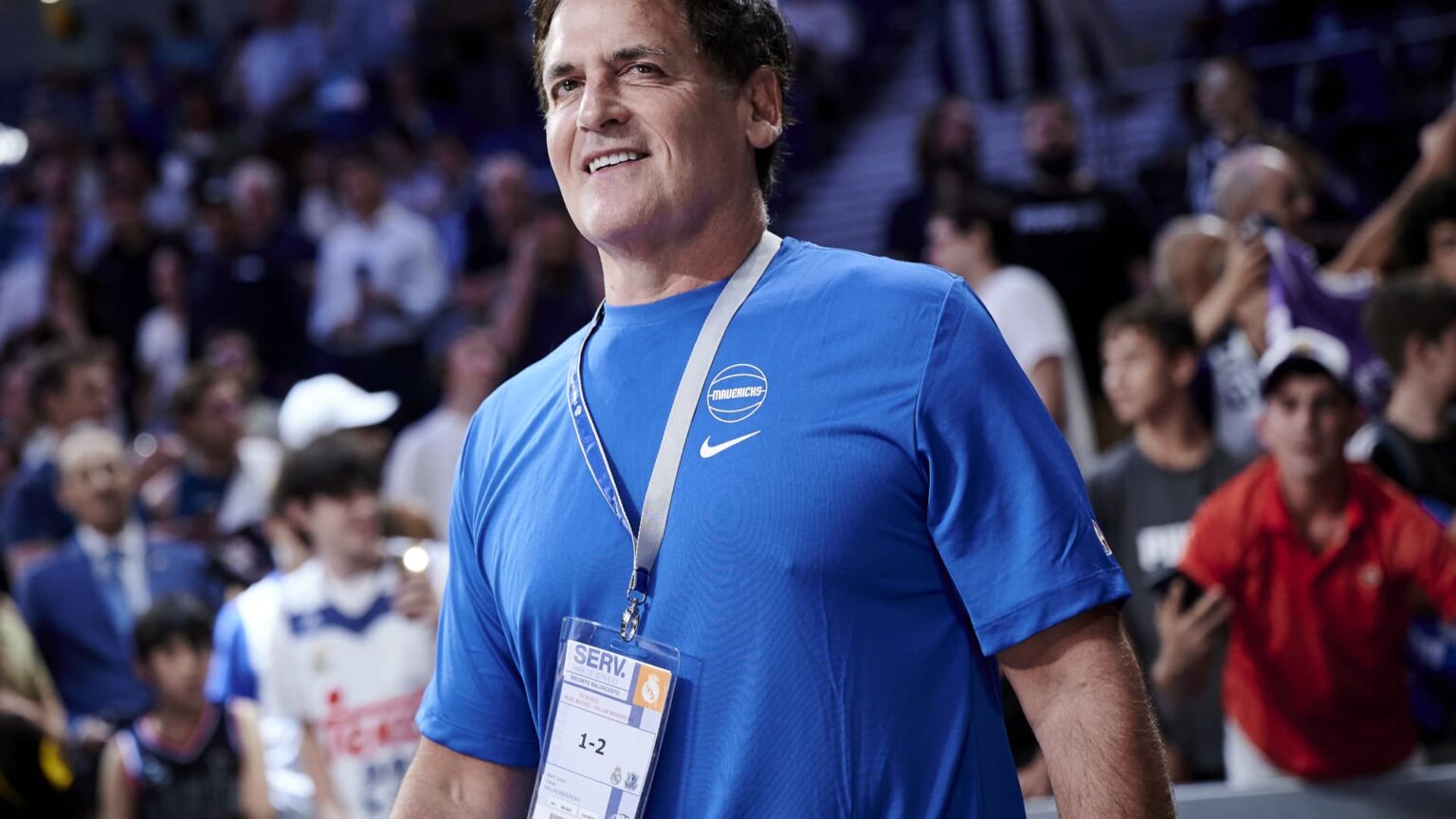

Billionaire investor Mark Cuban is selling a majority stake of the Dallas Mavericks to Miriam Adelson and her family, a source familiar with the deal told CNBC.

Cuban still owns a stake in the team and will run basketball operations.

Adelson is selling $2 billion worth of Las Vegas Sands stock, or roughly 10% of her stake, according to an announcement from the company. The proceeds will be used to buy a professional sports team, the casino company said in a filing Tuesday.

Adelson and her family are the largest shareholders in Las Vegas Sands.

“We have been advised by the Selling Stockholders that they currently intend to use the net proceeds from this offering, along with additional cash on hand, to fund the purchase of a majority interest in a professional sports franchise pursuant to a binding purchase agreement, subject to customary league approvals,” Las Vegas Sands said in the filing.

Las Vegas, which has become a sports mecca, has been rumored to be a destination for an NBA team. The WNBA’s Aces play there, and the city will play host to the final games of the NBA’s midseason tournament.

The league did not comment on the news, and the Mavericks referred CNBC to the Adelson family for comment. CNBC has reached out to Cuban for comment.

Adelson is listed as the fifth richest woman in the world by Forbes. She and her family inherited 56% of the shares of the world’s largest casino company when her spouse, Las Vegas Sands founder Sheldon Adelson, died in 2021. At market close Tuesday, shares owned by the Adelson estates were valued at more than $20 billion.

Shares of LVS are roughly flat year-to-date, an indication investors are discounting the reopening of casinos in Macao, where the company has the biggest real-estate footprint in the market, and in Singapore.

Las Vegas Sands disclosed in filings Tuesday that it will buy $250 million worth of Adelson’s shares. The company announced a $2 billion share repurchase authorization during its third quarter earnings call Oct. 18. The stock fell more than 4% in extended trading following the news of Adelson’s share sale.

“As we consider our future capital return, we expect share repurchase will be more heavily weighted than dividends. We believe repurchases will be more accretive than dividends over time, as they reduce the denominator,” Patrick Dumont, Sands’ president and chief operating officer and Adelson’s son-in-law, said on the earnings call. “We fundamentally believe in the compounding long-term benefit of share repurchases.”

Owning a sports franchise will be a significant departure from the activities that Miriam Adelson and her late husband were known for.

The couple set records for political giving, including more than $218 million to Republican and conservative causes in the 2020 election cycle alone, according to the Center for Responsive Politics, which tracks political spending.

According to published reports, Miriam has recently met with GOP candidate Nikki Haley in Las Vegas, as well as former President Donald Trump.

As a medical doctor, Miriam Adelson is also widely known for her focus on addiction.

Born in Israel, she has made significant philanthropic donations significant toward causes that improve Jewish relations in the United States. Recently, she has been a vocal critic of people protesting Israel’s military response to Hamas’ terrorist attacks of Oct. 7.

–CNBC’s Jessica Golden contributed to this article.

Read the full article here