GOLD OUTLOOK & ANALYSIS

- Fed Chair Powell ramps up dovish bets.

- US ISM services PMI and NFP under the spotlight next week.

- Overbought gold could be heading lower next week.

Elevate your trading skills and gain a competitive edge. Get your hands on the Gold Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Warren Venketas

Get Your Free Gold Forecast

XAU/USD FUNDAMENTAL FORECAST

Gold prices turned higher on Friday after US ISM manufacturing PMI’s disappointed followed by Fed Chair Jerome Powell providing some less aggressive messaging, possibly hinting at the peak of the Fed’s hiking cycle. Although Mr. Powell attempted to refrain from sounding overly dovish, market did not take heed to these sentiments. Some key statements include:

“Fed Funds range well into restrictive territory.”

“It is ‘premature’ to say monetary policy is restrictive enough.”

“I expect spending and output to slow over the next year.”

From a money market perspective (refer to table below), interest rates are expected below the 4% mark by December 2024. The recent slew of US economic data has contributed to this narrative alongside a slump in US Treasury yields as the 2-year edges towards the 4.5% support level.

IMPLIED FED FUNDS FUTURES

Source: Refinitiv

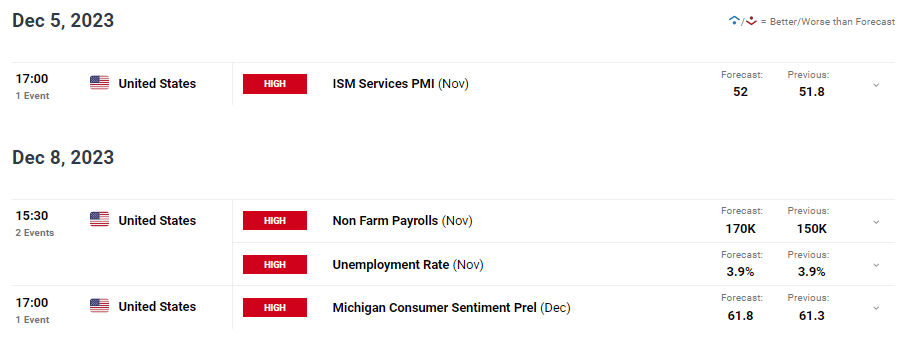

The week ahead sees ISM services PMI data come into focus. The more significant of the two PMI releases as the US is primarily a services driven economy. Gold bears will be observing a tick higher to 52 with the highlight of the week coming from Non-Farm Payrolls (NFP). A strong NFP number could reverse the recent gold rally while another upside advocate stemmed from the recommencement of the Israel-Hamas war in Gaza. Bullions safe haven appeal has been reignited after the recent ceasefire and any escalation could keep prices bid.

GOLD ECONOMIC CALENDAR

Source: DailyFX

Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of the latest market moving events!

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL ANALYSIS

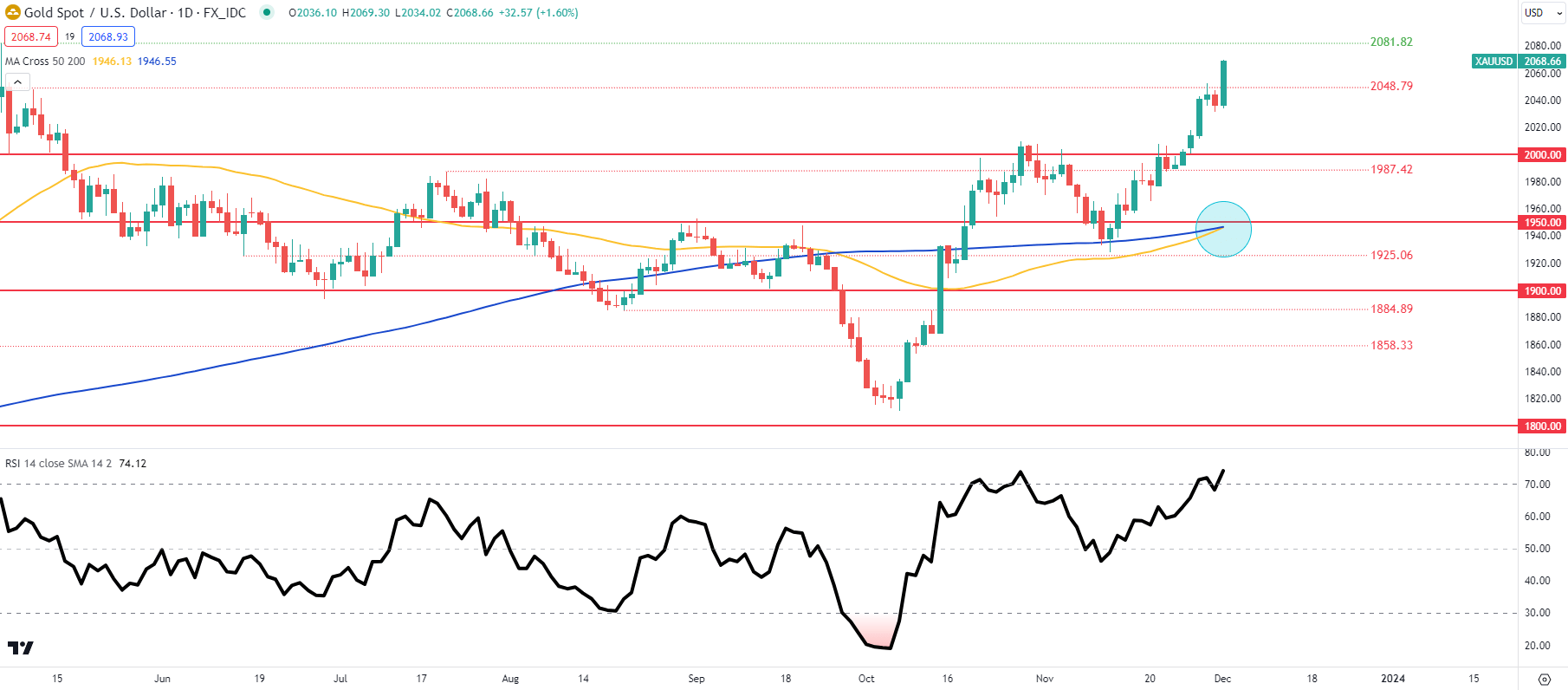

GOLD PRICE DAILY CHART

Chart prepared by Warren Venketas, TradingView

Daily XAU/USD price action looks to head up towards the March 2022 and May 2023 resistance zone around the 2081.82 level. The Relative Strength Index (RSI) is deep within overbought territory and could hint at a pullback lower. That being said, bulls will be looking at the looming golden cross formation that could extend the recent rally.

Resistance levels:

Support levels:

- 2048.79

- 2000.00

- 1987.42

- 1950.00

GOLD IG CLIENT SENTIMENT: MIXED

IGCS shows retail traders are currently net SHORT on GOLD, with 53% of traders currently holding long positions.

Curious to learn how market positioning can affect asset prices? Our sentiment guide holds the insights—download it now!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

Read the full article here