EUR/USD ANALYSIS

- Mixed euro area inputs are providing no firm guidance as to the path forward.

- German Ifo business climate report and ECB officials under the spotlight.

- EUR/USD consolidating in anticipation of fundamental catalysts.

Elevate your trading skills and gain a competitive edge. Get your hands on the Euro Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL BACKDROP

The euro appreciated against the USD on Thanksgiving Day yesterday after eurozone PMI data showed some improvements despite remaining below the 50 threshold that delineates contraction from expansion. The European Central Bank (ECB) Monetary Policy Meeting Accounts were also released yesterday and highlighted market uncertainty as well as data dependency going forward, hiking interest rates if required. ECB officials on the other hand were mixed and it will be interesting to see how today’s speakers add to the overall rhetoric.

Earlier this morning, German GDP figures (see economic calendar below) showed the country slump into it’s first negative growth quarter since Q4 2022 (compounding recessionary fears) while YoY statistics missed estimates. Being the largest economy in the euro area, Germany is often used as a gauge for overall eurozone health. The day ahead is skewed towards euro area data including Germany’s Ifo Business Climate as well as ECB officials including President Christine Lagarde. The trading day wraps up with US PMI’s but with the Thanksgiving hangover still in place, volatility may be muted.

ECONOMIC CALENDAR (GMT+02:00)

Source: Refinitiv

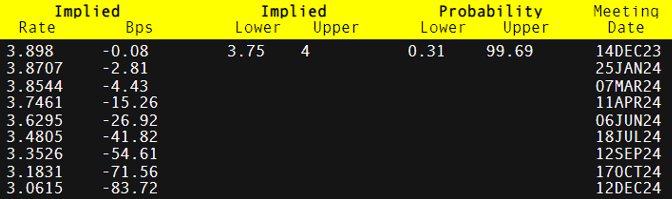

Option expiries for today show the largest proportion around the 1.0800 handle which could see the pair trade weaker as expiry looms. Looking at rate probabilities (refer to table below), little has changed as markets view current levels as the peak of the hiking cycle with cuts expected to begin around June 2024.

EUR/USD:1.0800 (EU1.18b), 1.0925 (EU925m), 1.1000 (EU759.1m)

ECB INTEREST RATE PROBABILITIES

Source: Refinitiv

Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of the latest market moving events!

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL ANALYSIS

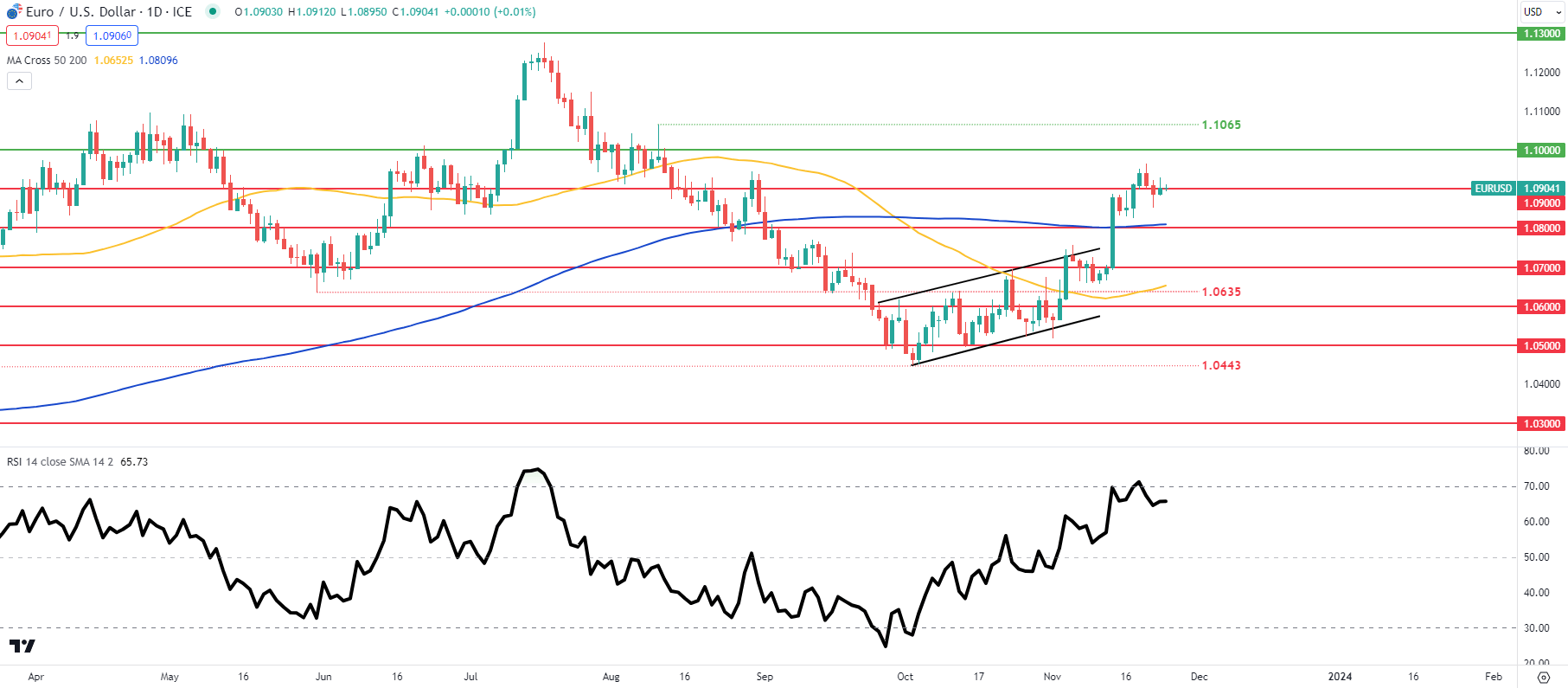

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

The daily EUR/USD chart has not yet managed to push higher after breaching the overbought zone of the Relative Strength Index (RSI) alongisde the 1.0900 pyshcological handle. Recent consolidation is a sign of hesitancy by EUR/USD traders ahead of next week’s inflation data.

Resistance levels:

Support levels:

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently neither NET SHORT on EUR/USD, with 57% of traders currently holding long positions (as of this writing).

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect EUR/USD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

Read the full article here