Shares in bitcoin-related companies — including Coinbase, MicroStrategy, Riot Platforms and Marathon Digital — slid yesterday as trading began for the 11 newly approved spot bitcoin ETFs in the United States.

The stocks have risen significantly over the past year — gaining up to 300% — with investors potentially using the products as a proxy for bitcoin pre-spot ETF approval. Now that the bitcoin ETF products have launched, profit-taking appears to occur as the narrative draws to a close. However, some are speculating the proxy stocks are now draining into the new spot bitcoin funds.

Bitcoin BTC -2.89% mining company Riot was the most brutal hit, dropping 15.8% yesterday to $13.09 and is down a further 2.6% in pre-market trading, according to TradingView. The stock has gained 137% over the past year.

RIOT/USD price chart. Image: TradingView.

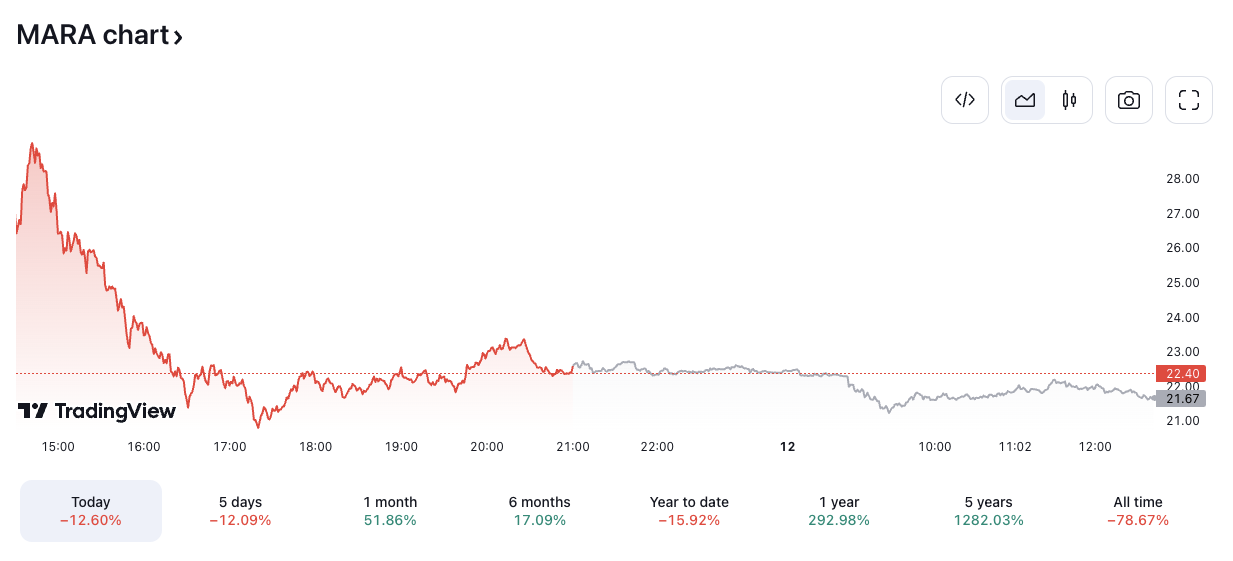

Marathon only fared slightly better — down 12.6% yesterday to hit $22.40 by market close — and is currently another 3.3% down in pre-market trading. MARA is up by around 293% in the last year, however.

Fellow mining firms CleanSpark and Iris Energy also fell — dropping 7% and 6%, respectively.

MARA/USD price chart. Image: TradingView.

Coinbase and MicroStrategy shares also decline

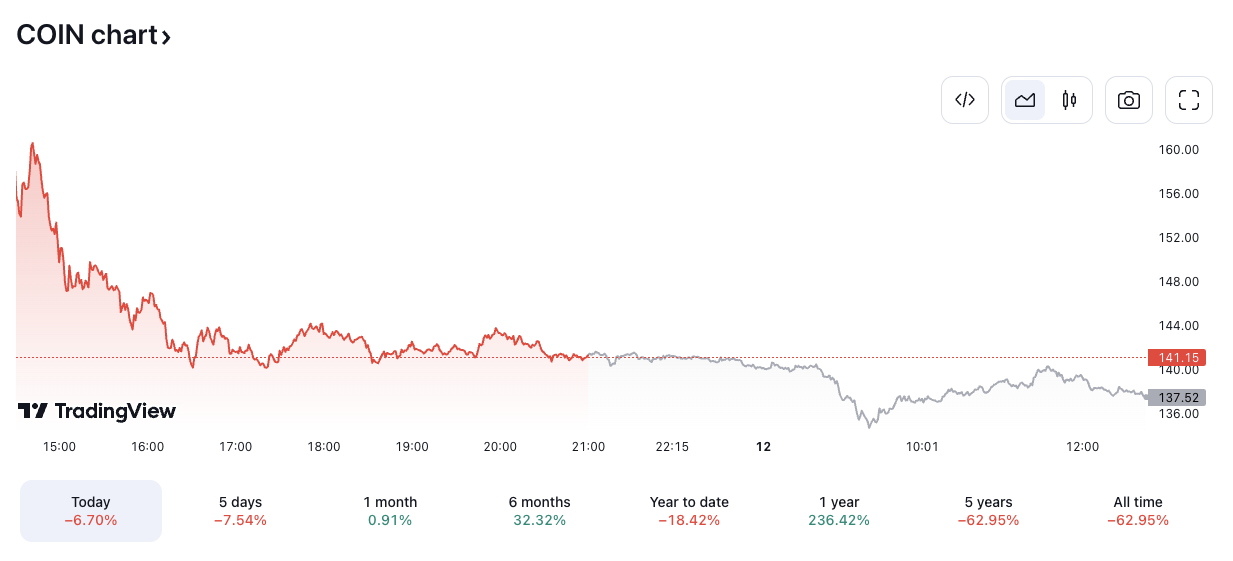

Shares in crypto exchange Coinbase — which is also the custodian for the majority of the new U.S. spot bitcoin ETFs — fell 6.7% on Thursday to $141.16 by market close and has dropped another 2.6% in this morning’s pre-market trading. Coinbase’s stock has also been on an impressive run leading up to the bitcoin ETF approvals, gaining more than 236% over the past year.

COIN/USD price chart. Image: TradingView.

MicroStrategy is the the largest corporate holder of bitcoin, owning 189,150 BTC it purchased at an average price of $31,168. The software firm’s stock fell 5.2% yesterday to close at $536.18 and is currently down 1.5% in pre-market activity today. Like the other bitcoin-related stocks, MicroStrategy is also up significantly during the last 12 months — rising by 184%.

MSTR/USD price chart. Image: TradingView.

New spot bitcoin ETFs hit $4.5 billion in day-one trading volume

Thursday marked the first day for trading U.S. spot bitcoin ETFs after the Securities and Exchange Commission approved 11 new products on Wednesday — generating a total trading volume of more than $4.5 billion, according to data from Yahoo Finance compiled by The Block.

BlackRock’s spot bitcoin ETF (IBIT) reached $1.05 billion in trading volume, surpassing BITO’s $1 billion first-day futures bitcoin ETF volume in 2021.

Fidelity’s FBTC spot bitcoin ETF hit nearly $685 million.

Grayscale’s spot bitcoin ETF product (GBTC) generated greater trading volume than those two, combined — reaching about $2.3 billion. However, Grayscale’s ETF is a conversion of its flagship GBTC fund, and it’s unclear how much of Grayscale’s volume could be capital flowing out of the instrument.

The ARK 21Shares bitcoin ETF (ARKB) has generated $278 million worth of trading volume so far, and Bitwise (BITB) $122 million. Of the remaining ETFs, Franklin Templeton (EZBC), Invesco Galaxy (BTCO) and VanEck (HODL) all witnessed trading volumes below $100 million. Meanwhile, Valkyrie (BRRR), WisdomTree (BTCW) and Hashdex’s (DEFI) trading volumes fell short of $10 million.

“While it’s premature to make final judgments, this significant trading volume indicates a considerable influx of investor funds into the spot-based bitcoin ETFs,” CoinShares Head of Research James Butterfill said.

Read the full article here