EUR/USD ANALYSIS

- FOMC announcement under the spotlight today.

- EUR/USD rising wedge breakout could see euro collapse further.

Elevate your trading skills and gain a competitive edge. Get your hands on the Euro Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL BACKDROP

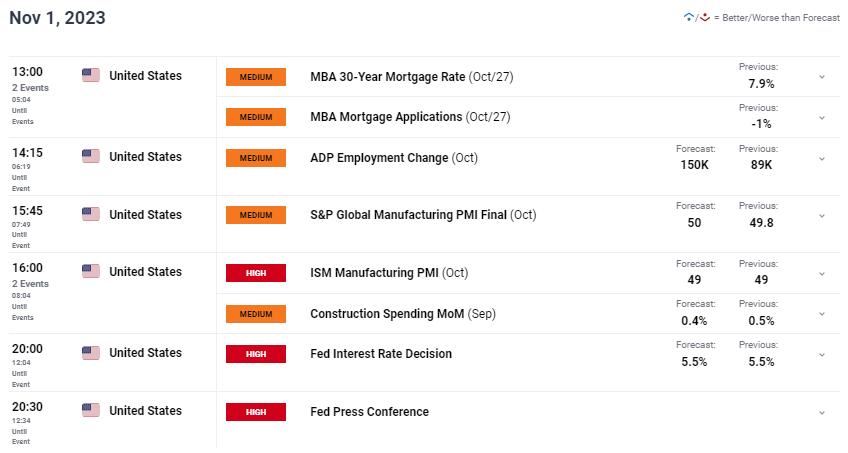

The euro faces the Federal Reserve interest rate decision later today (see economic calendar below). Although expectations for a rate pause are almost certain (99.5%) as shown via the implied Fed funds futures table, recent US economic data has been relatively robust. Strong GDP, persistent inflation pressures and a resilient labor market should maintain the ‘higher for longer’ message. That being said, high US Treasury yields could reduce the need for additional hikes. In summary, if we see no change to rates the US dollar could remain relatively stable leaving the EUR depressed.

IMPLIED FED FUNDS FUTURES

Source: Refinitiv

From a euro perspective, recent weak Chinese PMI’s will weigh negatively on the EUR and with bleak growth prospects within the region, the USD is unlikely to lose its attractiveness. In addition, the ongoing geopolitical issues (Israel-Hamas war) will keep the greenback’s safe haven attraction alive.

Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of the latest market moving events!

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Another key data point to look out for today will be the ISM manufacturing report which includes JOLTs data alongside the ADP release. This information will be key moving forward but should not have much bearing on todays rate decision.

ECONOMIC CALENDAR (GMT+02:00)

Source: Refinitiv

TECHNICAL ANALYSIS

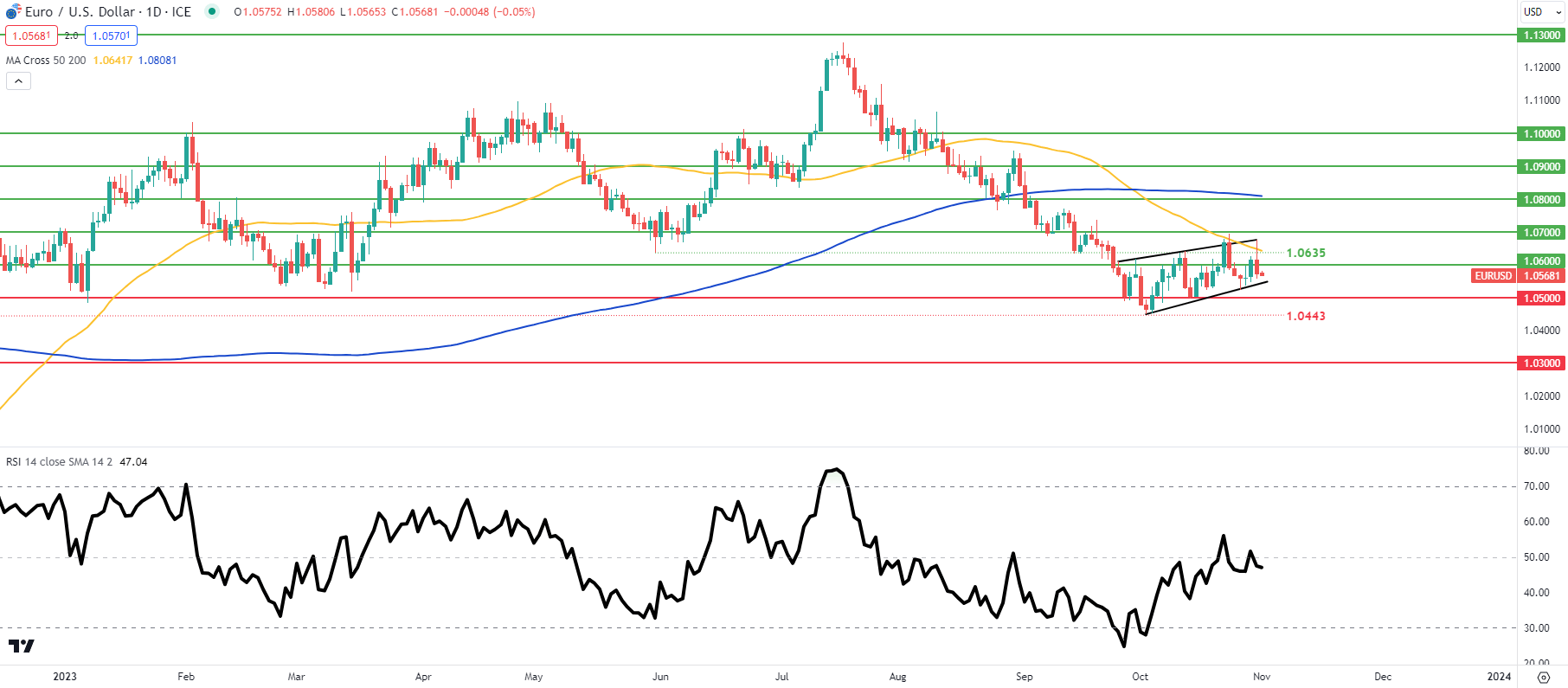

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

The daily EUR/USD daily chart above trades within a developing rising wedge/bear flag pattern (black) that may hint at subsequent downside should price breach wedge/flag support. Bulls were unable to push above the 50-day moving average (yellow) and the upcoming Fed catalyst could spark a pattern breakout. The Relative Strength Index (RSI) currently hovers around its midpoint zone thus indicating no preference for bullish nor bearish momentum (hesitancy).

Resistance levels:

Support levels:

IG CLIENT SENTIMENT DATA: BEARISH

IGCS shows retail traders are currently neither NET LONG on EUR/USD, with 68% of traders currently holding long positions (as of this writing).

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect EUR/USD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

Read the full article here