(Bloomberg) — Shares in Asia were set for a muted open, mirroring a flat day on Wall Street while bonds extended a rally on bets the Federal Reserve may start cutting interest rates in the first half of 2024.

Most Read from Bloomberg

Australian stocks and equity futures for Japan were flat while those for Hong Kong were slightly higher, even as the Golden Dragon index of US-listed Chinese companies slipped 1.3%. The S&P 500 and tech-heavy Nasdaq 100 ended near session lows with 0.1% declines. US futures were little changed early Thursday in Asia.

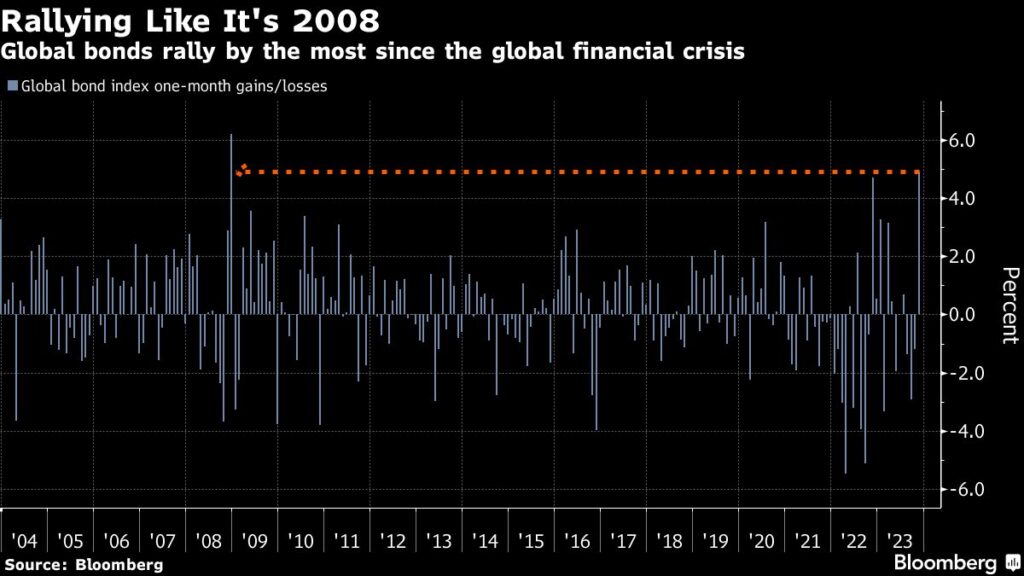

Bond bulls again latched onto comments from Fed officials, juicing a rally in November that has placed a gauge of global sovereign and corporate debt on track for the best month since 2008. Two-year yields fell nine basis points, while those on 10-year notes eased seven basis points lower to 4.26%. Australian and New Zealand bond yields also tracked lower Thursday.

The rise in bonds followed a ramping up of expectations the Fed will cut rates quicker than previously expected. Swaps pricing now reflects market forecasts that the central bank will cut by 25 basis points in May, bringing forward prior expectations for a June cut.

Those moves reflected comments from Cleveland Fed President Loretta Mester, who suggested she would support another rate pause at the Fed’s December meeting. Atlanta Fed President Raphael Bostic, meanwhile, voiced further confidence that inflation was on a downward trajectory. The comments echo sentiment from Fed speakers on Tuesday, further emboldening bond bulls.

“The Fed could find themselves in a ‘sweet spot’,” said Jeffrey Roach at LPL Financial. “Inflation is trending lower, the consumer is still spending — but at a slower pace — and the Fed could end its rate hiking campaign without much pain inflicted on the economy.”

Hard data provided support for a soft landing for the US economy. Economic activity slowed in recent weeks as consumers pulled back on discretionary spending, the Fed said in its latest “Beige Book”. Gross domestic product rose at the fastest pace in nearly two years, while consumer spending advanced at a less-robust rate and the Fed’s preferred inflation metric — the personal consumption expenditures price index — was revised lower.

Investors will be keeping a close eye on economic releases in Asia, including official November PMIs for China, industrial output and consumer confidence for Japan and a monetary policy decision in South Korea. Later Thursday, inflation and unemployment data for the Eurozone will be released, as will US jobless claims and the PCE deflator.

In currencies, the dollar was weaker against most Group-of-10 peers, led by the Japanese yen which added to its four days of gains and hovered around 147 versus the greenback. Elsewhere, oil edged lower after rallying Wednesday ahead of a scheduled OPEC+ meeting. The group of oil-producing nations is expected to convene after delaying a previously arranged get together.

Shares in Australia-listed Origin Energy Ltd fell after the company said in a statement that a takeover bid from Brookfield Asset management was not in shareholders’ best interests, damping confidence a deal will proceed.

Other corporate highlights included Walt Disney Co. Chief Executive Officer Bob Iger saying no longer is considering selling the company’s traditional TV channels, like ABC and FX, reversing comments he made earlier this year. General Motors Co., meanwhile, will boost its dividend by 33% and repurchase $10 billion of shares — its biggest-ever buyback plan. The automaker’s stock jumped.

Key events this week:

-

China non-manufacturing PMI, manufacturing PMI, Thursday

-

OPEC+ meeting, Thursday

-

Eurozone CPI, unemployment, Thursday

-

US personal income, PCE deflator, initial jobless claims, pending home sales, Thursday

-

China Caixin Manufacturing PMI, Friday

-

Eurozone S&P Global Manufacturing PMI, Friday

-

US construction spending, ISM Manufacturing, Friday

-

Fed Chair Jerome Powell to participate in “fireside chat” in Atlanta, Friday

-

Chicago Fed President Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 8:39 a.m. Tokyo time

-

Nasdaq 100 futures rose 0.1%

-

Nikkei 225 futures were little changed

-

Hang Seng futures rose 0.4%

-

Australia’s S&P/ASX 200 was little changed

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0973

-

The Japanese yen rose 0.1% to 147.03 per dollar

-

The offshore yuan was little changed at 7.1425 per dollar

-

The Australian dollar was little changed at $0.6619

Cryptocurrencies

-

Bitcoin rose 0.3% to $37,865.59

-

Ether was little changed at $2,029.35

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Read the full article here