ASX: ORG Elliott Wave technical analysis

Greetings, Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with ORIGIN ENERGY LIMITED – ORG. We see ORG.ASX continuing to push lower. And after the correction wave is complete, wave (5)-orange may return to push higher.

ASX: ORG one-day chart analysis

Function: Major trend (Minute degree, navy).

Mode: Motive.

Structure: Impulse.

Position: Wave C-grey of Wave (4)-orange.

Details: Wave 4-grey is developing under a strong and steep pattern, namely a Zigzag pattern labeled A,B,C-grey. Wave A-grey is complete, and so is wave B-grey, now it is time for wave C-grey to push lower, aiming for a low around 8.96.

Invalidation point: 10.44.

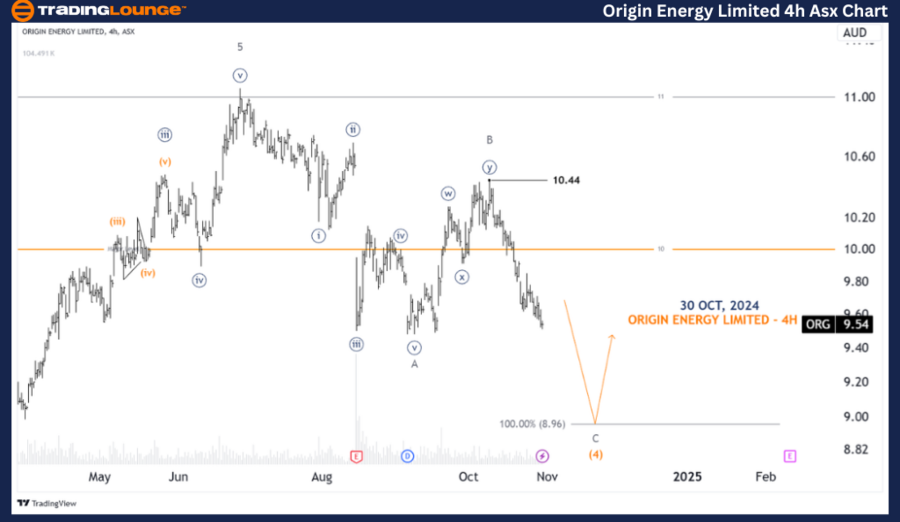

ASX: ORG four-hour chart analysis

Function: Major trend (Minute degree, navy).

Mode: Motive.

Structure: Impulse.

Position: Wave C-grey of Wave (4)-orange.

Details: Wave 4-grey is developing under a strong and steep pattern, namely a Zigzag pattern labeled A,B,C-grey. Wave A-grey is complete, and so is wave B-grey, now it is time for wave C-grey to push lower, aiming for a low around 8.96. Then the whole wave (4)-orange can complete ABC-grey around that low, and we expect wave (5)-orange to come back to push higher. And the Major Level at 100.00 when it becomes tested support, we will have a quality Long Trade position.

Invalidation point: 10.44

Conclusion

Our analysis, forecast of contextual trends, and short-term outlook for ASX: ORIGIN ENERGY LIMITED – ORG aim to provide readers with insights into the current market trends and how to capitalize on them effectively. We offer specific price points that act as validation or invalidation signals for our wave count, enhancing the confidence in our perspective. By combining these factors, we strive to offer readers the most objective and professional perspective on market trends.

Origin Energy Limited Elliott Wave technical forecast [Video]

Read the full article here

![Origin Energy Limited Elliott Wave technical forecast [Video]](https://news.vittaverse.com/wp-content/uploads/2024/04/dax-macro-concept-57844002_Large.jpg)