Apple (NASDAQ:AAPL) stock may be perceived as less AI-savvy than its rivals in the Magnificent Seven. Undoubtedly, the company’s virtual assistant, Siri, doesn’t seem too impressive in the age of ChatGPT. Though generative AI technologies, like large language models (LLMs), have been touted by many firms, Apple has continued to stay on the down-low regarding its AI ambitions. Nonetheless, various reports suggest Apple is investing heavily in AI to keep up with the likes of Microsoft (NASDAQ:MSFT) and ChatGPT-maker OpenAI.

Reportedly, Apple has a big stake in the generative AI game and is en route to spending around $1 billion on its development, according to a recent Bloomberg report. For now, it’s impossible to tell where Apple stands in the generative AI race. Given its size and ability to innovate (and dominate markets it enters), I’d certainly not be surprised if the firm has an AI product — next-gen Siri, Apple GPT, or something else — that’s even more capable than the latest iteration of ChatGPT.

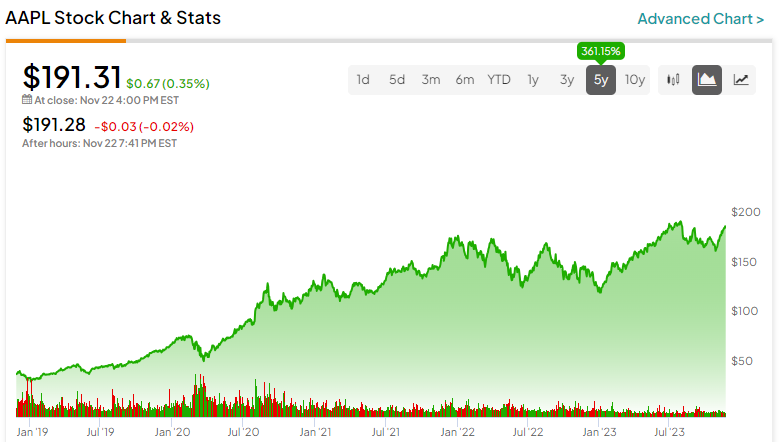

As Apple quietly invests in its own take on AI, I continue to be bullish on the stock, even as the doubters doubt and the stock slowly begins to flirt with new all-time highs again.

Apple is an AI Stock, Even if the Market Doubts Its Potential

At the end of the day, Apple is famous for letting its hardware and software do the hype-building for it. Looking ahead, expect Apple to continue taking on a more product- and consumer-oriented approach rather than letting AI hog the podium — something other AI-savvy tech firms seem to be doing of late.

Undoubtedly, this entails treating AI not as the main focal point but as something working behind the scenes to make the lives of its customers easier. At the end of the day, the features that generative AI technologies make possible are a part of the magic of new tech-driven features. And as you may know, Apple is all about delivering products and experiences that work almost “like magic.” In that regard, a truly fantastic magician never reveals the full extent of his secrets.

Could Apple’s App Store be Pressured by OpenAI’s GPTs?

OpenAI’s recent DevDay unveiled some pretty exciting new features, including GPTs, which allow for customizable chatbots. However, more recently, the board’s short-lived ousting of CEO Sam Altman was the bombshell that hogged all the attention. As the situation settles and Altman returns to the corner office over at OpenAI, expect the focus to return to the firm’s latest and greatest innovations, which may very well lay down the foundation for its own ecosystem or App Store for AI, as some folks are putting it.

Undoubtedly, if you can use a chatbot to order food, answer questions, and carry out various tasks, smartphone app usage could take a bit of a hit. ARK Invest’s Cathie Wood seems to think ChatGPT could be a disruptor to Apple. While Wood has been known to make extremely forward-looking comments, I do think the advent of GPTs could evolve to become a credible threat to Apple’s App Store if it’s complacent.

Fortunately for Apple shareholders, the company does not seem to be taking the potential of AI lightly, not in the slightest. As Apple continues spending a pretty penny on generative AI tech, the company may be keeping up, stride for stride, with the likes of the market’s most-rewarded AI companies. Further, what ultimately succeeds Apple’s App Store may very well be something of its own creation.

Remember, Apple is a firm that’s more than willing to cannibalize its own business as new tech rolls around. The advent of Apple Music may have eaten into iTunes’ sales. But at the end of the day, Apple has a heck of a lot more to gain than lose from the rise of new nascent technologies.

As for when Siri will be ready for the ChatGPT era, a recent report by Mark Gurman suggests that Siri may be in for its big upgrade next year. Additionally, Apple may be ready to sprinkle AI across its offerings (Pages, Numbers, Keynote, Apple Music, and Xcode) in the near future.

Is AAPL Stock a Buy, According to Analysts?

On TipRanks, AAPL stock comes in as a Strong Buy. Out of 33 analyst ratings, there are 25 Buys and eight Hold recommendations. The average Apple stock price target is $201.99, implying upside potential of 5.6%. Analyst price targets range from a low of $150.00 per share to a high of $240.00 per share.

The Bottom Line on AAPL Shares

Apple has a lot on the line as generative AI continues to take off. Though 2023 may be a slow year for AI innovations, 2024 could be a year where the firm really makes up for lost time, perhaps allowing it to pull ahead of rivals like Microsoft.

Disclosure

Read the full article here