Speculating on low-liquidity cryptocurrencies is risky but sometimes rewarding. A crypto trader recently beat the risk of ruin, turning $3,000 to more than $651,000 in 19 hours.

Lookonchain reported this successful trading story on X (formerly Twitter) on January 25 at 06:25 am (UTC). At that time, the trader held 314.9 trillion SNOW worth around $535,000.

Notably, the address ‘0xf8a…F8683’ started with a purchase of 386.94 trillion SNOW for 1.31 ETH, worth $2,931. First, he sold 72 trillion tokens for 53.4 ETH, worth $119,000. Thus, realizing a profit of 52.09 ETH ($116,000).

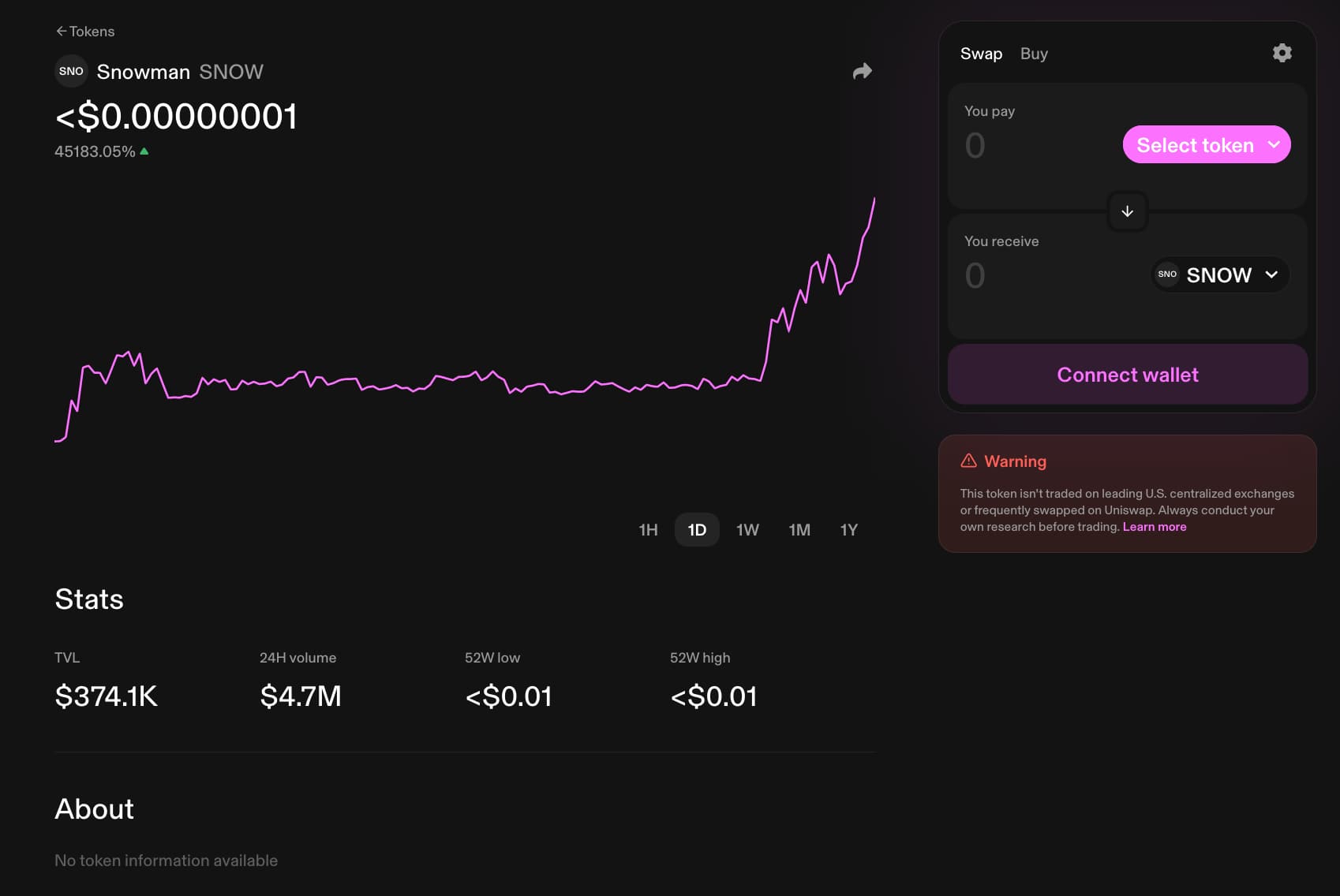

Snowman (SNOW) analysis on Uniswap

Snowman (SNOW) is a low-liquidity and low-cap ERC-20 token only traded on Uniswap. In particular, no token information is available on the decentralized exchange, suggesting a purely speculative memecoin. It exists under the smart contract ‘0xD1f…a557f’.

Additionally, the token has a TVL of $374,100 in its liquidity pools, making over $4.7 million 24-hour volume. Its circulating supply is 888.888 trillion SNOW, and the price is sub $0.00000001.

Interestingly, the trader’s first purchase was equivalent to 43.5% of the circulating supply. Meanwhile, the address’s current balance equals 28.3% of all Snowman tokens, more than the available liquidity.

This trade could have been a lucky strike, a successful operation by a smart trader, or even an internal job. Still, it illustrates the high volatility of low-liquidity tokens – this time favoring the speculators.

Nevertheless, these trades often do not have a happy ending. Speculators might find it difficult to realize any meaningful profit in a low-liquidity environment, while volatility could quickly shift, resulting in massive losses and an investor’s ruin.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here