Shares in Coinbase and MicroStrategy have surged around 6% and 9%, respectively, in pre-market trading this morning as bitcoin broke past $45,000 amid U.S. spot ETF approval anticipation.

Coinbase stock rose 6.4% to $184.99 in early New Year trading, after closing 2023 at $173.92. Coinbase shares increased by 36% over the past month and nearly 420% in a year, according to TradingView. However, COIN is still around 46% below its all-time high of approximately $343, set in November 2021.

COIN/USD price chart. Image: TradingView.

Coinbase is currently valued at $32.4 billion, according to The Block’s data dashboard.

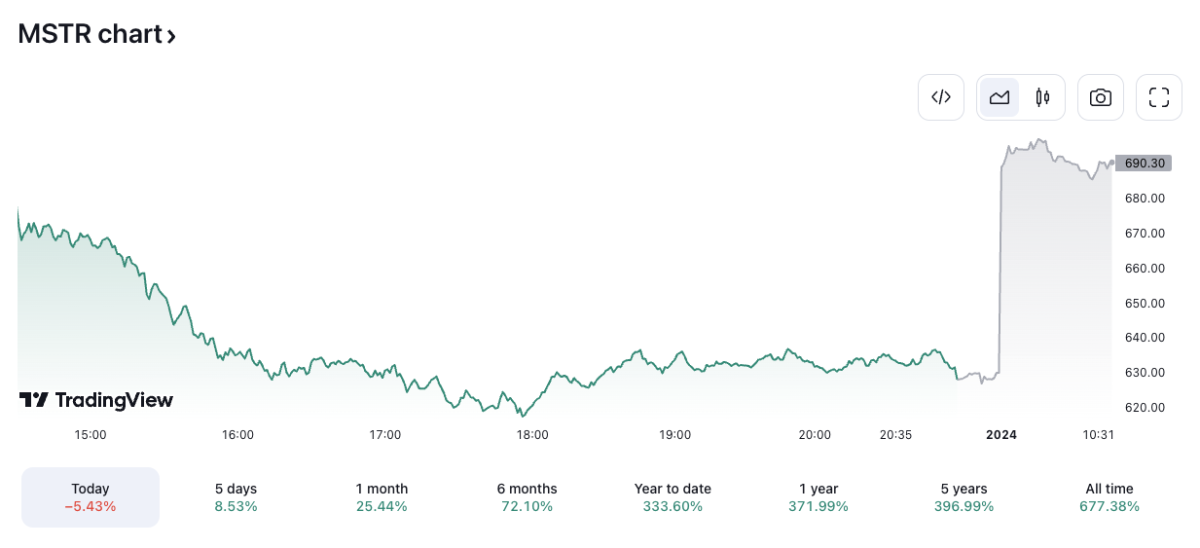

Similarly, shares in MicroStrategy jumped 9.3% in pre-market trading today to $690.30 after ending last year at $631.6. MicroStrategy stock gained 25% over the past month and 372% over the past year, according to TradingView. MSTR is now 8% off its 2021 high of $750.

MSTR/USD price chart. Image: TradingView.

Bitcoin spot ETF anticipation

The moves follow a breakout in the price of bitcoin, up around 7% over the last 24 hours to approach $46,000, with anticipation increasing for U.S. spot bitcoin ETFs to be approved in the coming days. Bitcoin BTC +6.51% currently trades at $45,653, according to The Block’s price page.

BTC/USD price chart. Image: The Block/TradingView.

Crypto exchange Coinbase has been tasked by several spot bitcoin ETF filers, including BlackRock, Franklin Templeton and Grayscale, to provide custodial services for the funds. “We have extensively prepared for ETF approval,” a Coinbase spokesperson told Bloomberg on Friday. “Our systems have been designed and tested to handle added trading volume, increased liquidity and general increases in demand on our systems.”

Last week, software firm MicroStrategy, well known for its bitcoin holdings, announced it had added a further 14,620 BTC to its stash between Nov. 30 and Dec. 26. MicroStrategy’s bitcoin holdings now total 189,150 — worth around $8.7 billion at current prices. Purchased at an average price of $31,168, the company is currently up $2.8 billion on paper.

Read the full article here