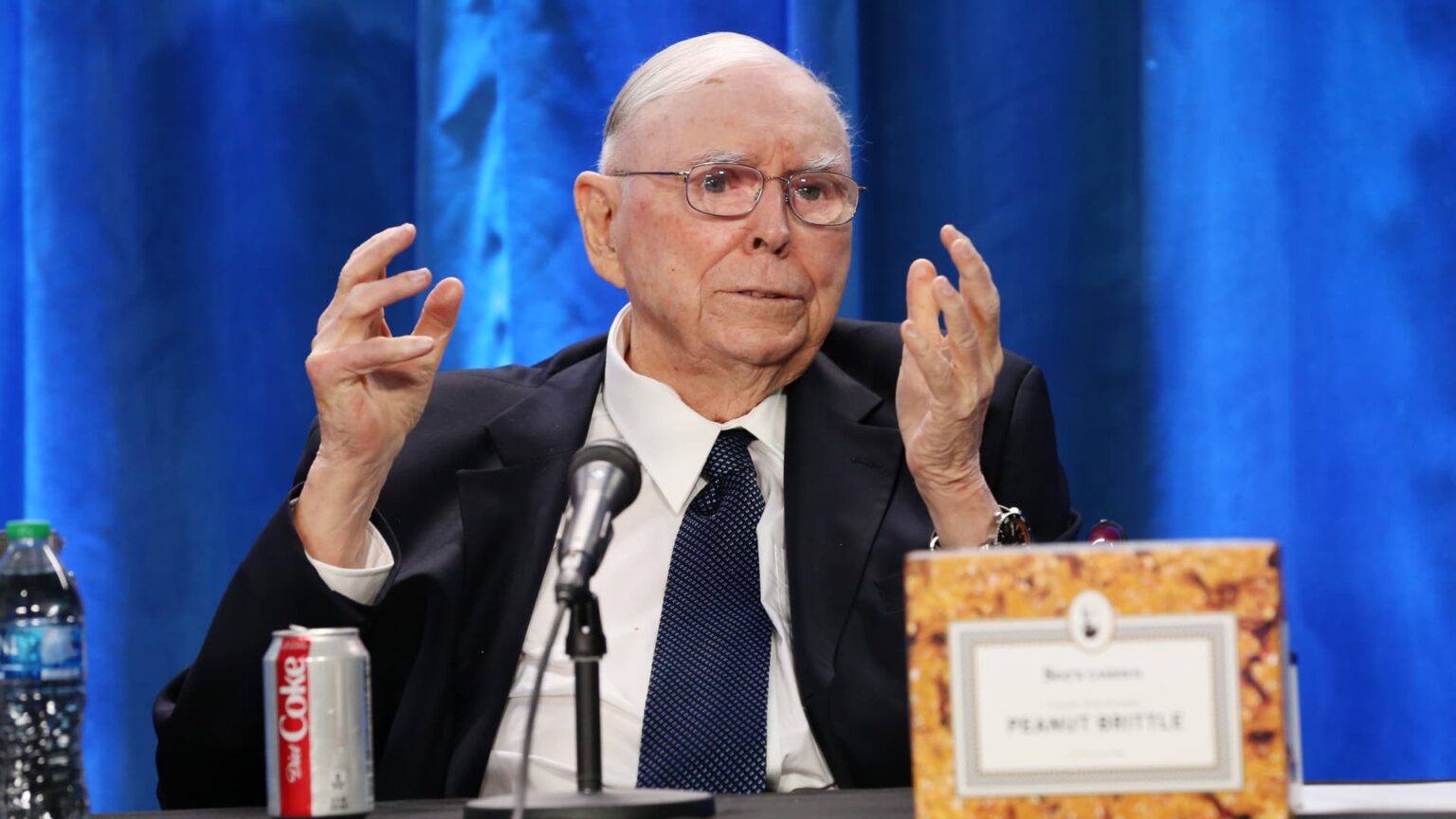

Charlie Munger, Warren Buffett’s righthand man for nearly six decades, was a shrewd investment genius in his own right, passing on rich investing wisdom for generations of investors to learn from.

Buffett, who studied under fabled father of value investing Benjamin Graham at Columbia University after World War II, developed an extraordinary knack for picking cheap stocks. However, it was Munger who broadened his approach to focus on quality companies, enabling Berkshire Hathaway to grow into an insurance, railroad and consumer goods conglomerate.

One of the best examples was Berkshire’s acquisition of See’s Candies in 1972 under Munger’s influence, at a price way higher than Buffett was comfortable at paying for businesses.

“It’s not that much fun to buy a business where you really hope this sucker liquidates before it goes broke,” Munger said in 1998.

Say no to diversification

Unlike the investing philosophy in most textbooks, Munger didn’t believe in diversification, or mixing a wide variety of investments within a portfolio, to lower risk. In fact, the Berkshire vice chairman called it “insane” to teach that one has to diversify when investing in common stocks.

“One of the inane things that’s taught in modern university education is that a vast diversification is absolutely mandatory in investing in common stocks …That is an insane idea,” Munger said in Berkshire’s meeting this year.

“It’s not that easy to have a vast plethora of good opportunities that are easily identified. And if you’ve only got three, I’d rather be in my best ideas instead of my worst,” Munger said.

Know your strength

Much like Buffett’s theory about the “circle of competence,” Munger believed that savvy investors should focus on areas within their expertise and strength in order to avoid mistakes.

“We’re not so smart, but we kind of know where the edge of our smartness is … That is a very important part of practical intelligence,” Munger said.

Munger particularly valued the power of strong brands and loyal customers. He said one of the best investments of his life was Costco Wholesale Corp., which he had invested in before the retailer merged with Price Club in 1993.

“I have a friend who says the first rule of fishing is to fish where the fish are. The second rule of fishing is to never forget the first rule. We’ve gotten good at fishing where the fish are,” the then-93-year-old Munger told the thousands of people at Berkshire’s 2017 meeting.

Big money is in the ‘waiting’

The investing sage believed that in investing, it pays to wait. Munger thought that the key to stock-picking success is sometimes doing nothing for years and pulling the trigger with “aggression” when it’s time.

“The big money is not in the buying and selling, but in the waiting,” Munger once said. He added he liked the word “assiduity” because “it means sit down on your ass until you do it.”

Virtue of sitting on sidelines

The conglomerate was often questioned about its huge cash war chest and the lack of deals, when interest rates were near zero. Munger often defended Berkshire’s inaction as he always saw the virtue of sitting on the sidelines to wait for a good opportunity.

Berkshire Hathaway, long term

“There are worse situations than drowning in cash, and sitting, sitting, sitting. I remember when I wasn’t awash cash — and I don’t want to go back, Munger said.

Berkshire’s massive cash pile is now earning the firm a substantial return with short-term rates topping 5%.

Crypto hater

Munger was a longtime cryptocurrency skeptic, and he never minced words when it came to his critique. He said digital currencies are a malicious combination of fraud and delusion.

“I don’t welcome a currency that’s so useful to kidnappers and extortionists and so forth, nor do I like just shuffling out of your extra billions of billions of dollars to somebody who just invented a new financial product out of thin air,” Munger said in 2021.

He also called bitcoin a “turd,” “worthless, artificial gold” and that trading digital tokens is “just dementia.”

Munger was also against commission-free trading apps that often facilitate momentum-driven trading activity by amateur investors, such as the meme stock mania in 2021.

Read the full article here