This article focuses exclusively on the euro’s technical outlook for the first quarter. For a more in-depth look at the common currency’s fundamental profile for the next three months, request the full first-quarter forecast. The trading guide is free!

Recommended by Diego Colman

Get Your Free EUR Forecast

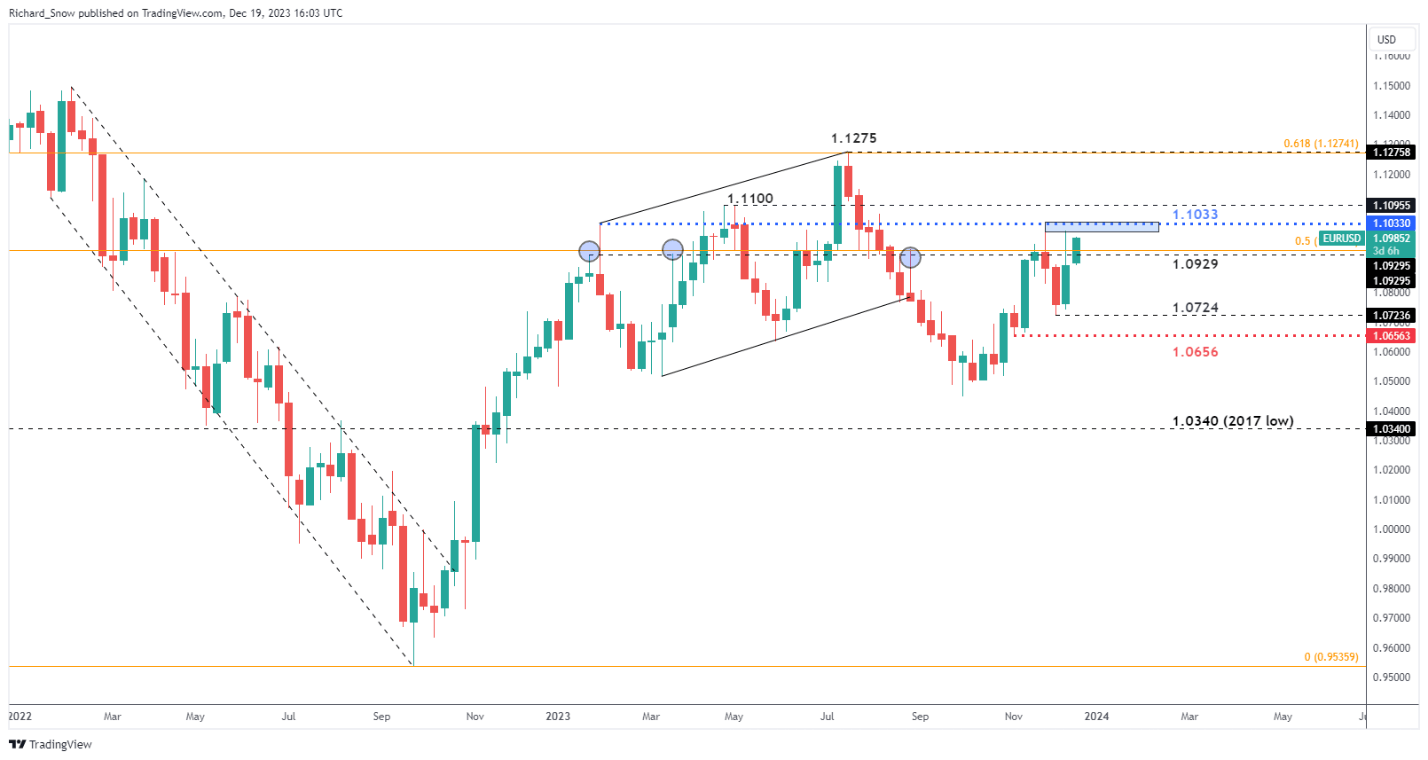

EUR/USD with Limited Room to the Upside as Resistance Comes into Focus

EUR/USD is on track to close out 2023 on a positive note, recovering a sizeable chunk of the decline witnessed in the second half of the year. The medium-term trend appears to the upside but yield differentials (purple line) struggle to motivate a prolonged period of upside potential. The difference between the yield on the German 10-year bund minus the yield of the 10-year US Treasury has struggled to show a meaningful move to the upside despite price action managing to maintain the broader move higher. This is something that could limit EUR/USD upside in Q1 2024.

EUR/USD Alongside German-US Yield Differentials

Source: TradingView, Prepared by Richard Snow

EUR/USD strives to make higher highs and higher lows as the medium-term trend to the upside remains constructive. Incoming inflation and growth data is likely to influence price action throughout the first quarter but there does appear to be further room to the upside.

The first zone of resistance appears at the 1.1033 level, the January 2023 spike high, followed by the 1.1100 level which witnessed many failed attempts to trade beyond the marker. 1.1100 could prove to be too much to handle once again and if that is the case, EUR/USD could trade within 1.1100 and 1.0656 for the first quarter of the year. This is a wide range but there are a lot of uncertainties ahead.

On the upside, one may view 1.1033 as a tripwire for a potential bullish continuation but anything falling short of 1.1100 may usher in another phase to the downside. A move below 1.0929 (the 50% Fibonacci retracement of the 2021-2022 decline) highlights the 1.0724 level of support. In other words, the beginning of the quarter may see another attempt to trade higher, if unsuccessful, a return to sub 1.1000 levels could come into play.

Recommended by Diego Colman

Get Your Free Top Trading Opportunities Forecast

EUR/USD Weekly Chart

Source: TradingView, Prepared by Richard Snow

Explore the influence of crowd mentality in FX markets. Download our sentiment guide to gain insights into how EUR/JPY’s positioning may impact the exchange rate’s direction.

of clients are net long.

of clients are net short.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -2% | 0% |

| Weekly | -6% | 2% | -1% |

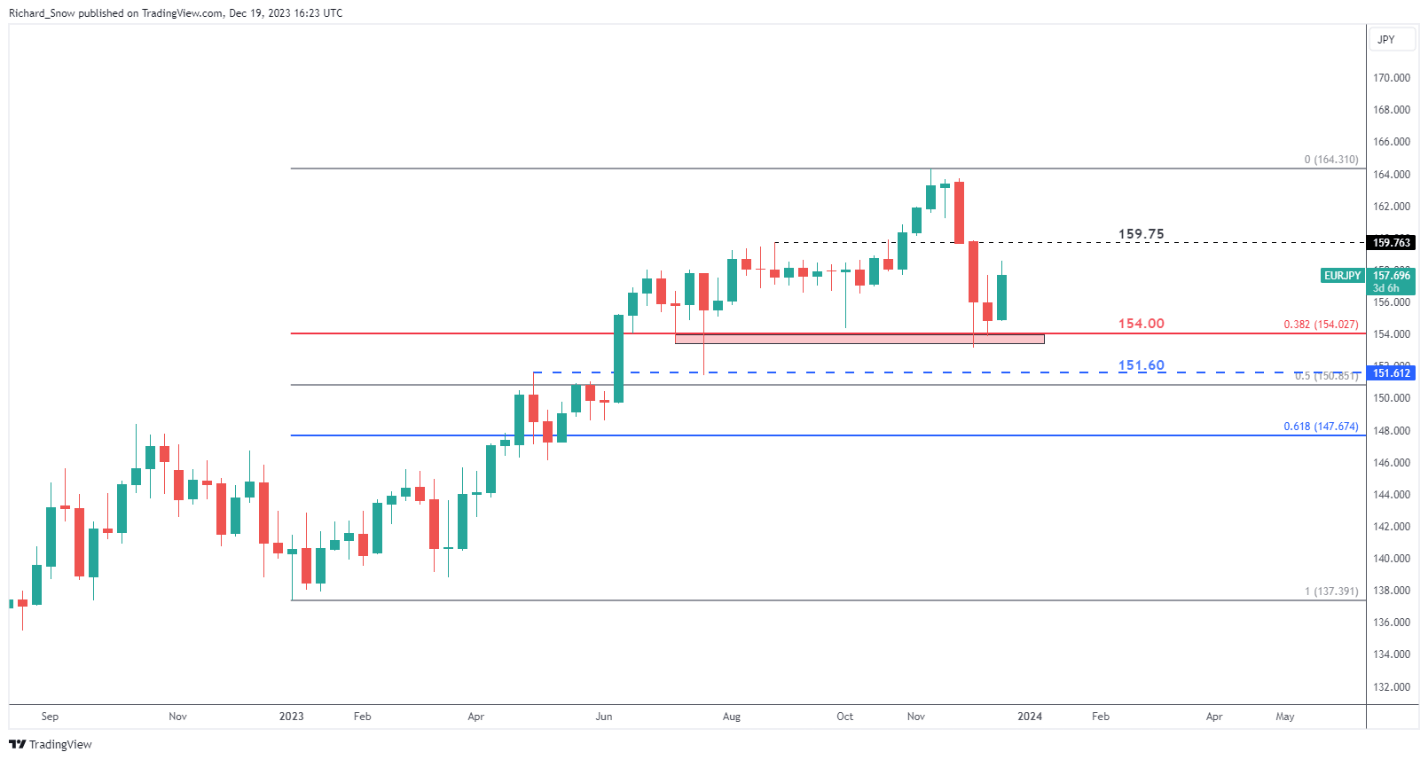

EUR/JPY Support to Come Under Pressure Amid BoJ Pivot

EUR/JPY is likely to come under pressure as speculation around the Bank of Japan’s withdrawal from ultra-loose policy draws nearer. Towards the end of 2023, the pair dropped sharply, halted by the zone of support around the 154.00 marker, which happens to include the 38.2% Fibonacci retracement of the 2023 rise.

The upside potential in EUR/JPY provides an unflattering risk-to-reward ratio, particularly if the pair struggles to trade above 159.75 – the prior level of resistance. Speculation around an eventual BoJ pivot is likely to gain momentum especially if inflation and wage growth continue to grow – as the trend in the data would suggest.

Yen strength could result in a test of 154.00 in early Q1, with potential momentum opening the door to 151.60 and even the 61.8% Fibonacci retracement at 147.67 in an extreme sell-off. Given the size of the weekly candles, momentum appears to have shifted from advances on the upside, to bouts of selling and a greater potential for EUR/JPY weakness.

EUR/JPY Weekly Chart

Source: TradingView, Prepared by Richard Snow

Read the full article here