Digital asset company New Frontier Labs has partnered with BitGo Bank & Trust National Association, the entity that crypto infrastructure company BitGo will use to issue and provide custodial services for the FYUSD stablecoin, a dollar-pegged token for Insitutional investors in the Asia region.

BitGo’s announcement said FYUSD is compliant with the GENIUS Act stablecoin regulatory framework. The regulations include 1:1 backing with cash deposits held by a custodian or short-term US government debt instruments, anti-money laundering (AML) requirements and know-your-customer (KYC) checks.

Some of the requirements for a regulated dollar-pegged stablecoin under the GENIUS framework. Source: Cointelegraph

The company also developed “Fypher,” a suite of stablecoin infrastructure tools that provides a “programmable settlement” layer for the FYUSD token that allows it to be used by autonomous AI agents for commercial transactions.

US Treasury Secretary Scott Bessent has touted stablecoins as a way to preserve US dollar dominance by reducing settlement times, transaction costs and democratizing access to US dollars for individuals without access to traditional banking infrastructure.

Related: 21Shares taps BitGo for expanded regulated staking, custody support across US, Europe

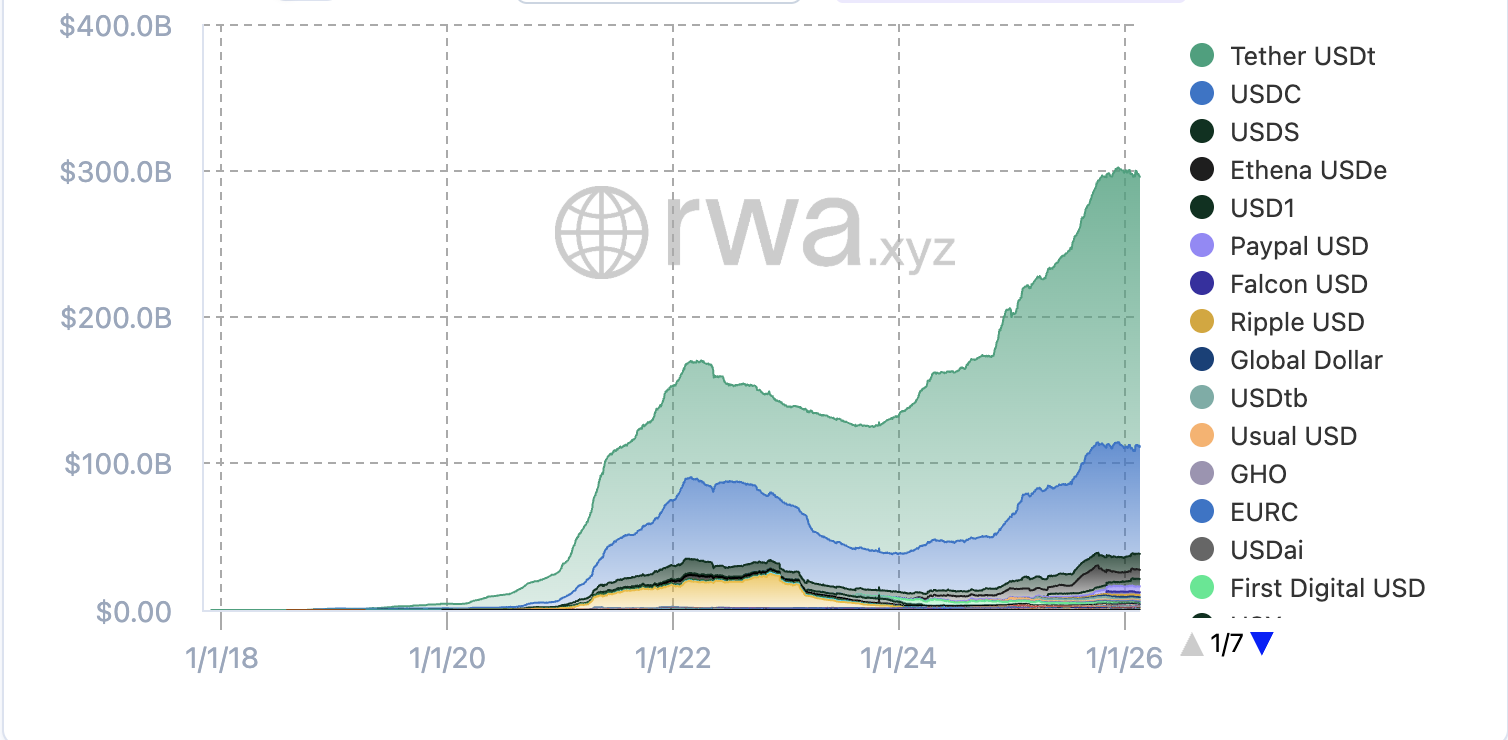

Stablecoins are down from the market cap peak of over $300 billion

The total market capitalization of stablecoins is over $295 billion at the time of this writing, according to RWA.XYZ, down from the peak of over $300 billion recorded in December.

The current stablecoin market cap is over $295 billion. Source: RWA.XYZ

Stablecoin issuer Tether, the issuer of the USDt ($USDT) dollar-pegged token, is on-track for the steepest monthly drop in USDt circulating supply since the collapse of the FTX crypto exchange in 2022. At time of writing, circulating supply was 183.64 billion $USDT, CoinMarketCap data showed.

While USDt remains the world’s largest stablecoin by market capitalization, its circulating supply is down $1.5 billion so far in February, data from Artemis shows. This is shaping up to be the second month of ramped up user redemptions, following a $1.2 billion drop in January.

Stablecoin redemptions could signal a broader contraction in the crypto market, as investors liquidate their positions and move their holdings off-chain, potentially into other investments.

However, spokespeople for Tether told Cointelegraph that the data represent short-term positioning, rather than a long-term trend of sustained outflows and market contraction.

Magazine: Bitcoin payments are being undermined by centralized stablecoins

Read the full article here