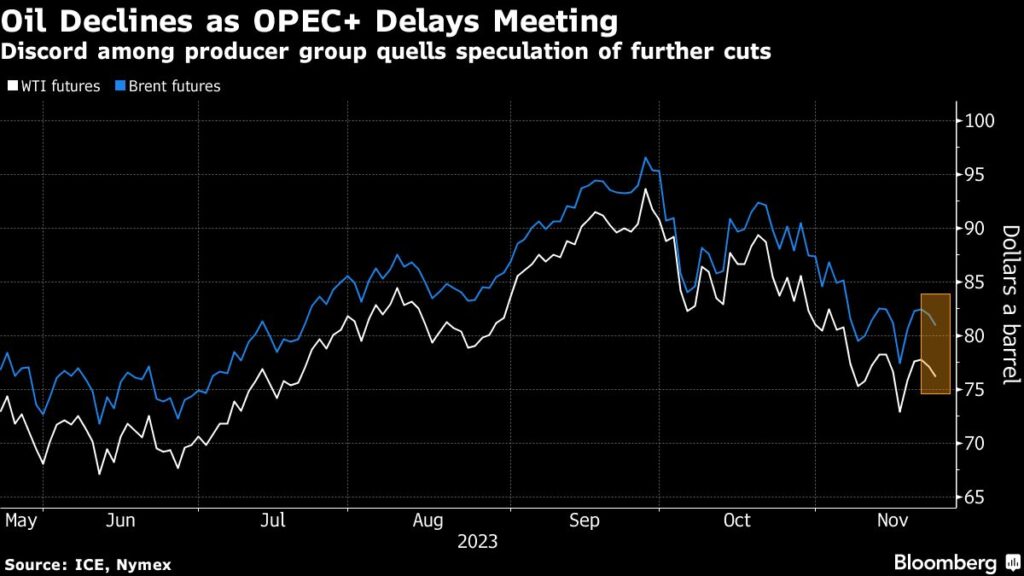

Oil continued its slide on news that OPEC+ will hold its delayed meeting online rather than in-person. The delay, and discord between members over quotas, has cast doubt on the prospect of further production cuts.

Cash Treasuries resumed trading in Asia with yields nudging higher in thin dealings. It came after European bonds fell Thursday on a report that Germany will suspend debt limits for a fourth consecutive year, adding to concerns over more borrowing as the euro-area economy slows.

The Bloomberg dollar index steadied after falling Thursday as the greenback gave up gains against most major currencies. Australian and New Zealand yields advanced.

Inflation in Japan accelerated, although the October reading was slightly less than expected. Consumer prices rose 3.3% year-over-year, shy of the 3.4% consensus estimate. This went against the Bank of Japan’s view that prices will decelerate, likely strengthening expectations of policy normalization.

Elsewhere in Asia, data set for release includes Taiwan money supply and consumer prices for Malaysia. Meanwhile, Sri Lanka’s central bank is expected to cut interest rates. In the US, manufacturing PMI data will be released later Friday.

In corporate news, Barclays Plc is working on plans to cut costs by as much as £1 billion ($1.3 billion) over several years, which could involve slashing as many as 2,000 jobs, Reuters reported.

Key events this week:

-

Germany IFO business climate, Friday

-

US S&P Global Manufacturing PMI, Friday

-

Black Friday, traditional kick-off for the US holiday shopping season

-

ECB’s Christine Lagarde speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 10:58 a.m. Tokyo time. Cash market was closed Thursday for a holiday.

-

Japan’s Topix rose 0.8%

-

Australia’s S&P/ASX 200 rose 0.4%

-

Hong Kong’s Hang Seng fell 1.2%

-

The Shanghai Composite fell 0.2%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0902

-

The Japanese yen was little changed at 149.52 per dollar

-

The offshore yuan was little changed at 7.1476 per dollar

-

The Australian dollar was little changed at $0.6564

Cryptocurrencies

-

Bitcoin rose 0.4% to $37,398.75

-

Ether was little changed at $2,068.93

Bonds

-

The yield on 10-year Treasuries advanced five basis points to 4.45%

-

Japan’s 10-year yield advanced four basis points to 0.765%

-

Australia’s 10-year yield advanced eight basis points to 4.56%

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Read the full article here