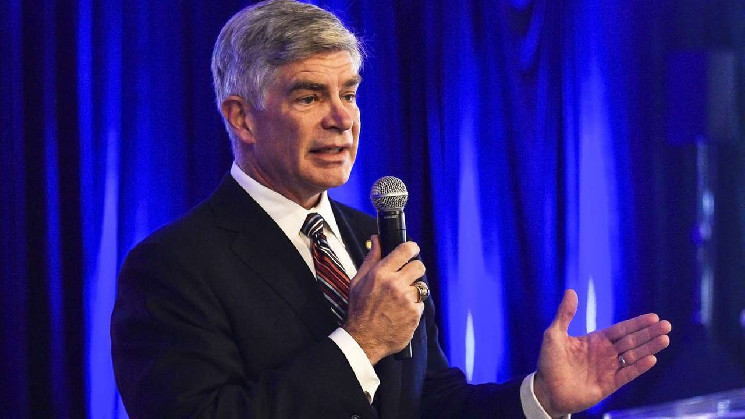

In a recent speech, FED member Patrick T. Harker touched on the institution’s policies and gave information about the current economic situation and future strategies.

Harker noted that the FED’s task of controlling inflation has not yet been completed. However, he expressed optimism about the inflation outlook, saying “things are looking better.”

Despite the positive outlook, Harker said he is hearing signs that things are starting to soften faster than the data indicates. Harker made an important statement and said that there was no need to increase interest rates anymore.

Harker also acknowledged the economic difficulties some people face, stating that “the reasons for some people’s bad economic feelings are real.”

Harker stated that “the FED will not reduce interest rates immediately” and stated that an immediate reduction in interest rates would not be possible, adding that a move should be made to reduce interest rates, but this would not happen immediately.

The FED chose to keep interest rates constant as a result of its two-day meeting last week. However, Chairman Jerome Powell also avoided using hawkish statements in his statement.

*This is not investment advice.

Read the full article here