Private-equity funds aimed at wealthy individuals continue to draw in fresh capital as the universe of alternative investments grows beyond its roots serving endowments, pension funds and other institutions, according to industry data.

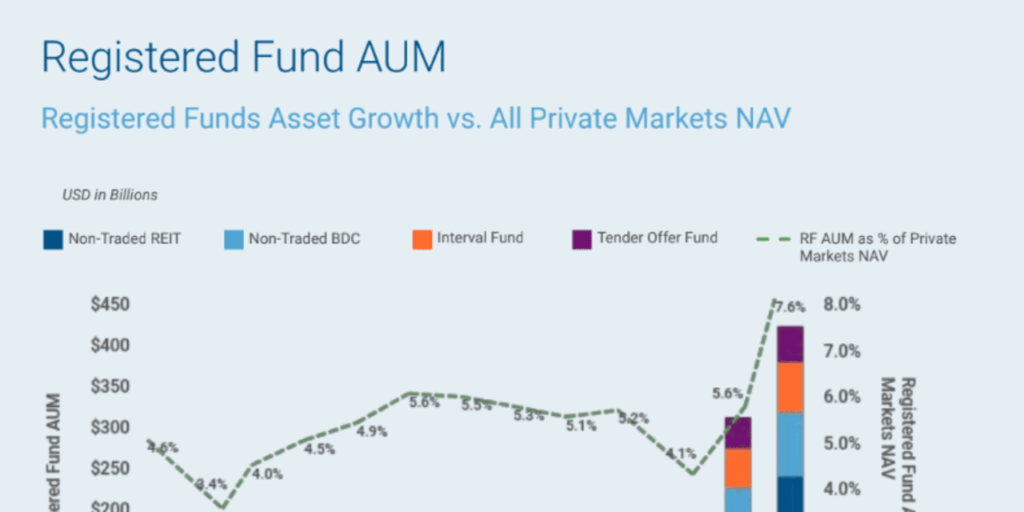

Registered funds that take investments from individuals and smaller institutions rose by about $125 billion in 2022 from the previous year to total assets under management (AUM) of $425 billion, according to data from private-equity investor and data provider Hamilton Lane Inc. HLNE.

The…

Master your money.

Subscribe to MarketWatch.

Get this article and all of MarketWatch.

Access from any device. Anywhere. Anytime.

Subscribe Now

Already a subscriber?

Log In

Read the full article here