AUD/USD ANALYSIS & TALKING POINTS

- Australian jobs market stays strong but not enough to extend AUD upside.

- US building permits and Fed officials in focus later today.

- AUD/USD may be in for further downside.

Elevate your trading skills and gain a competitive edge. Get your hands on the Australian dollar Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Warren Venketas

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian dollar has slipped back below the 0.6500 psychological handle once more. Yesterday, we saw Australian employment change data beat estimates despite unemployment ticking 0.1% higher. Overall, the Australian labor market remains tight and will keep the Reserve Bank of Australia (RBA) on its toes.

From a USD perspective, continuous jobless claims data rose to levels last seen roughly two years ago alongside an initial claims beat. Recent US economic data is showing signs of weakness but Fed officials fought back with some hawkish messaging in support of Fed Chair Jerome Powell’s recent comments.

The day ahead will be relatively muted but US building permit figures will dominate headlines after yesterday’s NAHB miss. Fed speakers will continue through to today and it will be interesting whether today’s speakers extend the pushback against easing monetary policy.

AUD/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, TradingView

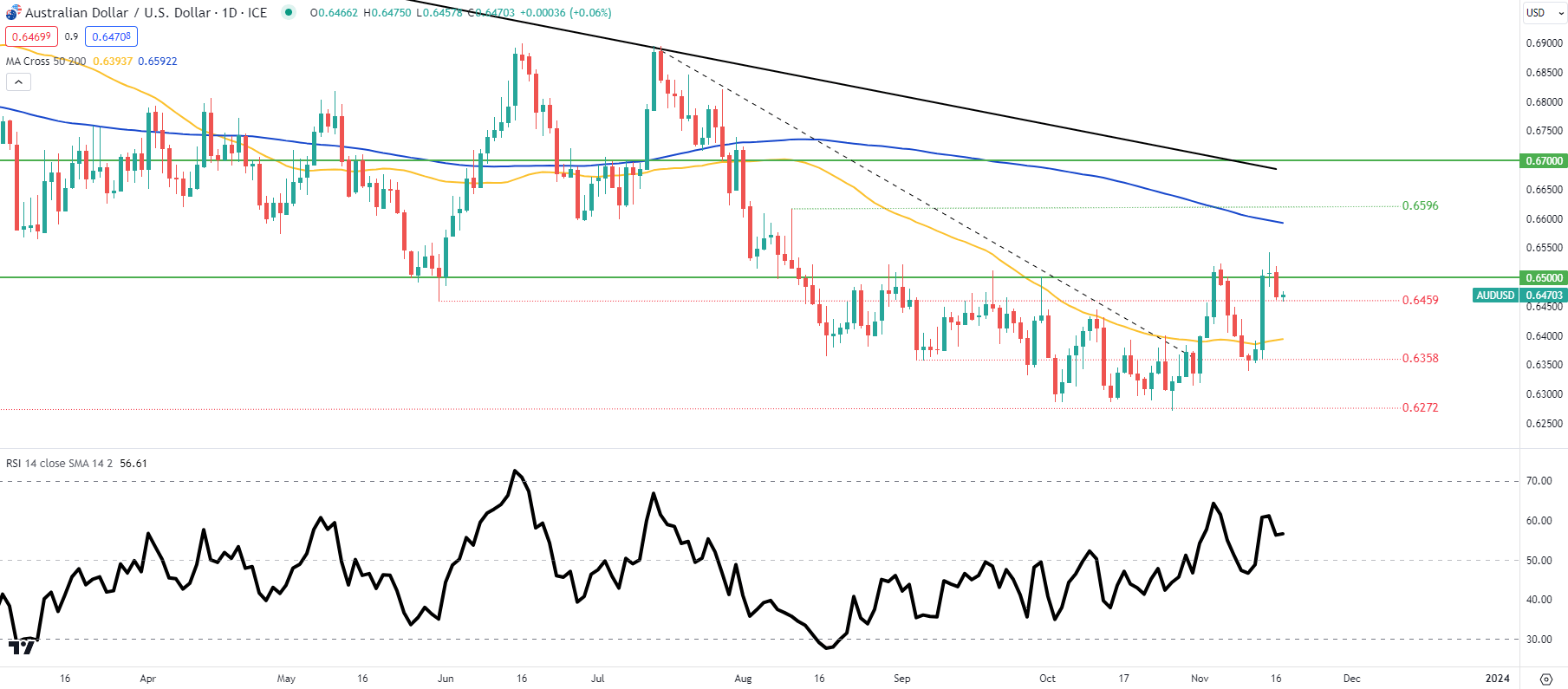

AUD/USD daily price action slumped after Wednesday’s long upper wick close now facing the 0.6459 swing support. The Relative Strength Index (RSI) shows bearish/negative divergence and could see the pair breakdown further should this unfold. If today’s close falls below the 0.6459 swing low, the 50-day moving average (yellow) could come into consideration for AUD bears.

Key support levels:

IG CLIENT SENTIMENT DATA: MIXED (AUD/USD)

IGCS shows retail traders are currently net LONG on AUD/USD, with 68% of traders currently holding long positions.

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect AUD/USD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

Read the full article here