Bitcoin (BTC) Prices, Charts, and Analysis:

- Bitcoin looking at $37.3k as the next level of resistance.

- Spot ETFs would change the landscape for Bitcoin.

Recommended by Nick Cawley

Get Your Free Bitcoin Forecast

At the end of October, we identified a Bullish Pennant pattern forming on the daily Bitcoin chart, along with a Golden Cross, another positive technical set-up. Since then Bitcoin has rallied by around $3,000 and is currently eyeing the next level of resistance at $37.3k. This level looks vulnerable and a concerted push would open the way to the next level of interest at $40k.

Bitcoin (BTC) Technical Outlook – Charts Suggests Higher Prices are Likely

Bitcoin guide

Bitcoin (BTC/USD) Daily Price Chart – November 9, 2023

Recommended by Nick Cawley

Get Your Free Introduction To Cryptocurrency Trading

The driving force behind the latest move higher is the growing belief that the SEC will shortly grant a raft of spot Bitcoin ETF applications. According to Bloomberg research, there is a window between November 9 and November 17 when all twelve ETF applications could be approved. The Bloomberg analysts assign a 90% chance that a Bitcoin ETF will be approved before January 10, 2024.

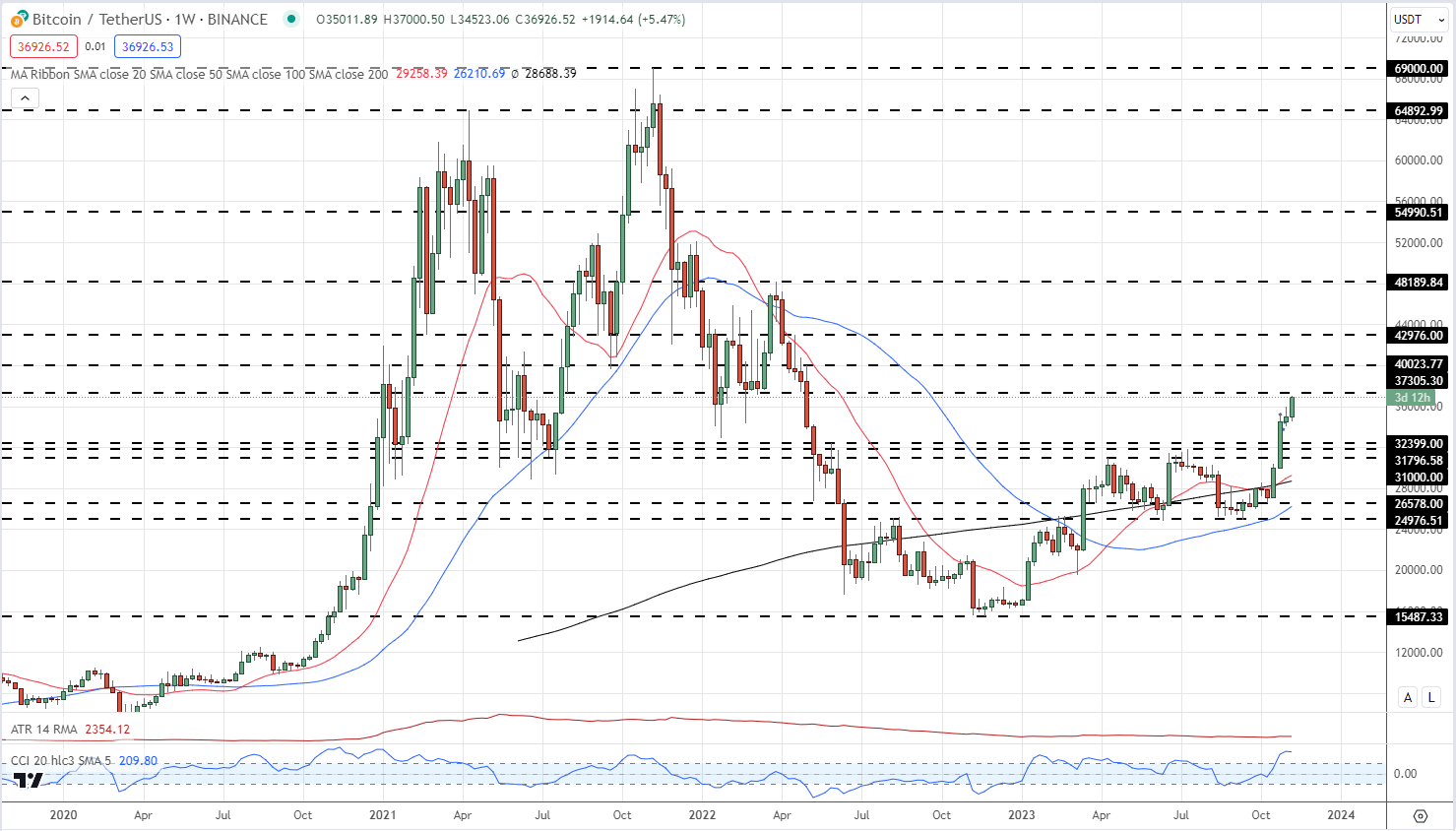

Looking further ahead, the $40k level may not hold Bitcoin for long. The largest cryptocurrency by market capitalization may well accelerate higher if/when spot ETFs are approved, especially as BTC nears its latest ‘halving’ event due in late April. After the halving, the block reward for miners will be reduced by 50% to 3.125 BTC from 6.25. The weekly chart shows resistance at $40k and a fraction under $43k before a gap to $48.2k appears.

If spot ETFs are not approved, Bitcoin could quickly fall to $32.4k before $31.8k and $31.0k come into focus.

Bitcoin (BTC/USD) Weekly Price Chart – November 9, 2023

Charts via TradingView

What is your view on Bitcoin – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Read the full article here