GBP PRICE, CHARTS AND ANALYSIS:

Read More: S&P 500, NAS 100 Make a Tepid Start to the Week, Where to Next?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

GBP OUTLOOK

The GBP and Cable in particular has had a mixed start to the week, fluctuating between gains and losses. Markets in general were a bit slow today ahead of what is a relatively busy week on the data front. The UK, however, does not have any high impact data releases with GBP pairs likely to face external threats.

The UK faces a quiet week on the data front following the UK Autumn Statement by Chancellor Hunt last week. The GBP enjoyed a decent week particularly against the Greenback.

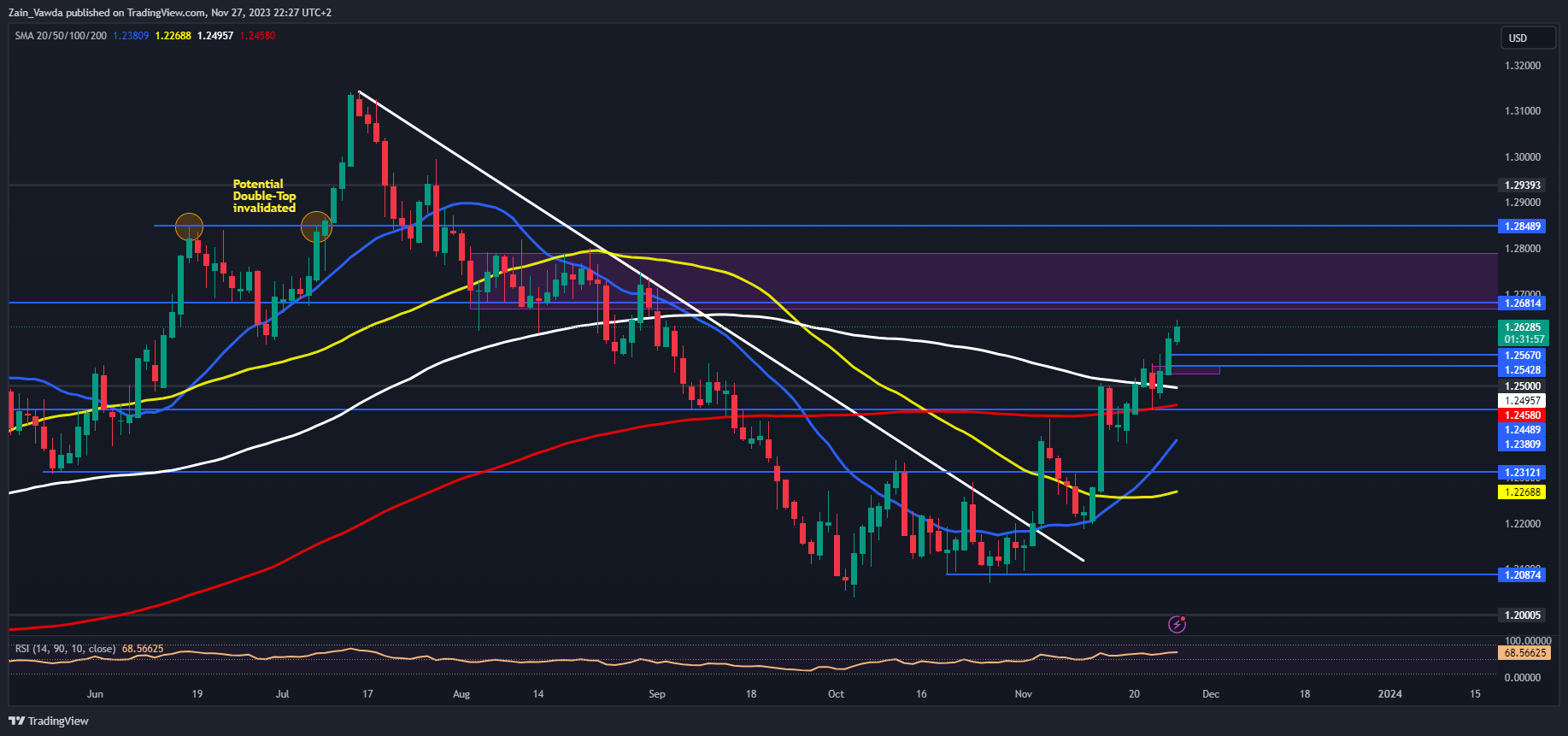

The rest of this week only has medium impact data from the UK. Last week brought PMI data which helped keep the GBP supported with a pledge by Chancellor Hunt during the Autumn statement. The Chancellor confirmed the UK Government plans to put GBP20 billion to work in the economy at a time when other countries in the Euro Area face a difficult task. These developments have left market participants a lot more cautious around rate cuts for 2024.

The biggest risk facing the GBP this week will come from a host of BoE policymakers scheduled to speak.

For all market-moving economic releases and events, see theDailyFX Calendar

Supercharge your trading prowess with insights and tips to trading GBP/USD.

Recommended by Zain Vawda

How to Trade GBP/USD

PRICE ACTION AND POTENTIAL SETUPS

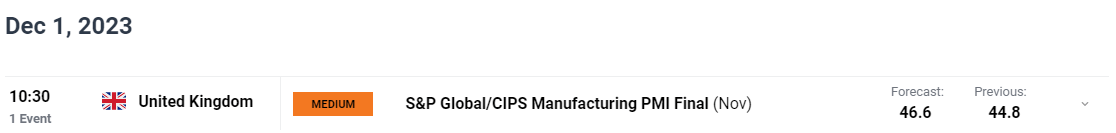

EURGBP

EUR/GBP Daily Chart

Source: TradingView, Prepared by Zain Vawda

From a technical perspective, EURGBP had finally broken out of the range it had been stuck in for around 6 months in October, closing above the 0.8720 mark. Following that however EURGBP failed to find acceptance above the 0.8760 resistance area with gains also capped by the top of the wedge pattern in play.

A selloff ensued over the past two weeks or so as GBP began its most recent rally, and this has pushed EURGBP back below the 0.8720 area and facilitated a breakout of the wedge pattern. There has also been a notable change in structure following the break of the swing low around the 0.87000 mark means that the bullish structure has been violated with bears looking likely to take control.

Any attempt at a retest of the wedge pattern could provide a better risk to reward opportunity for potential shorts with the first target being the 100-day MA resting at 0.8635. A break below this area brings the 0.8600 and 0.8560 support areas into focus.

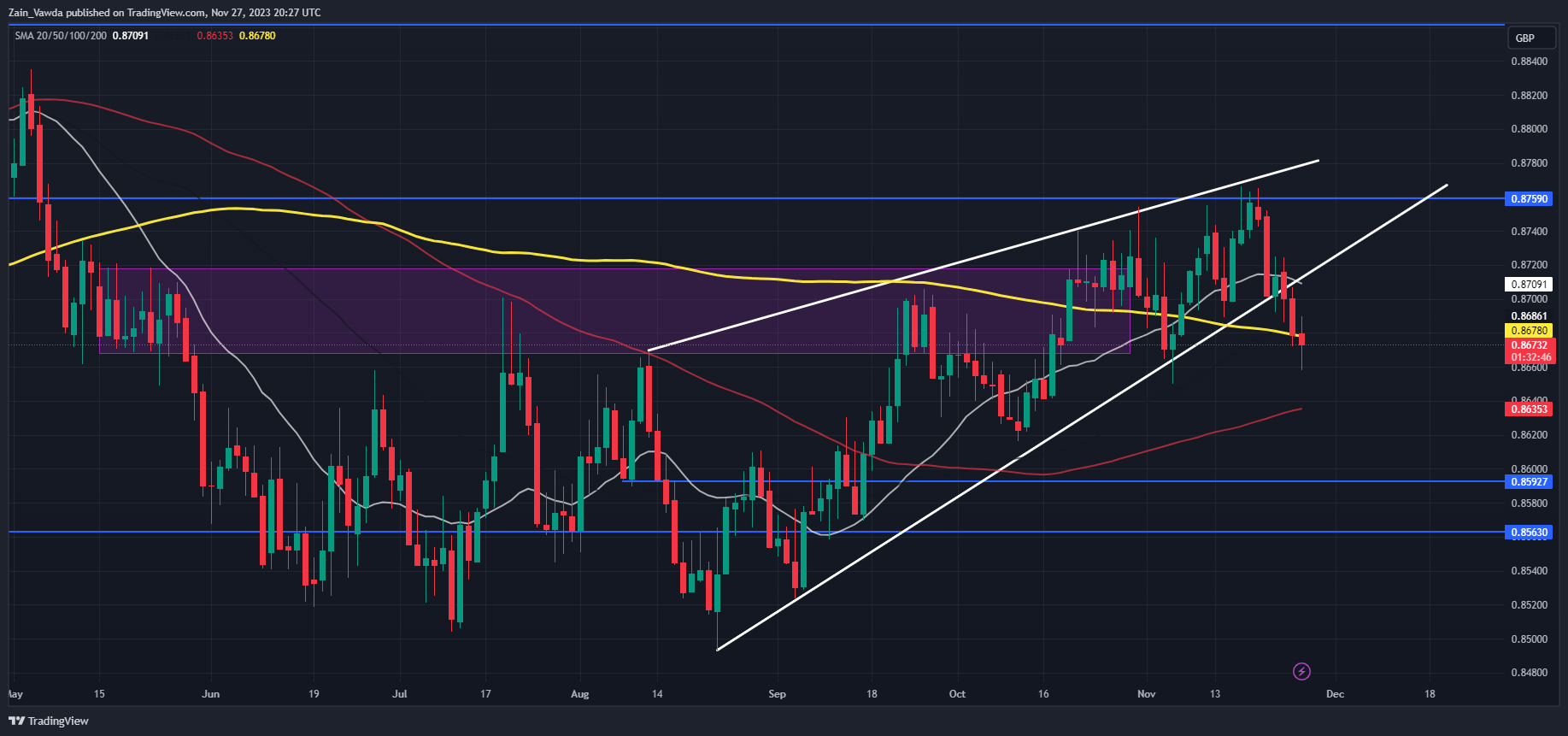

GBPAUD

GBPAUD has been rangebound for the best part of two months. For many pairs a 400-pip range is quite large but in the case of an exotic like GBPAUD it is not. As things stand there is a clearly defined range and some key areas of support and resistance which may be used for potential opportunities in the interim, which i will highlight below.

Support on the downside rests at the 1.9000 handle and just below at the 1.8950 mark. A move lower also brings the possibility that we may spike slightly lower to tap into the 200-day MA at 1.8911.

Key Levels that may provide resistance for potential shorts will be the 1.9211 area and then the 1.9278 before the range high at 1.9338 comes into focus. All these levels may provide an opportunity for potential shorts as even a breakout will only serve to improve the risk to reward ratio.

GBP/AUD Daily Chart

Source: TradingView, Prepared by Zain Vawda

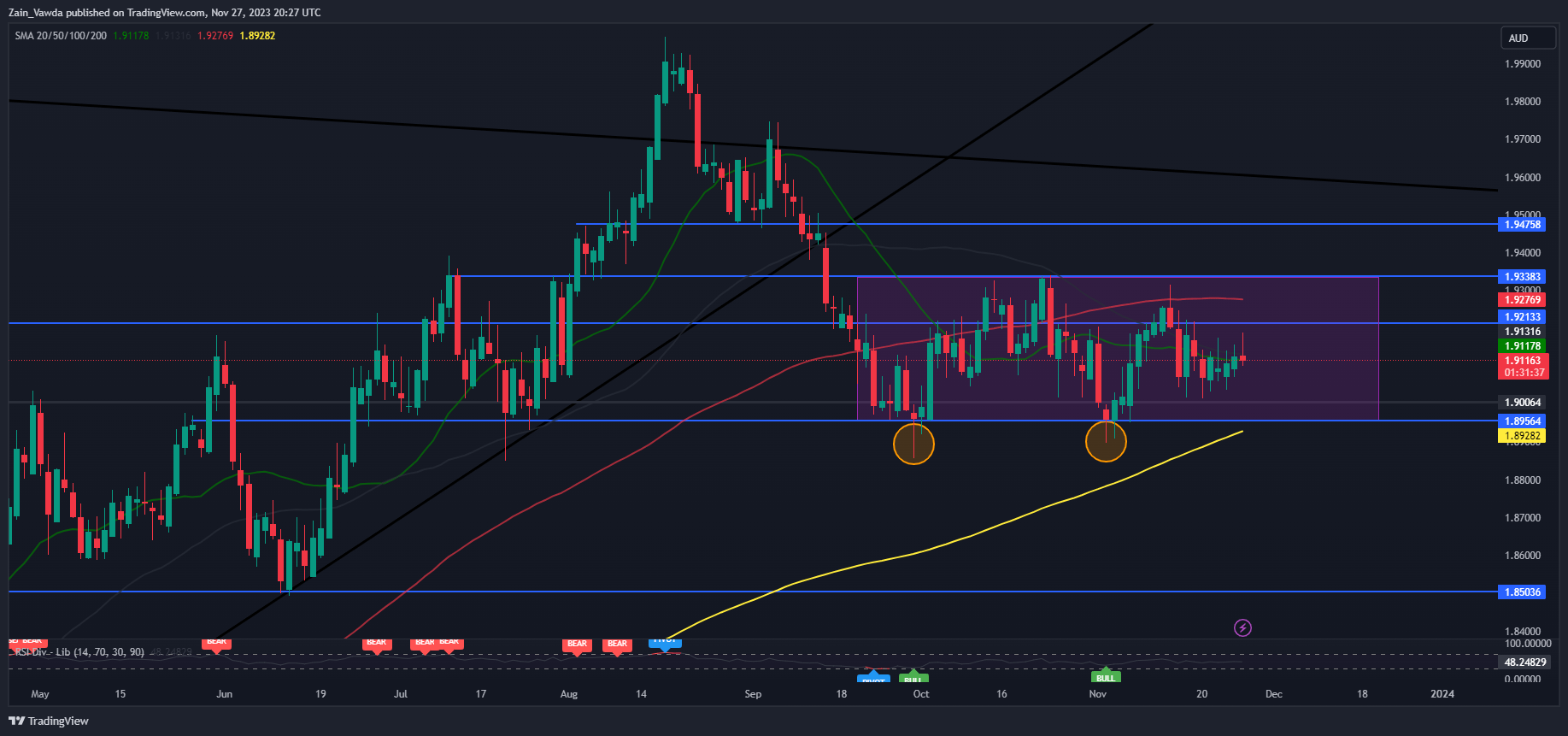

GBPUSD

GBP/USD Daily Chart

Source: TradingView, Prepared by Zain Vawda

GBPUSD is a bit clearer as we can see a clear pattern of higher highs and higher lows of late. Cable has printed a fresh high and the RSI is approaching overbought territory which may lead to some form of retracement this week.

Looking to the upside, there is a key resistance level at 1.2680 and a break of that level could open up a retest of the 1.2850 resistance area. Alternatively, a break to the downside faces support at the 1.2550 mark before the 1.2500 and 1.2450 levels come into focus.

IG CLIENT SENTIMENT

Taking a quick look at the IG Client Sentiment, Retail Traders are Long on GBPUSD with 55% of retail traders holding SHORT positions. Given the Contrarian View to Crowd Sentiment Adopted Here at DailyFX, is this a sign that GBPUSD may continue to Rise?

For a more in-depth look at GOLD client sentiment and changes in long and short positioning download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | 14% | 5% | 9% |

| Weekly | -5% | 17% | 6% |

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Read the full article here