BITCOIN, CRYPTO KEY POINTS:

- Bitcoin Trades Just Above the $38k Mark. Are We Finally Going to Print a Daily Close Above the Resistance Level with an Eye on the $40k Handle?

- Binance Users Pull $1 Billion Following the Exit of CEO Changpeng Zhao.

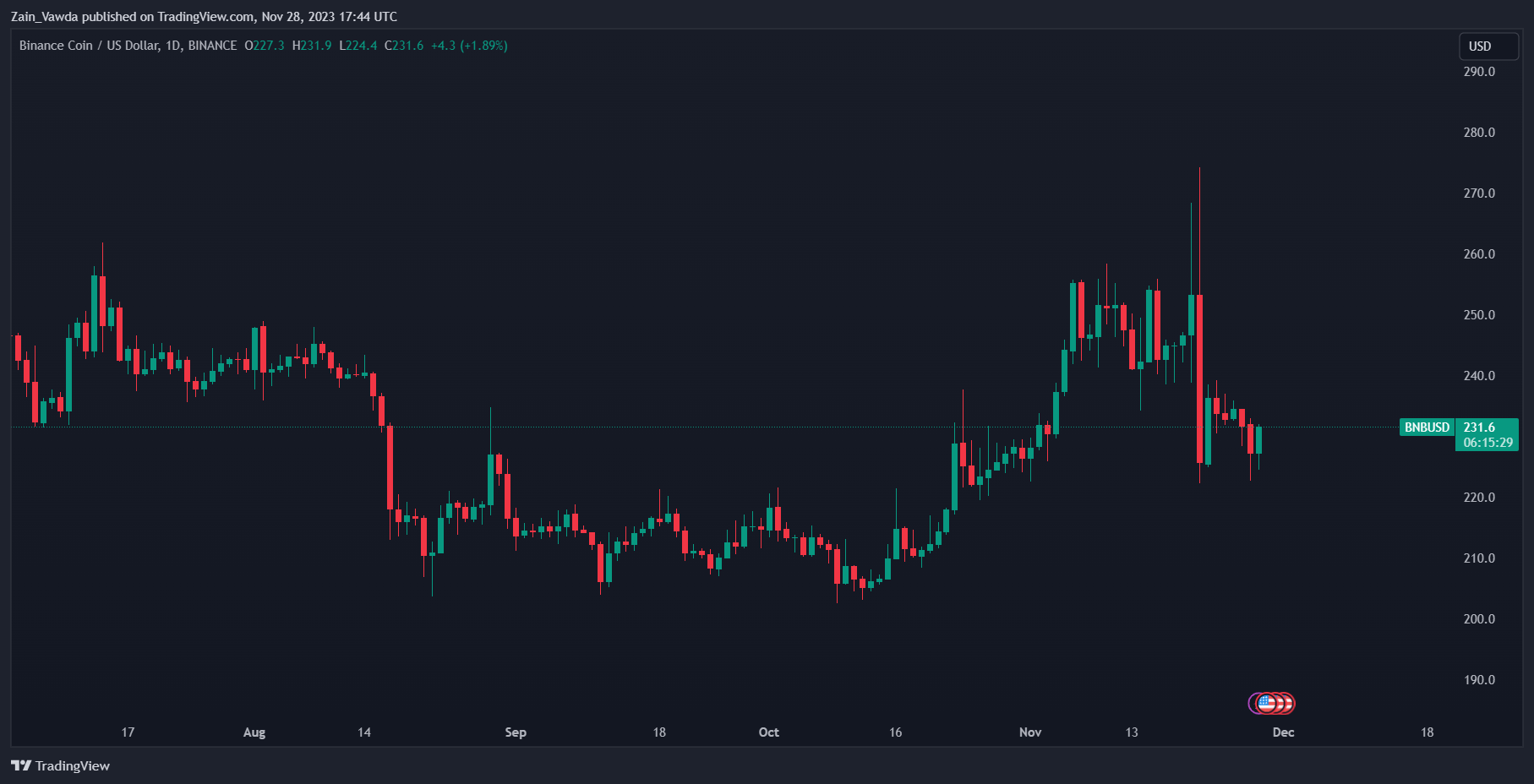

- BNB Token Struggles and Hovers Near Recent Lows. Can the Exchange Survive Moving Forward?

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Series.

READ MORE: Crypto Forecast: Will Bitcoin Have What it Takes to Break the $38k Mark?

Recommended by Zain Vawda

Get Your Free Introduction To Cryptocurrency Trading

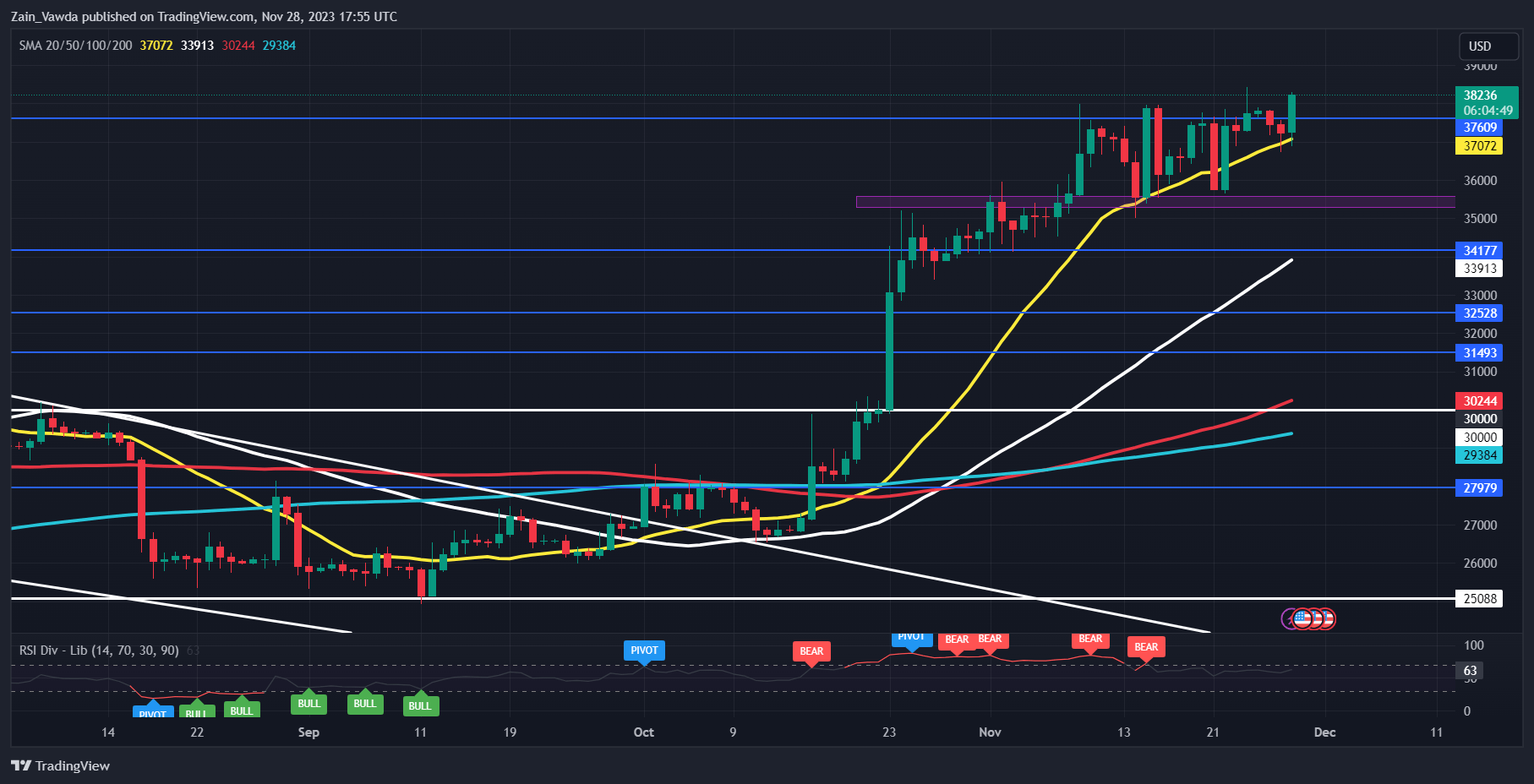

Bitcoin continues to threaten the $38k mark but remains unable to find acceptance above the key level. The reason the world’s largest cryptocurrency has held onto its gains may have to do with an increase in capital inflow from institutional investors over the past week, per a report by CoinShares.

There has also been a notable surge in demand for digital assets of late with the past week being the 9th consecutive week of positive inflows to the market. A lot of this could still be down to anticipation of the spot Bitcoin ETF and the halving event next year. Bitcoin in particular saw inflows of around $312 million over the past week with the yearly total now at around the $1.5 billion mark as investor confidence appears to be on the rise. There has also been a notable shift over the last 18 months with the number of Hodlers growing exponentially as well.

Source: TradingView

BINANCE FACES CLIENT EXODUS FOLLOWING ZHAO’S EXIT

It’s been a topsy turvy couple of days for Binance as it continues to grapple with the fallout from exit of former CEO Changpeng Zhao. This has left the world of crypto exchanges reeling even if Cryptocurrencies themselves have enjoyed a renaissance in Q4.

Binance faced questions last week about its ability to continue given the size of the fines imposed on the exchange which totaled $4.3 billion. As news filtered through the exchange saw outflows of around the $1 billion mark in the 24 hours post Zhao’s departure being announced. If this continues it could pose a serious risk to the exchange and may be worth monitoring in the days ahead.

The BNB token as well faced challenges in the aftermath as it fell as much as 8% following Zhao’s announcement. The exchange has also lost a significant amount of market share from zero-fee crypto trading since the removal of this lucrative incentive. Binance does not face the same charges as FTX but are we about to witness another titan of the industry disappear into the doldrums?

BNB Daily Chart, November 28, 2023

Source: TradingView

Recommended by Zain Vawda

The Fundamentals of Trend Trading

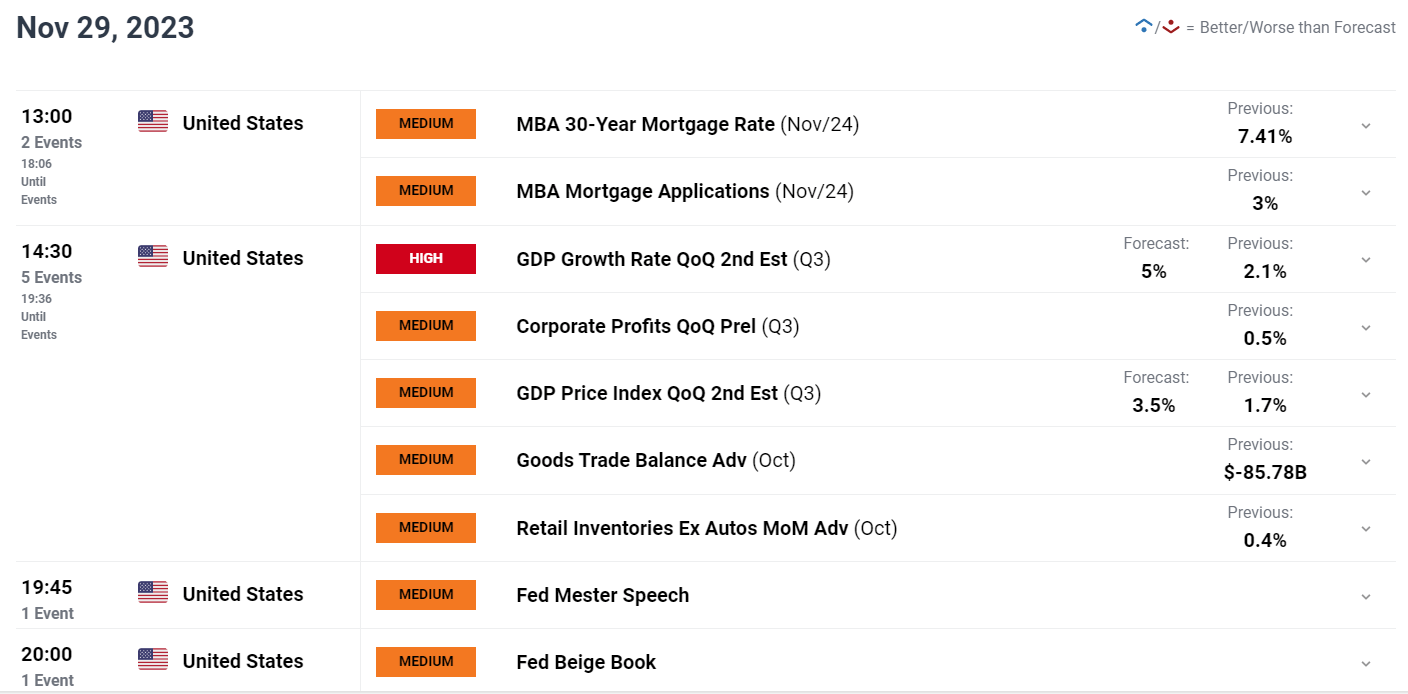

RISK EVENTS AHEAD

There remains some risk from a USD perspective this week which could impact the US Dollar and thus Bitcoin. We witnessed a bit of that today with Fed policymakers’ comments received as a tad dovish today which has seen the US Dollar selloff gain further traction.

Market participants appeared buoyed by comments from Fed Policymaker Waller in particular who stated that “If inflation consistently declines, there is no reason to insist that rates remain really high.” If market continue to perceive Fed comments and US data in a dovish light this week and the US Dollar selloff continues this could help Bitcoin achieve a clean break above the $38k mark.

For all market-moving economic releases and events, see the DailyFX Calendar

READ MORE: HOW TO USE TWITTER FOR TRADERS

BITCOIN TECHNICAL OUTLOOK AND FINAL THOUGHTS

From a technical standpoint BTCUSD is interesting as it hovers just below the $38k mark. Nothing much has changed from a technical standpoint from my article last week (link at the top of the article). The 38000 mark remains a stumbling block to further upside and I fear the longer we stall at this level the greater the likelihood for a selloff becomes.

Resistance levels:

Support levels:

BTCUSD Daily Chart, November 28, 2023.

Source: TradingView, chart prepared by Zain Vawda

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Read the full article here