Toast (NYSE: TOST) is coming off a lackluster year in 2023, where its share price rose by a modest 2%. The shaky ground the economy is on hasn’t been doing any favors for the company. But the business itself hasn’t been doing badly at all.

Restaurants use Toast’s point-of-sale (POS) devices to help simplify their operations, and it integrates with other functions as well. It adds a lot of value to the industry, and the number of restaurants using POS devices has been rising. With a potential soft landing for the economy in 2024, could this be a better year for Toast’s stock?

The company is experiencing strong growth

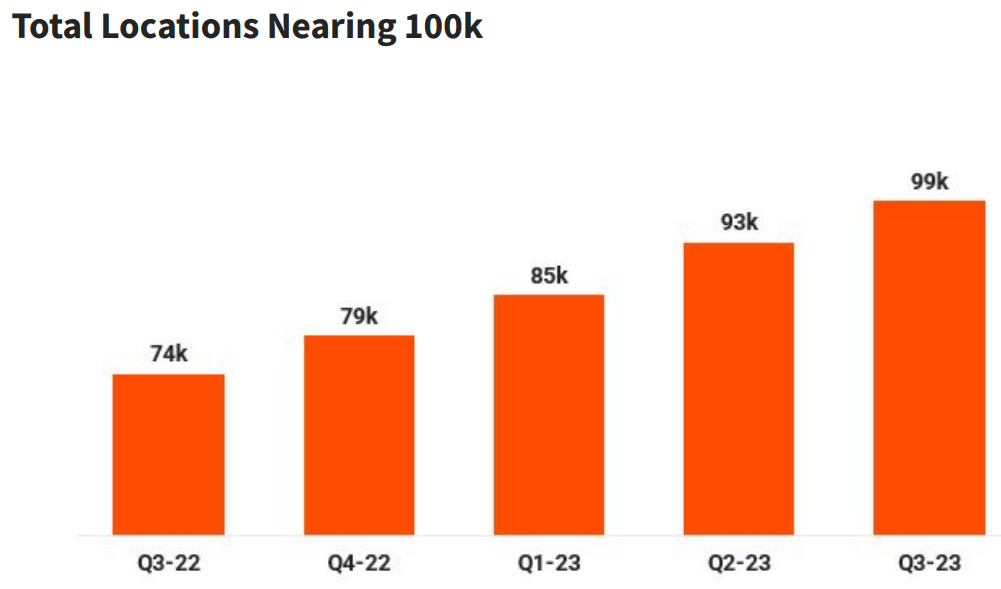

One encouraging sign for Toast’s business is that it is signing on more restaurants. As of the end of the third quarter (which ended Sept. 30), the company was serving 99,000 locations, adding 6,500 stores during the period.

Image source: Toast’s Q3 investor presentation.

By being in more locations, Toast can position itself for greater growth potential as economic conditions improve and consumer spending increases. Last quarter, revenue of just over $1 billion was up 37% year over year. If Toast’s location count keeps rising, its growth rate may remain strong in 2024, which may help attract growth investors.

Toast’s annualized recurring run rate has also been increasing

One of Toast’s key metrics is its annualized recurring run rate (ARR). This tells investors how much recurring revenue the business will generate over the course of a year based on where it is today. ARR is particularly useful for subscription-based businesses as it is not only a good indicator of whether a company is growing its subscriber base but also how strong the expected recurring revenue is projected to be.

Image source: Toast’s Q3 investor presentation. YoY = year over year.

Toast has done an excellent job of growing its ARR (increasing it by 40% last quarter). Suppose the company can build on these results and ARR rises further. In that case, it can make the business appear less risky to investors, as recurring revenue can provide a company’s financials with a great deal of stability.

Toast’s margins are also improving

Revenue growth is important, but so, too, is ensuring the business is on a path to profitability. Toast isn’t a profitable company just yet — it has incurred net losses of $254 million over the trailing 12 months, possibly one reason investors aren’t too bullish on the stock.

But the good news is the company has been making strides in improving its bottom line. Toast’s adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) have been improving in recent quarters. If that trend continues, its net loss should shrink as well.

What could derail Toast’s stock in 2024?

The biggest risk with Toast’s business is that it relies heavily on the restaurant industry. If they aren’t doing well, there’s a possibility that Toast won’t be able to sign up as many locations as it hopes, or worse, that existing customers will close up shop.

A lot will depend on the state of the economy and how it does. If it’s strong and there is a soft landing, that could bode well for the industry and for Toast’s business. But the danger is that if things are worse than expected and the industry struggles, it could limit the growth Toast generates in 2024, potentially leading to another poor performance for the stock.

Should you invest in Toast’s stock?

It’s uncertain how Toast will do this year because so much hinges on the recovery of the restaurant industry and the economy as a whole. But in the long run, the business has the potential to be an excellent investment. By adding value for restaurants and helping them improve and integrate their operations, Toast’s POS devices should be in strong demand. The growth in ARR and location count is a good indicator that restaurants are seeing value in the devices.

Regardless of how Toast’s stock does in 2024, this has the potential to be a great investment for the long haul. Buying it today could be a good move for investors.

Should you invest $1,000 in Toast right now?

Before you buy stock in Toast, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Toast wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of December 18, 2023

David Jagielski has no position in any of the stocks mentioned. The Motley Fool recommends Toast. The Motley Fool has a disclosure policy.

3 Reasons Toast’s Stock Could Soar Higher in 2024 (and 1 Reason It Might Struggle) was originally published by The Motley Fool

Read the full article here