It can pay to follow Warren Buffett. The legendary investor and operator of the conglomerate Berkshire Hathaway is indisputably the best investor in modern times, generating huge returns for those who invested along with him. His buy-and-hold strategy is a time-tested way to build wealth, even in the age of the internet and rapid algorithmic trading.

One of Buffett’s permanent holdings that he has owned for decades is American Express (NYSE: AXP). The credit card and payments giant is Buffett’s third-largest holding by market value and is actually beating the returns of Visa and Mastercard over the last five years. Here are three brilliant reasons to add American Express to your portfolio and never sell.

High-quality brand

The American Express brand has stood the test of time. Beginning its business back in 1850, the financial services company has evolved into one of the only vertically integrated credit card networks based in the United States. It offers high-fee premium credit cards to its customers, targeting wealthier customers who spend more. Operating its own network, it has the power to achieve discounts and perks for its customers, such as airport lounge access, that few other credit cards can match.

This brand power has been durable and evolved to meet modern needs over many decades. It has over 144 million cards in circulation and is adding 3 million new cardholders every quarter. It is able to do this and retain leadership in the credit card space because of decades of brand building as a premium service around the globe.

Permanent inflation protection

People know American Express for its high-fee credit cards, such as the platinum card. It has an annual fee of close to $700. However, card fees are only 13% of American Express’s overall revenue.

Over half comes from interchange fees, which are a take rate on every dollar spent on the American Express card network. These are 2.5% to 3.5% of every transaction and can be elevated vs. Visa and Mastercard because of the high-spending customer base at American Express. Merchants can decide to not accept American Express, but they risk alienating a cohort of high-spending wealthy customers.

What’s beautiful about the take rate business is that it scales perfectly with inflation. If the average high-end restaurant meal now costs $250 vs. $100 two decades ago, American Express earns a higher fee while doing minimal work. If this average meal costs $1000 in 30 years, American Express will see a growing cut of that transaction. The same goes for hotel purchases, airline tickets, and gas tank refills. It makes the credit card take rate one of the best business models in the world.

Dividend growth

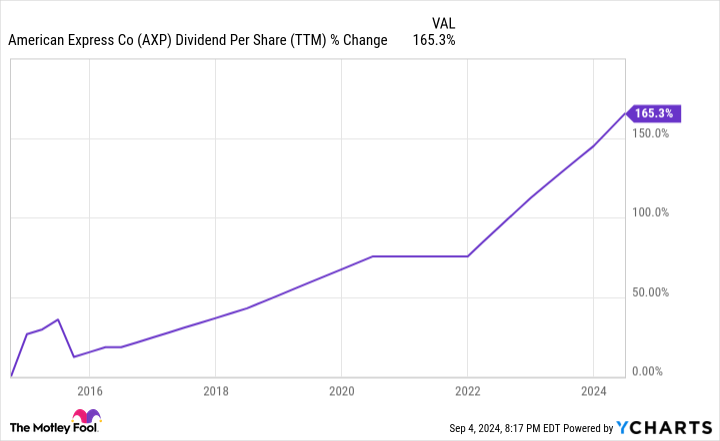

On top of this high-quality business, American Express has sturdy management that consistently returns capital to shareholders with dividends and share repurchases.

The dividend-per-share payout is up 165% in the last 10 years and shows no signs of slowing down. The company currently pays a dividend-per-share of $2.60 each year. Berkshire Hathaway owns 151.61 million shares of American Express, meaning the company rakes in close to $400 million in dividend income each year. With the dividend consistently raised, this number will only grow for Berkshire Hathaway over the next few decades as well.

It is hard to find holes in the American Express franchise. The brand is durable and targets high-spenders who are more recession-resistant. The business model is permanently protected from inflation. Management has shown it will consistently return capital to shareholders. In my book, these are three fantastic reasons to buy American Express stock and never sell it from your portfolio.

Should you invest $1,000 in American Express right now?

Before you buy stock in American Express, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and American Express wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 3, 2024

American Express is an advertising partner of The Ascent, a Motley Fool company. Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway, Mastercard, and Visa. The Motley Fool recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

3 Brilliant Reasons to Buy This Warren Buffett Stock and Never Sell was originally published by The Motley Fool

Read the full article here